Neutral Vedant Fashions Ltd for the Target Rs. 775 by Motilal Oswal Financial Services Ltd

Weak end to a subdued FY25; LFL recovery key

* Vedant Fashions (VFL) reported yet another weak quarter with a modest 1% revenue growth as same-store sales declined ~4.5%, while EBITDA/PAT declined 5%/13% YoY (9%/11% miss) due to operating deleverage.

* For FY25, VFL’s revenue growth remained subdued with ~1% CAGR over FY23-25, while its EBITDA and PAT declined for the second successive year.

* Demand remained muted, driven by weak consumer sentiment in the midpremium segment. Further, VFL has been majorly impacted by persisting weakness in AP and Telangana markets (excluding these markets, management indicated that SSSG would have been flat in FY25).

* Management indicated that LFL revenue growth would be the key focus area in FY26 and expects store consolidation to continue in 1HFY26.

* We cut our FY26-27E EBITDA by 4-5% and PAT by 8-9% due to a weak demand environment and the likely continuation of store consolidation. Overall, we model an 8-10% CAGR in VFL’s revenue/EBITDA/PAT over FY25-27E.

* While the stock is currently trading ~40% below its average P/E, we await signs of demand recovery before we turn more constructive on VFL. Reiterate Neutral with a revised TP of INR775, premised on 40x FY27E P/E

Another weak quarter; EBITDA dips 5% YoY (9% miss)

* Customer sales grew ~2% YoY to INR5.2b in 4QFY25, as ~5% increase in area was offset by a 4.5% decline in same-store sales.

* Consolidated revenue inched up ~1% YoY to INR3.7b (4% below) as demand trends remained subdued.

* VFL added 12 stores (6 SIS, 6 EBOs) in 4Q, taking the total store count to 678, with a store area of ~1.79m sqft. (up ~5% YoY).

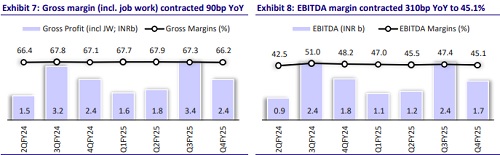

* Gross profit increased 3% YoY to INR2.7b as gross margin expanded 110bp YoY to 73.6% (100bp beat).

* Employee cost increased 15% YoY (6% higher), while other expenses rose ~20% YoY (7% higher).

* EBITDA declined ~5% YoY to INR1.7b (9% miss), driven by weaker revenue growth and higher other expenses. EBITDA margins contracted ~310bp YoY to 45.1% (~210bp miss).

* Reported PAT declined ~13% YoY to INR1b (11% miss).

Subdued performance continued in FY25

* Customer sales grew ~2% YoY to INR18.9b, as ~5% increase in area was offset by a 4.2% decline in same-store sales. Management indicated that LTL sales grew 2.9% YoY in the Jul’24 to Mar’25 period and would have been flat in FY25, excluding the AP and Telangana markets.

* Reported revenue inched up 1% YoY to INR13.9b (~1% FY23-25 CAGR).

* In FY25, VFL added 85k net retail area, and two net stores were added (the SIS count increased by 13, while the EBO count reduced by 11). The company exited 11 domestic and 1 international cities in FY25.

* EBITDA at INR 6.5b declined 2% YoY, a second straight year of YoY decline.

* PAT declined 6% YoY to INR3.9b and was ~10% below its FY23 PAT.

* Inventory days rose to 53 in FY25 (from ~37 YoY), while its reported receivable days increased to ~187 (from ~151 days YoY). Overall WC capital days increased to 213 (vs. 164 days YoY).

* FCF moderated to INR2.1b in FY25 (vs. ~INR3.3b YoY) on adverse WC changes.

Highlights from the management commentary

* Demand trends: VFL’s performance was weighed down by: 1) continued weakness in consumer sentiment, 2) persisting weakness in markets such as AP and Telangana (TS), and 3) also increased competitive intensity in the ethnic wear category. Management indicated that excluding AP/TS, SSSG for FY25 was flat (4.2% decline).

* Demand outlook: Management is witnessing some green shoots in demand in 1QFY26 (albeit on a weak base). However, overall demand sentiments still remain weaker than expectations.

* Key focus areas for FY26: Management indicated that LFL growth recovery is the key focus for the company in FY26. Further, it expects the consolidation of high-rental unprofitable stores to continue, at least until 1HFY26.

* Mohey: It has undergone a strategic shift from being a bridal wear brand to a broader wedding wear brand, which has positively impacted footfalls and conversions. During FY25, ~40% of the new retail area addition was dedicated to Mohey, which has been the fastest-growing brand in VFL’s portfolio. Management indicated that Mohey accounts for ~14% of VFL’s retail area, while revenue productivity is slightly lower than Manyavar, but on an improving trend.

* Competitive intensity: India’s men’s ethnic wear market has seen an increase in competition over the past 2–3 years, with an unprecedented number of store openings (up 3x) due to the entry of several new retailers. Management believes that despite significant store openings, no single player has gained any significant share, and most new stores would not be at long-term sustainable profitability levels. Further, management indicated that legacy competitors have seen consolidation due to weak demand, but new entrants are still opening stores

Valuation and view

* FY25 marked a second successive year of subdued revenue growth and weaker profitability for VFL. We believe that apart from the overall weaker demand sentiment, rising competition, and slower-than-expected shift from the unorganized to organized in the ethnic-wear category have been the key headwinds.

* Growth recovery in Manyavar (on a low base of the last few years), scale-up of Mohey (women’s celebration wear) and Twamev (premium offering in celebration wear), along with improved traction in its recent forays in the newer categories (Diwas, a value brand catering to festive wear), remain the key growth drivers for VFL.

* We cut our FY26-27E EBITDA by 4-5% and PAT by 8-9% due to a weak demand environment and the likely continuation of store consolidation. Overall, we model an 8-10% CAGR in VFL’s revenue/EBITDA/PAT over FY25-27E.

* While the stock is currently trading ~40% below its average P/E, we await signs of demand recovery before we turn more constructive on VFL. Reiterate Neutral with a revised TP of INR775, premised on 40x FY27E P/E (vs. INR850 earlier).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)