Buy CAMS Ltd for the Target Rs.5,000 by Motilal Oswal Financial Services Ltd

Non-MF businesses gaining traction; MF yields under pressure

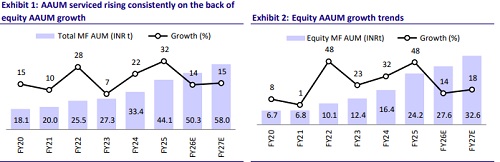

* MF AUM growth has picked up in the recent past, supported by sustained SIP inflows and MTM gains. We expect this momentum to continue, given the rising adoption of MFs as a savings product. Direct investing through discount brokers has also gained traction, and with MF penetration still at just 4%, we expect this trajectory to sustain. CAMS is well-positioned to benefit from this trend.

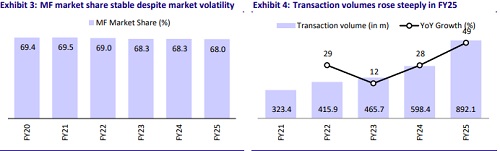

* CAMS continues to reinforce its position in the mutual fund industry, holding ~68% market share and serviced AUM size of INR44.1t (FY25). The company managed about 132 new fund offers in FY25, mobilizing a cumulative amount of INR734b.

* CAMS experienced accelerated yield compression in FY25, largely driven by a structural repricing with a large MF client (partial impact in Q4FY25; remainder expected in 1HFY26). Realization dipped to 2.24bp in Q4FY25 (FY25 avg: 2.33bp), implying a 6-7% YoY decline, with normalization expected post-Q2FY26. Yield headwinds are expected to be partly offset by ~12-14% AUM growth, improving traction in non-MF segments (Payments, Alternatives, KRA), and operating leverage.

* CAMS won its first overseas RTA mandate with Ceybank AMC, Sri Lanka, and expanded its presence in the GIFT City, inaugurating a new facility in Oct’24.

* CAMS Pay witnessed significant growth in UPI-based mandate registrations (up 25% QoQ) in Q4FY25. As UPI AutoPay continues to become the preferred mode for SIPs and recurring purchases, the company is well-placed as a trusted infra partner to AMCs and distributors. With strong backend integrations, CAMS Pay is positioned to become a critical layer in recurring digital payments infrastructure for financial services.

* CAMS Pay witnessed significant growth in UPI-based mandate registrations (up 25% QoQ) in Q4FY25. As UPI AutoPay continues to become the preferred mode for SIPs and recurring purchases, the company is well-placed as a trusted infra partner to AMCs and distributors. With strong backend integrations, CAMS Pay is positioned to become a critical layer in recurring digital payments infrastructure for financial services.

* CAMSRep reported strong volume growth, driven by rising adoption of epolicies (over 11m) issued via BIMA Central and higher insurer integration (with three insurers live on the platform alongside LIC). Favorable regulations around the dematerialization of life insurance policies have aided this momentum.

* CAMS’ KRA business is emerging as a clear differentiator, with 10-minute KYC processing vs around three hours for peers. WhatsApp-based KYC, APIled integrations, and compliance automation make CAMS a preferred infra provider for intermediaries under evolving SEBI norms.

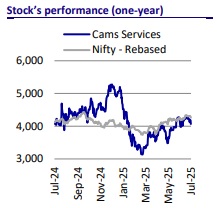

* Valuation and view: We have largely maintained our earnings estimates for FY26/FY27, as healthy AUM growth and increasing traction in non-MF segments are expected to offset the decline in yields, as guided by the management. We expect revenue/PAT to post a CAGR of 11%/12% over FY25-27E. We reiterate a BUY rating on the stock with a one-year TP of INR5,000, premised at a P/E multiple of 42x on FY27E earnings.

Market leadership in MF RTA continues

* CAMS continues to maintain its dominant position in the MF RTA industry, holding a market share of ~68% and serviced AUM size of INR44.1t (FY25). It remains the preferred partner for asset managers, with 26 out of 51 AMCs currently on-boarded (five more expected to go live over the next six months).

* In FY25, CAMS's AUM expanded by 34% YoY, in line with overall industry growth, driven primarily by a robust 47% YoY increase in equity assets.

* The platform supported over 723m systematic transactions—marking a 43% YoY increase—with an SIP book size of 57.2m, rising 18% YoY. It processed 892m MF transactions during the year (YoY growth of 49%) and managed ~94.2m live investor folios, recording a 30% YoY increase. The unique investor base grew 26% YoY to 40.4m, faster than the industry growth of 22%.

* CAMS reinforced its tech leadership with a continued emphasis on digitization and user-centric platforms. It initiated a five-year strategic collaboration with Google Cloud to re-architect its core MF platform into a modular, AI-enabled cloud-native ecosystem. This upgrade is expected to improve scalability, digital security, and data analytics capabilities while supporting the evolving demands of AMCs and investors.

Key highlights of FY25:

* Appointed as the RTA by three newly licensed mutual fund AMCs, including the soon-to-be-launched Jio BlackRock

* Secured a critical migration mandate from an existing AMC that was previously served by a competitor, signaling strong client confidence in CAMS’ scalable technology and service quality.

* Won its first overseas RTA mandate with Ceybank AMC, Sri Lanka, and expanded its presence at GIFT City, Gujarat, by inaugurating a larger facility in Oct’24.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412