Neutral IRB Infrastructure Ltd for the Target Rs. 50 by Motilal Oswal Financial Services Ltd

Performance marginally above estimates; order pipeline remains robust

* IRB’s revenue grew 4% YoY to INR21.5b in 4QFY25 and was 11% above our estimate. Revenue included: a) gains on InvITs and related assets as per fair value measurement, and b) dividend/interest income from InvITs and related assets. This income would be recurring going forward.

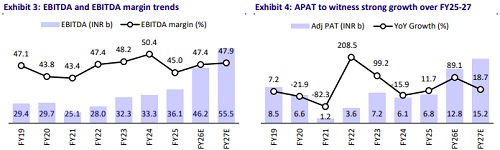

* EBITDA margin came in at 46.4% (our estimate 47.2%) in 4QFY25 (+230bp YoY and -220bp QoQ). EBITDA grew 12% YoY to ~INR10b against our estimate of INR9.1b.

* APAT grew 14% YoY to INR2.1b (against our estimate of INR2b).

* Construction revenue stood at INR12b (-17% YoY); BOT revenue stood at INR6.4b (+4% YoY); and InvIT and related assets revenue stood at INR3.1b (- 23% YoY).

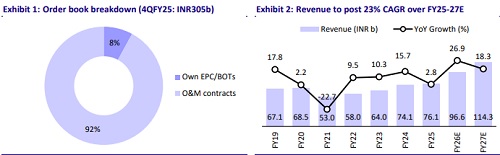

* Order book stood at INR305b (excl. GST) as of Mar’25 end, of which the O&M order book was INR281b and the EPC order book was INR24b.

* During FY25, revenue was INR 76.1b (+3% YoY), EBITDA was INR 36b (+8% YoY), EBITDA margin came in at 47.4%, and APAT was INR 6.8b (+12% YoY)

* IRB’s focus on InvIT investments and asset monetization provides steady income and long-term value. A strong order book, rising toll revenue, and key projects like the Ganga Expressway support steady growth. While order inflows remain weak, IRB expects ordering momentum to improve in FY26.

* We largely retain our revenue estimates for FY26/FY27 while reducing APAT estimates by ~6 for each year, factoring in stagnant income from Private InVIT. With a strong order book and a robust tender pipeline, driven by BOT projects, we expect a revenue CAGR of 23% over FY25-27. Reiterate Neutral with an SoTP-based TP of INR50.

Strong Order Book, Steady InVIT cash flows, and emerging BOT/TOT opportunities

* IRB’s total order book stood at INR305b as of Mar’25, with INR50b executable over the next two years (EPC: INR24b; O&M: INR26b). The order book provides strong revenue visibility, particularly for the construction and O&M segments.

* Private InVIT has continued to generate positive cash flows since FY24, with 4QFY25 distributions of INR540m and cumulative FY25 distributions of INR2.4b, proportionate to IRB’s 51% stake. The InVIT’s enterprise value was assessed at INR85b as of Mar’25.

* Order inflows were muted in FY25 due to election-related delays in NHAI project awards, impacting the sector. However, BOT and TOT bidding showed promise, with 4-5 bidders participating, indicating sustained interest in private participation models.

Key takeaways from the management commentary

* IRB expects lower double-digit toll revenue growth in FY26, driven by the operationalization of the Palsit-Dankuni and Ganga Expressway projects in 2HFY26. These projects will enhance revenue through increased tariffs and traffic growth, with no new projects factored into this projection.

* Construction business is expected to achieve a 15% CAGR over the next two to three years, with stable EBITDA margins of 20-25%, driven by the executable EPC order book and efficient project execution.

* The O&M order book, with 20-year visibility, is projected to grow from 20-25% to ~30% of the total order book within two to three years.

* IRB anticipates a rebound in order inflows in FY26, particularly in BOT and TOT projects, as the government prioritizes private-sector participation. The company is preparing to capitalize on this by leveraging proceeds from asset monetization, targeting bids worth up to INR250b.

* IRB aims to maintain its 25-30% market share in BOT and TOT projects, despite intense competition in EPC and HAM segments. The company is not looking to add projects from other Infra sectors.

Valuation and view

* While election-related delays posed challenges in FY25, the government’s renewed focus on BOT and TOT projects presents significant opportunities. IRB’s strong order book and strategic asset monetization position it well to capture these opportunities, though competition in EPC and HAM segments remains a challenge.

* We largely retain our revenue estimates for FY26/FY27 while reducing our APAT estimate by ~6 for each year, factoring in stagnant income from Private InVIT. With a strong order book and a robust tender pipeline, driven by BOT projects, we expect a revenue CAGR of 23% over FY25-27. Reiterate Neutral with an SoTP-based TP of INR50.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412