Buy Bharat Dynamics Ltd for the Target Rs. 2,000 by Motilal Oswal Financial Services Ltd

Execution ramping up

Bharat Dynamics (BDL) delivered a strong performance in 2QFY26 as supply chain issues started easing out, resulting in a sharp execution ramp-up. However, margins were affected by project mix during the quarter. The company also announced an order inflow of INR20b from Invar anti-tank missiles, and BDL is expected to benefit from emergency procurement, QRSAM, follow-on Astra orders from HAL, VSHORADS, etc. With a strong order book of INR235b and a focus on execution, we expect the company to grow revenue/EBITDA/PAT at 35%/64%/51% over FY25-28. The stock is currently trading at 40.1x/29.2x P/E on FY27/FY28 estimates. We reiterate our BUY rating on the stock with a revised TP of INR2,000, based on 42x Dec’27E earnings.

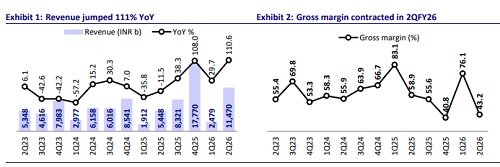

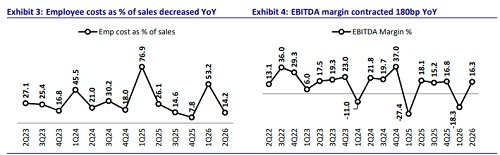

Beat across all parameters

BDL’s revenue jumped 111% YoY to INR11.5b, beating our estimate by 62%. Gross margin dipped to 43.2% in 2QFY26 from 58.9% last year, though a lower share of employee costs and other expenses softened the EBITDA margin contraction to 16.3% (-180bp YoY). Absolute EBITDA increased 90% YoY to INR1.9b, beating our estimate by 32%. Aided by strong top-line growth, higherthan-expected other income, and a lower tax rate, BDL’s PAT increased 76% YoY to INR2.2b, which was 32% above our estimates of INR1.6b. For 1HFY26, revenue/EBITDA/PAT increased by 90%/206%/81% to INR13.9b/INR1.4b/ INR2.3b, while the margin expanded 390bp YoY to 10.2%. For 1HFY26, BDL’s OCF/FCF stood at negative INR0.8b/INR1.5b, though it has improved significantly compared to last year, when OCF/FCF stood at negative INR8b/INR9b.

Working capital stable, capex on track

Working capital in 1H was broadly in line at around 160 days vs. 152 days in FY25. Inventory/receivables/other current assets at 419/156/ 422 days moved up from FY25 levels of 289/90/312. However, this increase was offset by an increase in payables/other current liabilities days. The company has incurred a capex of ~INR1b during 1H, which is in line with our full-year estimate of INR2b.

Execution ramp-up driven by strong order book

BDL has a current order book of nearly INR235b to be executed over the next 3-4 years. This also includes the order win of INR20b for Invar Anti-Tank missiles for the Indian Army. The company is also likely to receive a few orders from emergency procurement. During 2QFY26, revenue growth was driven by execution ramp-up across key projects such as the Akash missile, Astra Mk-1, and anti-tank guided missile orders. The company was earlier hit by supply chain issues, but now, with the easing of those issues, it has been able to ramp up execution across projects much faster. Gross margin in the current quarter was impacted by a higher share of bought-out items for the Akash and Astra Mk-1 projects. Provisions were also higher in the current quarter, in line with higher warranties for corresponding deliveries in the current quarter. This had impacted margins during the quarter. Going ahead, we expect execution growth to remain strong, driven by a healthy order book of INR235b, and we also expect margins to improve as operating leverage benefits kick in.

Targeting an increased share of export revenue

Excluding FY25, when exports rose sharply, BDL’s export share has historically stayed below 10% of total revenue. The company has now outlined a strategy to raise this share to 25% by FY29-30 by deepening ties with friendly nations and countries facing geopolitical challenges. During the quarter, export orders also surged, and the current export order book is likely to be over by 1QFY27. Its export portfolio spans anti-tank guided missiles (ATGMs), surface-to-air missiles (SAMs), air-to-air missiles (AAMs), underwater weapons, and avionics systems. With several products approved for exports by the Government of India, BDL is steadily expanding its global footprint through customized solutions and comprehensive lifecycle management. The export order book stood at INR11.7b as of the end of FY25, and rising interest from international markets for BDL’s products like Akash will further strengthen the company’s export pipeline.

Future growth strategies

BDL has a strong order pipeline of ~INR500b for the next five years, of which the company is targeting ~INR200b worth of orders to come in within the next 2-3 years. By FY30-31, the company expects to reach an annual turnover of INR100b. To achieve these targets, BDL has initiated a series of strategic measures, including:

* Planned capex: BDL plans to spend capex of ~INR2b on various programs, including the construction of the Jhansi Unit (for missile propulsion systems), Phase-II infrastructure development at Ibrahimpatnam (for larger missiles and advanced composites), and the ceramic radome facility at Kanchanbagh.

* Increasing indigenized content: BDL prioritizes the indigenous development of critical defense technologies, including missile seekers, homing systems, avionics, cruise missile propulsion, specialized warheads, and electronic warfare systems, with 80-90% levels reached in most of these products and more than 90% levels reached for DRDO-designed systems.

* R&D push: The company is prioritizing technology leadership through sustained investment in R&D, targeting 9% of revenue over the next five years. It is working closely with DRDO, academia, start-ups, and MSMEs to develop indigenous solutions and integrate technologies such as AI, ML, and Industry 4.0 into its manufacturing ecosystem.

BDL-PTC JV to strengthen the domestic defense propulsion capabilities

BDL signed a contract with PTC Industries (PTC) to set up a JV company to design, develop, and manufacture complete propulsion systems, guided bombs, and aeroengines for missiles, UAVs, and loitering munitions. The JV will combine BDL’s missile systems engineering and production pedigree with PTC’s capabilities in strategic materials, precision engineering, and super alloys. Key scope of work of the JV includes:

* Solid and liquid propulsion modules for short-to-medium-range missiles and loitering munitions.

* Small, high-performance aero-engines are suitable for advanced UAVs and loiterers where compact power plants are a critical enabler.

* Guided glide and powered bombs, and the supporting production infrastructure, including airframes, guided sub-assemblies, and warhead integration.

Recent DAC approvals support our growth thesis

BDL is well placed to benefit from the recent DAC approvals since the start of FY26, totaling ~INR2.5t, which focused on missile systems, undersea warfare equipment, and naval armament. Its strong capabilities in tactical and strategic missiles position it favorably for the approved surface-to-air missile projects and moored mines. The company is also likely to participate in the upgrade of the BARAK-1 point defense missile system and the BrahMos launcher and fire control systems cleared for the Navy. In underwater weapon systems, BDL could gain from orders for moored mines and advanced lightweight torpedoes, supported by its collaboration with DRDO. The approval for the Nag missile system Mk-II further strengthens its anti-tank portfolio. With these projects advancing toward the contract stage, BDL’s medium to long-term growth prospects appear robust, backed by a wider and more diversified order base.

Financial outlook

We maintain our estimates and expect a CAGR of 35%/64% in revenue/EBITDA over FY25-28, primarily driven by a sharp scale-up in execution due to moderating supply chain issues. We expect the EBITDA margin to remain strong at 23.8%/24.7%/25.5% in FY26/FY27/FY28, fueled by the various indigenization efforts taken by the company and lower provisions. With an estimated annual capex of INR2.0b/ INR2.5b/INR3.0b in FY26/FY27/FY28 and comfortable working capital, we expect a 51% CAGR in PAT over FY25-28. With improving revenue and stable margins, we expect its RoE/RoCE to remain comfortable, reaching 25.2%/25.6% by FY28.

Valuation and view

The stock currently trades at 53.7x/40.1x/29.2x P/E on FY26/FY27/FY28 estimates. We maintain our estimates and expect execution and margins to scale up in the coming quarters. We maintain our BUY rating on the stock with a revised TP of INR2,000, based on 42x P/E Dec’27E EPS.

Key risks and concerns

Key risks for the company include a decline or reprioritization of the Indian defense budget, termination of existing contracts or failure to succeed in tendering projects, changes in procurement rules and regulations of the MoD and the government, and supply-chain-related issues.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)