Neutral Info Edge Ltd for the Target Rs. 1,350 by Motilal Oswal Financial Services Ltd

Ltd.jpg)

Stable execution continues…

…but margins hit by higher marketing expenses; reiterate Neutral

* Info Edge (INFOE)’s standalone revenue stood at INR6.8b, up 13% YoY/2.3% QoQ, below our estimate of ~INR7b. EBITDA margin came in at 37.7% (down 546bp QoQ/290bp YoY), below our estimate of 43.7%. Overall billings rose 19% YoY and were INR9.8b. Adj. PAT stood at INR2.4b (below our est. of 2.7b. The company’s revenue/EBITDA grew 11.4%/7.5% YoY while PAT declined 7.1% in FY25. We expect revenue/EBITDA/PAT to grow 17.2%/23.2%/19.3% YoY in 1QFY26. We reiterate our NEUTRAL rating on the stock with a TP of INR1,350, implying an 8% downside.

Our view: Non-recruitment businesses on the verge of break-even

* INFOE delivered a steady 4QFY25, with healthy momentum across both recruitment and non-recruitment businesses. Recruitment billings grew across key segments – IT Services and GCCs – all clocking high-teens growth. Interestingly, non-tech sectors such as BFSI, healthcare, and infrastructure also posted strong double-digit gains, which we believe point to early signs of a more balanced hiring recovery beyond traditional tech-heavy segments.

* That said, the overall hiring environment remains modest. The Naukri Jobspeak Index indicates some softness, particularly among IT clients, who continue to remain cautious about recruitment spending. However, we believe INFOE’s positioning as a cost-effective partner is helping it gain wallet share in this environment.

* 99acres posted another strong quarter, with billing growth supported by both customer volumes and improved pricing. Broker and channel partner participation is outpacing that of developers, and investments in digital marketing are helping sharpen execution. INFOE was near cash break-even in FY25, and, in our opinion, the current momentum and marketing-led visibility could push the platform into profitability over the medium term.

* Jeevansathi continued to outperform in its niche. It has a solid North India presence and is benefiting from AI/ML-led product upgrades. The freemium model is driving higher engagement, with improved metrics across profile acceptances and chats. INFOE is targeting 20-25% growth in FY26E while gradually moving toward breakeven.

* Margins took a hit in 4Q, with EBITDA margin at 37.7% (down ~546bp QoQ), primarily due to elevated marketing expenses in recruitment and real estate – partly driven by IPL campaigns – and higher employee costs from AI hiring and incentive payouts. In our opinion, these investments, while impacting near-term margins, are aligned with INFOE’s growth strategy.

* We believe margin expansion may be limited in the near term, as growthled investments are likely to continue. We forecast EBITDA margins at 40.5%/41.1% for FY26/FY27.

Valuations and changes to our estimates

* Our estimates are broadly unchanged. While INFOE’s businesses exhibit steady growth in recruitment and real estate, limited near-term profitability upside weighs on the outlook. In our opinion, current valuations already reflect much of the expected growth, leaving little room for re-rating.

* We value the company’s operating entities using DCF valuation. Our SoTP-based valuation indicates a TP of INR1,350. Reiterate Neutral.

Miss on revenue and margins; billings grew 19% YoY

* Standalone revenue stood at INR6.8b, up 13% YoY/2.3% QoQ, below our estimates (~INR7b).

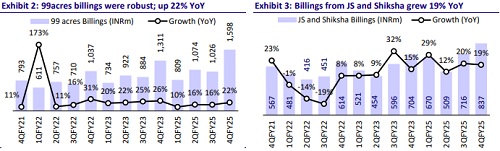

* Overall billings rose 19% YoY and were INR9.8b. Billings for Recruitment/ 99acres came in at INR7.4b/INR1.6b vs. INR6.2b/INR1.3b in 4QFY24.

* EBITDA margin came in at 37.7% (down 546bp QoQ/290bp YoY), below our estimate of 43.7%. The margin contraction was due to higher advertisement expenses (12.3% of revenue vs. 9.9% in 3QFY25).

* Naukri’s PBT margin was down 450bp QoQ at 54.5%, while 99acres’ PBT loss percentage increased 950bp QoQ to 14.1%.

* Adj. PAT stood at INR2.4b (below our est. of 2.7b) owing to lower-than-expected EBITDA margin and other income.

* The Board declared a final dividend of INR3.6 per equity share for FY25.

Highlights from the management commentary

* Recruitment: The Jobspeak Index showed muted momentum. The hiring market remains modest, though better than a year ago. In this environment, IT companies are cautious about spending on recruitment firms, making Naukri a cost-effective option. In 4QFY25, overall billings grew 19% YoY. Billing growth was broad-based, with the IT segment growing by 17%, the non-IT segment by 19%, and the recruitment consultant segment by 15%. No major new product launches, but algorithmic improvements through AI have enhanced existing product performance. The go-to-market strategy is being refined to diversify the client base, with a focus on growing presence among GCCs, SMEs, Tier 2 cities, and non-IT segments.

* Real Estate: Billing growth in 4Q was supported by both a rise in the number of billed customers and higher average billing per customer. Significant market share gains were recorded in 4Q. It plans to continue gaining share. Broker and channel partner billings grew faster than developer billings. 99acres was near breakeven on an FY25-cash basis. If the current marketing efforts (with increased supplier participation and customer engagement) deliver, growth could accelerate. The new strategy has shown better ROI.

Valuations and view

* While we expect a gradual recovery in IT services demand, near-term recruitment growth is likely to remain range-bound as companies rely on their current bench to meet demand, resulting in overall muted growth for INFOE.

* With the management investing prudently, some of its current investments should scale up over the medium-to-long term, thereby contributing to the group’s valuation.

* We value the company’s operating entities using DCF valuation. Our SoTP-based valuation indicates a TP of INR1,350. Reiterate Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412