Buy Apollo Hospitals Ltd for the Target Rs. 8,050 by Motilal Oswal Financial Services Ltd

Operationally in-line 4Q; ends FY25 on a strong note

Beds addition/improving GMV to drive overall better outlook

* Apollo Hospitals Enterprises (APHS) posted marginally better-than-expected revenue (4% beat), while EBITDA was in line for the quarter. The lower tax rate led to better-than-expected earnings for the quarter.

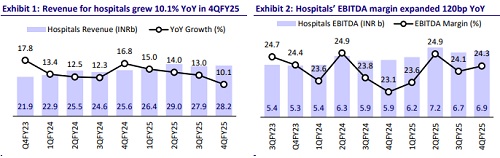

* While operating beds inched up for FY25, APHS delivered healthy revenue growth in healthcare services (10%/13% YoY for 4QFY25/FY25), driven by improved case mix and occupancy. Further, the addition of beds is on track (870 beds in FY26; 10% YoY increase).

* The cash loss in the digital segment of Healthco has reduced from INR1.1b in 4QFY24 to INR798m in 4QFY25 and is expected to break even in 2Q/3QFY26.

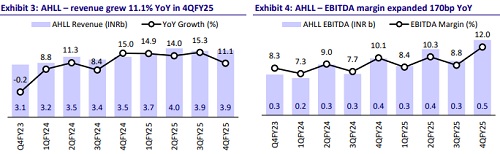

* Primary care within the AHLL segment saw a sharp improvement in margins QoQ led by superior execution, while diagnostics witnessed a moderation in margins due to the ongoing strategic reset in the business.

* We broadly retain our estimates for FY26/FY27. We value APHS on an SoTP basis (30x EV/EBITDA for the hospital business, 15x EV/EBITDA for retained pharmacy, 23x EV/EBITDA for AHLL, 22x EV/EBITDA for front-end pharmacy, and 2x EV/sales for Apollo 24/7) to arrive at our TP of INR8,050.

* We expect a 15%/17%/23% CAGR in revenue/EBITDA/PAT over FY25-27. This would mainly be driven by 1) the addition of beds in the healthcare services segment coupled with improvement in productivity at existing facilities, 2) reduction in losses at the healthco level, and 3) revival in revenue growth/profitability in the diagnostic segment. Reiterate BUY.

Strong growth across segments; EBITDA margin inches up to 13.8% in 4Q

* APHS’ 4QFY25 revenue grew 13.1% YoY to INR55.9b (est. INR53.7b).

* Healthcare services (hospitals) revenue grew 10.3% YoY to INR28.2b. The Healthco revenue grew 17.2% YoY to INR23.7b. AHLL revenue grew 11.1% YoY to INR3.9b.

* EBITDA margin expanded 80bp YoY to 13.8% (our est. of 14.3%) due to lower other expenses (160bp YoY as % sales) offset by an increase in RM costs (80bp YoY as % sales).

* EBITDA grew 20.2% YoY to INR7.6b (in line with estimates).

* Adj. PAT grew 53.5% YoY to INR3.9b (our est: INR3.5b).

* Its revenue/EBITDA/PAT grew 14.3%/26.4%/61% to INR217b/INR30.2b/ INR14.2b in FY25.

* Healthcare services EBITDA grew 16% YoY to INR6.8b for 4QFY25. EBITDA margin grew 20bp YoY to 24.3% in 4QFY25. Healthco exhibited EBITDA of INR363m for 4QFY25 vs. INR566m for 3QFY25. AHLL’s EBITDA grew 32% YoY in 4QFY25 to INR472m (EBITDA margin at 12%).

* GMV for Apollo 24/7 grew 11% YoY to INR8b in 4QFY25.

* Max added 266 offline pharmacy stores in 4Q, bringing the total to 6,626.

Highlights from the management commentary

* APHS is on track to achieve cash EBITDA breakeven (excluding ESOP cost) in Healthco by 2QFY26/3QFY26.

* Management sees GMV growth of 25-30% YoY in FY26.

* APHS indicated the sales:GMV ratio to be 40-45% in FY26 (37% in FY25).

* The company expects to maintain profitability of the healthcare services segment despite the new addition of operating beds, led by increased occupancy at existing facilities and cost optimization.

* It expects healthcare services revenue to grow by low teens organically. There is potential to add INR10b in revenue from inorganic initiatives in FY27.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412