Buy Mahanagar Gas Ltd for the Target Rs. 1,700 by Motilal Oswal Financial Services Ltd

Ahead in volume growth, sustaining resilient margins

* Volume growth with margin tailwinds: MAHGL is set to deliver robust earnings growth, driven by aggressive CNG network expansion, improving throughput at existing stations, and strategic land tie-ups that strengthen long-term visibility. The company’s sharper focus on network-wide IRR assessment and partnerships such as BEST further support accelerated rollout. On the margin front, favorable gas sourcing dynamics – softer crude, lower slopes on new LNG contracts, and resilient CNG price competitiveness – provide a buffer against regulatory cost headwinds and INR depreciation vs. USD. Together, these levers position MAHGL strongly for sustained volume growth and margin expansion through the medium term.

* Limited EV risk & regulatory tailwinds to drive outperformance vs. peers: MAHGL remains well-positioned among CGDs with a strong volume growth outlook, limited EV/alternate fuel substitution risk, and emerging regulatory tailwinds. We highlight that the three-wheeler segment, which contributes ~34% of volumes, faces minimal near-term EV risk in Mumbai. Further, policy initiatives such as the High Court’s review of phasing out petrol/diesel vehicles in favor of CNG/EVs and the mandated transition of bakeries to cleaner fuels could provide incremental upside. While execution challenges remain in some segments, MAHGL’s stable margin profile and favorable demand environment reinforce its relative strength vs. peers.

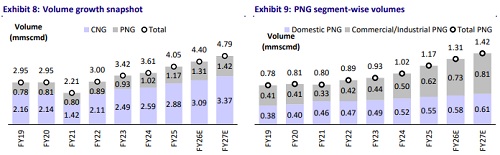

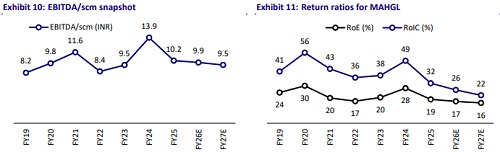

* MAHGL remains our preferred pick among CGDs: As highlighted in our recent sector update (Era of margin expansion for CGDs), MAHGL remains our preferred pick among CGDs. We retain our estimates as we model MAHGL’s volumes to clock a 9% CAGR over FY25-27 and estimate an EBITDA margin of INR9.5-10/scm during the period. MAHGL currently trades at 11.1x FY27E SA P/E. Reiterate BUY with a TP of INR1,700.

CNG volume growth underpinned by aggressive CNG station expansion.

* CNG station additions surged 2.7x over FY21-25: MAHGL has been significantly accelerating its CNG station rollout, which remains the cornerstone of its future volume growth strategy. On a standalone basis, the company has increased annual CNG station additions from 15 in FY21 to 40 in FY25 and now targets adding ~50 stations in FY26. Under UEPL, the company plans to add another ~30 stations in FY26 (26 additions in FY25). Looking ahead, management has outlined an aggressive plan to add 250 CNG stations by FY30, alongside upgrading existing infrastructure to enhance efficiency.

* Tie-up with BEST expands CNG access over 15 stations: MAHGL has partnered with BEST to make 15 depot-based CNG stations available for public use, subject to pre-registration. As of 30th Jun’25, 8 out of these 15 stations have already been opened to all vehicles, providing additional access points and further strengthening the company’s CNG distribution network.

* Improved IRR assessment aligned to network economics: The company now evaluates returns on a network-wide basis rather than at an individual station level, reflecting incremental investments more accurately. This makes new CNG outlets appear more attractive, enabling quicker approvals and faster rollout.

* Strategic focus on land acquisition and partnerships: Taking a stronger approach to land acquisition, which is critical for scaling CNG infrastructure, MAHGL has been actively engaging with government authorities to secure land parcels. This effort should facilitate a smoother rollout process.

* Enhancing throughput at existing stations: Alongside network expansion, MAHGL is exploring opportunities to improve asset productivity by adding dispensers at existing stations. This initiative not only increases throughput but also enhances customer accessibility and reduces congestion at high-traffic locations, strengthening MAHGL’s service reliability.

* Mega CNG stations – exciting prospects at prime locations: MAHGL is developing three mega CNG stations at Sion, Wadala, and Mumbai Port Trust (near Atal Setu), with completion expected in ~1.5 years. These hubs will feature up to 50 dispensers each, a sharp scale-up from the earlier 10. With strategic land parcels already secured, these high-capacity stations in prime locations will strengthen MAHGL’s CNG network and ease congestion at existing outlets.

Reducing raw material costs to drive margin expansion

* Weaker crude and lower slope – the twin emerging tailwinds: As highlighted in our recent sector update (Era of margin expansion for CGDs), we expect that a soft crude price outlook, coupled with a lower pricing slope for natural gas amid the upcoming LNG oversupply, will reduce gas costs. This should also ease concerns around the APM deallocation affecting margins.

* R-LNG cost could dip INR2.5/scm: While Brent crude prices averaged ~USD69/bbl in 2QFY26YTD, we forecast Brent to average USD65/bbl in FY26/FY27. We estimate every USD5/bbl decline in Brent prices reduces the landed cost of natural gas by ~INR2.5/scm. Further, according to our discussions with the listed and unlisted India CGD companies, new long-term gas contracts are already being signed for a 1.0-1.3% lower slope given the expected surge in LNG supply in 2HFY26 and beyond. Note that the risks of crude oil prices falling below the USD65/bbl mark are mounting as OPEC+ strategy shifts from “managing” oil prices to “protecting market share”.

* Lower crude outlook to ease APM/NWG gas costs by ~INR4/scm: Similarly, a weak crude price outlook shall also lower APM & New Well Gas (NWG) price. If the APM/NWG price dips to USD6/7.2 per mmbtu (from USD7/8.4 per mmbtu currently), the cost of natural gas reduces by ~INR3.6/4.3 per scm.

* Estimate ~INR2/scm margin expansion scope amid favorable fundamentals: About 40%/12%/6% of MAHGL’s gas sourced is APM/NWG/Brent-linked. With respect to APM/NWG, we estimate that a USD10/bbl decline in crude prices can lead to an EBITDA margin improvement of ~INR2/scm for MAHGL. Similarly, for Brent-linked RLNG, a USD10/bbl decline in crude prices and a simultaneous 1% decline in pricing slope can lead to an EBITDA margin improvement of ~INR0.5/scm. However, benefits may partly be offset by rupee weakness, as in 2QFY26YTD the ~2% INR depreciation vs. USD implies a margin drag of ~INR0.6/scm.

* Impact of zonal tariff reform likely to be passed on: In the 1QFY26 earnings call, management guided for an INR0.6-0.7/scm CNG EBITDA margin impact from PNGRB’s move to a 2-zone tariff regime. We expect MAHGL to pass on the cost increase, supported by CNG’s continued price advantage of ~47% vs. petrol and ~12% vs. diesel, limiting any demand risk

Well-positioned vs. peers: Strong volumes, stable margins!

* Strong volume growth outlook: In FY25, volumes for MAHGL grew at 12% YoY (IGL/GUJGA: 6%/3%). Further, we project MAHGL to clock a volume CAGR of 9% over FY25-27 (guidance: 9-10%), vs. 7%/3% for IGL/GUJGA (guidance by IGL: 10%).

* Limited EV substitution risk in the three-wheeler segment: Three-wheelers contribute ~34% of MAHGL’s volumes, with limited risk of substitution by EVs in the near term (unlike in Delhi). No directive has been issued mandating a shift to EV autos, and penetration in Mumbai remains negligible due to structural challenges – lack of charging infrastructure, roadside parking, and round-theclock vehicle usage by multiple drivers, which makes charging downtime unfeasible.

* Regulatory tailwinds: CNG and cleaner fuel adoption in Mumbai:

* The Bombay High Court has directed a committee to evaluate the phased replacement of petrol and diesel vehicles in Mumbai and the wider MMR with CNG and EV alternatives (link). While the final recommendations are still pending, such a move could structurally favor CNG adoption in the medium term given the relatively limited penetration of EVs and the existing scalability of CNG infrastructure. For MAHGL, this presents a potential upside risk to volumes, though policy contours and implementation timelines remain uncertain.

* The Bombay High Court has also mandated bakeries to shift from coal/wood to cleaner fuels by Jul’25 (link) and dismissed a plea by 12 bakeries seeking more time, stressing public health over business concerns (link). For MAHGL, the opportunity set is modest – individual bakery volumes are typically ~25scmd, and network connectivity is not always feasible – yet the company benefits from higher margins in the commercial segment. While the overall volume impact may be limited and execution challenging, the policy push underscores the government’s intent to drive cleaner fuel adoption.

Valuation and view

* We expect a 9% CAGR in volume over FY25-27, driven by multiple initiatives implemented by the company, such as collaborating with OEMs to drive conversions of commercial CNG vehicles and providing guaranteed price discounts to new I/C-PNG customers.

* Management guides a 40% YoY volume growth in UEPL volumes in FY26, with a long-term target volume of 1.2-1.3mmscmd (0.2-0.3mmscmd currently). Further, MAHGL’s foray into battery manufacturing, LNG, and CBG businesses shall provide a boost to earnings in the long run.

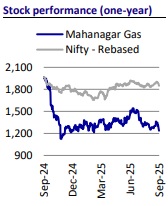

* The stock trades at 11.1x FY27E EPS of INR112. We value the stock at 15x FY27E EPS to arrive at our TP of INR1,700. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412