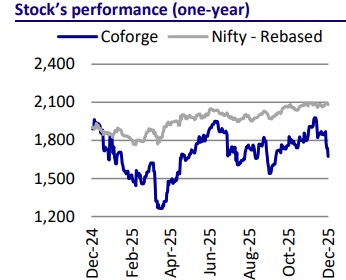

Buy Coforge Ltd for the Target Rs.2,500 by Motilal Oswal Financial Services Ltd

Our view on Coforge’s Encora acquisition

Encora to add capability and depth, but integration will be a key monitorable

* Coforge announced the acquisition of Encora, a US-based engineering and AI-led services firm with revenue of ~USD500m, adding ~26% to Coforge’s FY26E revenue base. Encora has ~9,300 employees, implying revenue per employee of ~USD74k vs. ~USD69k for Coforge, and operates at higher margins than Coforge. The vertical mix, primarily HiTech and Healthcare, is a positive, especially given Coforge’s strategic intent to scale these segments. Management has indicated that the transaction could be EPS accretive from day one. While there is limited clarity at this stage on the integration approach, past evidence is supportive: SLK Global was ~9-11% of Coforge revenue at the time of acquisition, while Cigniti was ~16%. That said, earlier acquisitions were largely client-led, whereas this transaction is more capability- and leadership-driven, making talent retention and execution discipline more critical given the larger scale of the deal.

* Transaction details: Coforge will acquire 100% of Encora for an enterprise value of USD2.35b through an all-equity share-swap arrangement, with equity consideration of ~USD1.89b and the balance to be used to retire Encora’s existing debt via a bridge loan and/or potential QIP. The transaction will result in the issuance of ~21.25% of post-issue equity to Encora shareholders, with no change in control, though investors will have the right to nominate two directors to the Board.

* Encora reported revenue of USD516m in FY25 (USD481m in FY24), with FY26E revenue guided at ~USD600m and an adjusted EBITDA margin of ~19%. The combined entity is expected to operate at ~14% EBIT margin post-amortization of intangibles, and the transaction is likely to close in 4- 6 months, subject to shareholder and regulatory approvals.

* We note that the scale of the transaction is large; therefore, execution remains critical. Integration, leadership retention, margin management post-integration, and amortization will be the key monitorables.

* We believe Coforge’s strong executable order book and resilient client spending across verticals bode well for its organic business. This acquisition expands Coforge’s presence in the Hi-Tech and Healthcare verticals, though we have not yet incorporated Encora's numbers into our valuation. We continue to view Coforge as a structurally strong mid-tier player well-placed to benefit from vendor consolidation/cost-takeout deals and digital transformation. We value Coforge at 32x (considering a potential dilution) FY28E EPS with a TP of INR2,500, implying a 49% potential upside. Reiterate BUY.

Rationale for acquisition – AI-driven engineering services

* The acquisition is strategically anchored around AI-led engineering services, an area where Encora already has meaningful AI-native capabilities, including proprietary agentic platforms and AI-embedded delivery models.

* From a vertical perspective, the deal materially strengthens Coforge’s Hi-Tech and Healthcare exposure, with both verticals expected to scale meaningfully after the acquisition. This is aligned with Coforge’s longer-term intent to deepen its presence in higher-growth, engineering-intensive verticals, where spend visibility and relevance of AI use cases are structurally stronger.

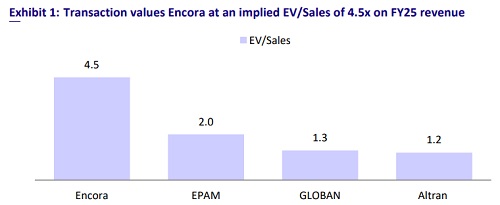

Price Paid- Relative valuation context

* The transaction values Encora at an implied ~4.5-4.0x EV/sales, which is based on FY25/FY26 revenue. The valuation sits within the range for scaled digital engineering assets. For context, listed digital engineering peers such as EPAM and Globant currently trade at 2.0/1.3x EV/sales (trailing). In comparison, Altran, which was acquired by Capgemini, was valued at ~1.2-1.3x EV/sales at the time of acquisition.

Integration – Evidence supportive, execution is the key

* While management has not yet outlined detailed integration mechanics, historical evidence is supportive. Prior acquisitions such as SLK Global and Cigniti—accounting for ~9-11% and ~16% of Coforge’s revenue at the time of acquisition, respectively—were integrated successfully, with subsequent client mining and margin improvement.

* That said, this transaction is structurally different: unlike earlier, client-centric acquisitions, Encora is primarily a capability- and leadership-led acquisition. Making senior talent retention, cultural alignment, and platform monetization more critical, particularly given the larger scale.

Better revenue per employee metrics despite nearshore presence

* Encora’s revenue per employee stands at ~USD74k vs. ~USD69k for Coforge. For a broader context, revenue per employee among digital engineering peers such as PSYS, EPAM, and Globant ranges from ~USD66k to ~USD90k.

* The above figures for Encora are notable, considering that it has a nearshore concentration, which typically results in lower bill rates compared to Coforge, which has a presence in the US and UK.

Details of the transaction

* Coforge will acquire 100% of Encora for an enterprise value of USD2.35b, funded through equity consideration of ~USD1.89b through a share swap, with the balance covered by a bridge loan and/or a potential QIP to retire Encora’s existing debt. The transaction will result in the issuance of ~21.25% of post-issue equity to Encora shareholders, with no change in control; however, investors will have the right to nominate two directors to the Board.

* Encora reported a revenue of USD516m in FY25 (FY24: USD481m), with FY26 revenue guidance of ~USD600m and an adjusted EBITDA margin of ~19%. The combined entity is expected to operate at ~14% EBIT margin post-amortization of intangibles. The closing is anticipated within four to six months, subject to shareholder and regulatory approvals.

Valuation and view

We believe Coforge’s strong executable order book and resilient client spending across verticals bode well for its organic business. This acquisition expands Coforge’s presence in the Hi-Tech and Healthcare verticals, though we have not yet incorporated Encora's numbers into our valuation. We continue to view Coforge as a structurally strong mid-tier player well-placed to benefit from vendor consolidation/cost-takeout deals and digital transformation. We value Coforge at 32x (considering a potential dilution) FY28E EPS with a TP of INR2,500, implying a 49% potential upside. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412