Buy ICICI Lombard Ltd for the Target Rs. 2,300 by Motilal Oswal Financial Services Ltd

Strong NEP growth leads to a beat on combined ratio

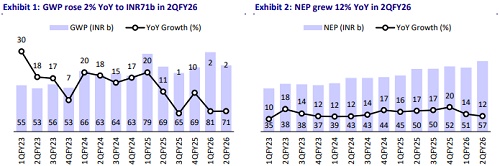

* ICICI Lombard’s (ICICIGI) gross written premium rose 2% YoY in 2QFY26 to INR70.6b (in line), impacted by the 1/n regulation. NEP grew 12% YoY to INR56.5b (16% beat). For 1HFY26, NEP grew 13% YoY to INR108b.

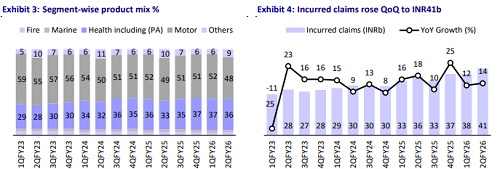

* The claims ratio stood at 72.1% (vs our est. of 74%) vs. 71.4% in 2QFY25. Commission ratio increased to 19.1% (our est. 17.5%) vs. 17.5% in 2QFY25, and opex ratio came in at 14% (our est. 14.5%) vs. 15.6% in 2QFY25.

* Combined ratio was at 105.1% in Q2FY26 vs 104.5% in 2QFY25. Excluding the impact of CAT losses of INR0.7b in 2QFY26 and INR0.9b in 2QFY25, the combined ratio stood at 103.8% and 102.6%, respectively.

* PAT grew 18% YoY to INR8.2b (18% beat) due to strong growth in NEP. For 1HFY26, PAT grew 23% YoY to INR15.7b.

* On the motor side, the company outperformed the motor insurance industry in terms of profitability amid steep pricing pressure through strong underwriting discipline. Early trends following the GST rate cuts indicate strong momentum, which the management expects to sustain, with a focus on driving market share gains.

* We have raised our FY26/FY27/FY28 NEP estimates by 6%/7%/7%, driven by GST benefit-led growth in the motor segment. However, we have raised EPS estimates by only 1%/2%/3% for FY26/FY27/FY28, due to the higher combined ratio in the motor segment. Reiterate BUY with a TP of INR2,300 (based on 30x Sep’27E EPS).

Higher commission and claim ratio drive YoY rise in combined ratio

* GDPI declined 1.9% YoY to INR66b in 2QFY26. Excluding the impact of 1/n, it rose 3.5% YoY.

* NEP growth of 12% YoY was driven by 10%/22% YoY growth in the motor/health (including PA) segments. The marine segment reported YoY growth of 4%, while the fire segment remained stable YoY.

* Underwriting loss stood at INR1.8b vs a loss of INR1.6b in 2QFY25 and MOFSLe of INR2.6b. Total Investment income on the policyholders’ account was 6% higher than our estimates at INR9.3b. For shareholders’ account, it was in line with our estimates.

* Claims ratio at 72.1% rose 70bp YoY, driven by a 420bp YoY rise in the motor OD segment loss ratio, while the motor TP segment remained flat YoY and the health segment improved 650bp YoY.

* Investment book grew 9% YoY to INR562b, reflecting strong investment leverage of 3.6x. Absolute investment yield for 2QFY26 stood at 2.2%, flat on a YoY basis. For 1HFY26, it stood at 4.6% vs 4.5% for 1HFY25. The investment portfolio mix for Corporate Bonds/G-Sec/Equity (incl. Equity ETF) was at 47.6%/34.0%/14.4%, respectively, for 1HFY26.

* Strong profitability due to robust investment gains resulted in RoE of 20.8% in 1HFY26 (20.3% in 1HFY25).

* Solvency ratio was at 2.73x (2.65x in 2QFY25 and 2.7x in 1QFY26).

Highlights from the management commentary

* GST exemption on health insurance is expected to make healthcare protection more affordable and expand coverage across households. The recent rate cut in auto insurance further reduces the cost of ownership for vehicle buyers. The company intends to pass on the full GST benefit to policyholders

* ICICIGI’s retail health segment outpaced the industry, increasing the market share to over 4% by Sep’25, driven by product innovation, wider distribution, and stronger customer engagement. Meanwhile, group health declined in 1HFY26 amid muted microfinance activity. The company aims to maintain the retail health loss ratio in the 65-70% range.

* ICICIGI’s fire premium grew in Sep’25 after a subdued start; management cited catastrophe-led volatility but emphasized that disciplined risk selection remains key to driving long-term profitability, while also highlighting the Sep’25 rebound as a recovery from earlier market share losses.

Valuation and view

* A recovery is anticipated in FY26, driven by favorable regulatory changes. The recent GST exemption is set to make health insurance more affordable. Rate cuts in auto insurance are expected to boost performance, positioning the company well to capitalize on market share gains.

* The company's retail health segment continues its strong momentum, driven by effective new customer acquisition and significant traction of its ‘Elevate’ product, leading to market share gains.

* We have raised our FY26/FY27/FY28 NEP estimates by 6%/7%/7%, driven by GST benefit-led growth in the motor segment. However, we have raised the EPS estimates by only 1%/2%/3% for FY26/FY27/FY28 due to a higher combined ratio in the motor segment. Reiterate BUY with a TP of INR2,300 (based on 30x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412