Buy Mahindra & Mahindra Financial Ltd For Target Rs. 335 by Motilal Oswal Financial Services Ltd

Operationally weak; NIM contraction a negative surprise

Earnings in line; NIM contracted ~15bp QoQ

* Mahindra & Mahindra Financial’s (MMFS) 4QFY25 PAT declined ~9% YoY to ~INR5.63b (in line), while FY25 PAT grew ~33% YoY to INR23.4b. NII in 4QFY25 stood at INR19.3b (in line) and grew ~6% YoY. Other income rose ~43% YoY to ~INR2.3b, aided by healthy improvement in fee income.

* NIM (calc.) contracted ~15bp QoQ to ~6.6%, primarily due to yield compression, which also reflected the impact of a one-time calibration in the computation of interest income. Annualized credit costs stood at ~1.6% (PQ: ~3bp and PY: ~1.4%).

* Opex stood at ~INR9.4b (up ~18% YoY) and the cost-income ratio stood at ~44% (PQ: ~42% and PY: ~40.5%). Management indicated that a few oneoff expenses in 4Q contributed to elevated opex during the quarter. PPoP stood at ~INR12.1b (~5% miss) and grew ~3% YoY.

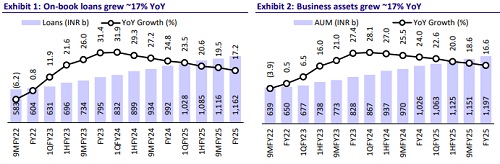

* Management expressed a cautiously optimistic outlook for FY26, considering recent demand trends and the sustained collection rigor in the Wheels segment (echoing the views outlined in our recent Vehicle Finance Report). MMFS guided for mid-to-high teen loan growth over the next 3-5 years (medium term). We model loan growth of ~15% in FY26 and ~14% loan CAGR over FY25-FY27E.

* MMFS acknowledged the challenging macro environment and noted that it has had to intensify its collection efforts. The company guided for throughcycle credit costs of ~1.3-1.7%. We have cut our FY26/FY27 PAT estimates by 5%/4% to factor in lower loan growth and slightly higher credit costs for MMFS. We estimate a ~24% PAT CAGR over FY25-FY27E, with FY27E RoA/RoE of 2.2%/16%. Reiterate BUY with a TP of INR335 (based on 1.7x Mar’27E BVPS).

* Key risks: a) yield compression due to higher competitive intensity and a change in the product mix, b) weakening of auto demand resulting in muted loan growth, and 3) continued volatility in PCR and credit costs, consistent with prior trends.

NIM contracts ~15bp QoQ due to moderation in yields

* Yields (calc.) declined ~30bp QoQ to ~14.1%, while CoF (calc.) declined ~20bp QoQ at 7.7%, leading to a ~10bp contraction in spreads. MMFS implemented changes to its LOS and LMS during the year, along with a one-time recalibration to ensure that interest income is charged to customers from the disbursement date rather than the agreement date. This resulted in a one-time impact on yields during the quarter.

* NIM (calc.) contracted ~15bp QoQ to ~6.6%. Management believes that NIMs have bottomed out and will exhibit a gradual improvement. NIM recovery is expected to be supported by a combination of rising fee income, lower cost of funds, and an improved product mix driven by higher growth in tractors.

* We expect the company’s NIM to improve in the current declining interest rate environment, with an estimated expansion of ~10bp each in FY26/FY27 to ~6.8%/6.9%.

Key takeaways from the management commentary

Management indicated that a well-structured, calibrated plan is in place to drive sustainable growth in the non-wheels business segment. Over the next 3-5 years, the company targets to maintain the Wheels business at ~75% of the loan mix, while increasing the combined contribution of the SME, Leasing, and Mortgage businesses to ~25%.

* MMFS aims to increase the share of pre-owned vehicle disbursements to ~20% of the overall disbursement mix (up from the current level of 17%).

* The company plans to focus on reviving its housing subsidiary, MRHFL, with the intention of repositioning it as an affordable housing business. All necessary provisions have been recognized, and management expects the subsidiary’s performance to improve going forward.

Valuation and view

* MMFS delivered a soft quarter with tepid disbursements, leading to subdued AUM growth. NIMs contracted sequentially due to a moderation in yields. Despite being the seasonally strongest quarter, the asset quality exhibited no significant improvement, while write-offs (and loan losses) remained elevated.

* MMFS currently trades at 1.4x FY27E P/BV. The outlook on loan growth and credit costs remains uncertain, with more clarity expected only at the end of 1QFY26. We believe this will be the true acid test for vehicle financiers. With a projected PAT CAGR of ~24% over FY25-FY27E and RoA/RoE of 2.2%/16% in FY27E, we reiterate our BUY rating with a TP of INR335 (based on 1.7x Mar’27E BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412