Neutral Dr Reddy`s Labs Ltd for the Target Rs. 1,220 by Motilal Oswal Financial Services Ltd

FY25 ends with a modest YoY earnings growth

Work in progress to add growth levers

* Dr Reddy’s Labs (DRRD) delivered in-line sales, while a slight miss on EBITDA for 4QFY25. The company posted healthy growth in revenue across the segments, partly aided by the addition of acquired businesses. In addition, pharmaceutical services and active ingredients saw a healthy revival in FY25 performance vs. the muted show in FY23/FY24.

* We broadly retain our earnings estimates for FY25/FY27. We value DRRD at 18x 12M forward earnings to arrive at our TP of INR1,220.

* After three years of a strong 30% earnings CAGR over FY21-24E, the company ended FY25 with a moderate 6% earnings growth. DRRD is implementing a plan to expand product offerings across markets and add/ build capacity to cater to the respective markets. Having said this, the intensified competitive pressures in the base portfolio would keep earnings growth in check.

* Accordingly, we model stable earnings over FY25-27. Reiterate Neutral.

Inferior product mix offset by lower opex

* DRRD’s 4QFY25 sales rose 20% YoY to INR85b (vs. est. of INR83b).

* The US sales increased 9% YoY to INR36b (~USD416m; 42% of sales), largely due to a rise in volumes of the base business and new launches, partly offset by price erosion. Europe sales surged 2.4x YoY to INR12.7b (15% of sales). India sales rose 16% YoY to INR13b (15% of sales). Emerging markets’ sales improved 16% YoY to INR14b (16% of sales).

* Pharmaceutical Services and Active Ingredients (PSAI) segment’s revenue grew 16% YoY to INR9.5b (11% of sales).

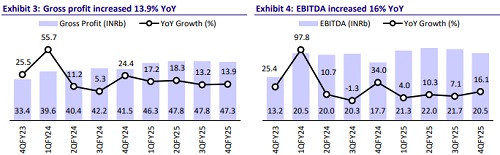

* Gross margin (GM) contracted 300bp YoY to 55.6%, mainly due to lower margins in the global generics business (down 270bp YoY). This was partly offset by a higher gross margin in the PSAI segment.

* EBITDA margin dipped 80bp YoY to 24% (our est: 26.5%) as lower GM was offset by lower expenses (R&D/SGA down 100bp/110bp YoY as % of sales).

* EBITDA was up 16% YoY to INR20.5b (vs. est. of INR21.9b).

* PAT grew at a higher rate of 26.7% YoY to INR15.4b, supported further by higher other income.

* During FY25, revenue/EBITDA/PAT grew 16%/9%/6% YoY to INR324b/ INR85.5b/INR56b.

Highlights from the management commentary

* Management guided a double-digit YoY revenue growth and will maintain the EBITDA margin at FY25 levels in FY26.

* A certain one-time cost hurt gross margin by 80bp for the quarter.

* DRRD launched 7/18 products in NA in 4QFY25/FY25.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412