Buy Hyundai Motor Ltd for the Target Rs. 4,900 by Motilal Oswal Financial Services Ltd

Improved mix drives earnings beat

New product launches and exports to drive healthy growth

* Hyundai India’s (HMIL) 2Q earnings at INR15.7b came in ahead of our estimate of INR14.8b, aided by better-than-expected margins. EBITDA margins at 13.9% were ahead of our estimate of 13.5% owing to improved product and export mix.

* HMI targets to launch 26 products by FY30, of which eight would be launched over FY26-27E. Considering its launch pipeline, we now factor in a 6% volume CAGR over FY25-28E, which is largely back-ended. This is likely to be boosted by 20% volume CAGR in exports. We also believe that higher-than-expected operating costs for the new Pune plant will impact earnings for the near to medium term. Overall, HMIL is expected to deliver 15% earnings CAGR over FY25-28E. We believe HMIL is well positioned to benefit from the premiumization trend in India, given its mix in favor of SUVs. Reiterate BUY with a TP of INR2,801, valued at 29x Sep’27E EPS.

Earnings ahead of estimates led by better-than-expected margins

* 2Q earnings at INR15.7b beat our estimate of INR14.8b, supported by better-than-expected margins.

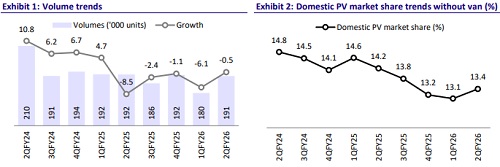

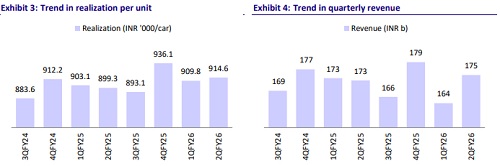

* Revenue improved marginally YoY to INR175b (in line) despite a marginal decline in volumes. While domestic sales declined ~7% YoY to 140k units, exports grew strongly by ~22% to 51.4k units. Avg ASP was up 1.7% YoY due to an improved mix.

* Gross margins improved 240bp YoY (+60bp QoQ) to 29.9%, above our estimate, led by an improved mix (SUV mix at 71% of domestic volumes, exports up at 27% from 22% YoY). The benefit of an improved mix was partially offset by higher-than-expected other expenses.

* Led by improved gross margins, EBITDA margin expanded 110bp YoY (+60bp QoQ) to 13.9%, ahead of our estimate of 13.5%.

* EBITDA grew 10% YoY and was ahead of our estimate by 4%.

* While other income was higher than our estimate, depreciation came in below estimate, which in turn boosted PAT.

* PAT grew 14.3% YoY to INR15.7b (vs. est. of INR14.8b).

* For 1HFY26, CFO came in at ~INR23b and capex at ~INR26b. Consequently, it reported FCF loss of INR3b.

* In 1HFY26, revenue fell 2.1% to INR346b, whereas EBITDA/PAT grew 1.5%/2.7% YoY to INR45b/INR29b. In 2HFY26, we expect revenue/ EBITDA/PAT to grow 9%/11.5%/10% YoY to INR377b/INR49b/INR30.4b.

Highlights from the management commentary

* From Navratri to Diwali, retail sales grew 23% for HMIL. Hatchback sales grew 16%, sedans grew 47% and SUVs grew 21%. Within SUVs, Venue and Exter outperformed with 28% growth. However, Venue growth was limited due to its upcoming new variant launch scheduled for 4th Nov.

* HMIL expects to grow in line with the industry in the domestic market in 2H, aided by the launch of new Venue and future product interventions.

* Exports are likely to exceed its initial growth guidance of 7-8% in FY26.

* The Pune plant commenced operations in Oct. Costs (employee expense, overheads and depreciation) are likely to rise by ~20% in the near term until the plant ramps up and operating leverage benefits kick-in. While this will impact profitability in the near term, operating efficiency and cost control measures are expected to offset this impact partially.

Valuation and view

* Considering its launch pipeline, we now factor in a 6% volume CAGR over FY25- 28E, which is largely back-ended. This is likely to be boosted by 20% volume CAGR in exports. We now believe that higher-than-anticipated operating costs for the new Pune plant would impact earnings in the near and medium term. Overall, HMIL is expected to deliver 15% earnings CAGR over FY25-28E. We believe HMIL remains well-positioned to benefit from the premiumization trend in India, given its mix in favor of SUVs. Reiterate BUY with a TP of INR2,801, valued at 29x Sep’27E EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412