Buy Adani Ports & SEZ Ltd for the Target Rs.1,700 by Motilal Oswal Financial Services Ltd

Performance marginally above expectation; focus on becoming an integrated transport utility company

* Adani Ports & SEZ (APSEZ) reported revenue growth of 31% YoY to INR91b in 1QFY26 (in-line). Cargo volumes grew 11% YoY to 121mmt. The growth was primarily led by containers.

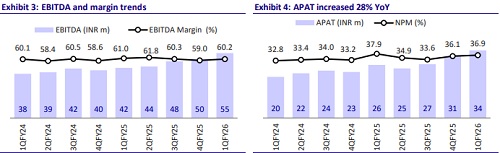

* EBITDA margin came in at 60.2% in 1QFY26 vs our estimate of 60.1% (-80bp YoY, +120bp QoQ). EBITDA grew 29% YoY to INR55b (7% above our estimate), while APAT increased 28% YoY to INR34b (9% above our estimate).

* The all-India cargo market’s share increased to 27.8% (vs 27.2% in 1QFY25). The container market’s share stood at 45.2% (vs 45.9% in 1QFY25).

* APSEZ reported a strong performance in 1QFY26, marked by robust growth in international port operations. Its logistics business emerged as a key growth driver, with significant improvement in network scale and last-mile connectivity, further complementing port operations. The marine business also saw strong traction, reflecting operational scale-up and integration. Overall, with continued market share gains, capacity additions, and expansion in value-added segments like logistics, APSEZ is well-positioned to grow faster than the broader industry.

* We largely retain our estimates for FY26 and FY27. We expect APSEZ to report a 10% growth in cargo volumes over FY25-27. This would drive a CAGR of 16%/16%/21% in revenue/EBITDA/PAT over FY25-27E. We reiterate our BUY rating with a TP of INR1,700 (premised on 16x on FY27E EV/EBITDA).

Performance led by strong growth in container cargo

* APSEZ reported strong operational momentum in 1QFY26, handling 121 MMT of cargo, marking an 11% YoY increase. The growth was primarily driven by a 19% YoY surge in container volumes, reflecting the continued strength of India’s export-import trade and APSEZ’s focus on enhancing container handling capabilities.

* Domestic cargo volumes rose 6% YoY to 112.9MMT, supported by growth across key ports. Mundra Port, while slightly lower in share compared to last year (48% in 1Q FY26 vs. 51% in 1Q FY25), remained the largest contributor to overall volumes. Krishnapatnam Port achieved a milestone by handling its highest-ever monthly volume of 5.85MMT in Jun’25.

* International cargo volumes witnessed a sharp ~250% YoY growth, rising from 2.2MMT to 7.7MMT, driven by a ramp-up at Haifa Port and the commencement of operations at the Colombo West International Terminal (CWIT).

Logistics and marine businesses gain momentum

* Logistics’ revenue doubled YoY to INR11.7b. APSEZ also saw strong traction in rail-based and integrated cargo movement. It handled 0.18m TEUs of container rail volume (+15% YoY) and ~6 MMT of GPWIS cargo (+9% YoY). Furthermore, APSEZ launched double-stack container rake movements between ICD Tumb and ICD Patli, further strengthening its multimodal logistics capabilities.

* The marine business revenue surged nearly 3x YoY to INR5.4b, with vessel count increasing to 118 from 76. Together, these segments contributed significantly to overall revenue growth in 1QFY26.

* As of Jun’25, APSEZ strengthened its integrated logistics network with a total rake count of 132. It operates 12 multi-modal logistics parks (MMLPs) and has expanded its warehousing capacity to 3.1m sq. ft. Agri silo capacity rose to 1.3MMT, with a target of 4MMT.

* In the marine business, APSEZ has significantly increased marine vessels to 118 as of Jun’25 (v/s 76 in 1Q FY25) and aims to increase revenue to INR33b in FY27.

Highlights from the management commentary

* The company continued to deepen its international presence by commencing operations at the Colombo West International Terminal and reporting record performance at Haifa Port. It also approved the acquisition of NQXT Port in Australia, positioning itself for future growth in global trade corridors.

* The integration of its marine services business (which includes Ocean Sparkle, Astro, and TAHID) has been progressing well, and APSEZ expects its marine business revenue to increase to INR33b in FY27 (3x FY25 revenue).

* Management expects to handle 505-515MMT of cargo in FY26, with containers being the primary growth driver, followed by dry cargo and liquid cargo.

* Volumes in July have been weak due to adverse weather conditions, but the situation is expected to normalize in August.

Valuation and view

* With strong cash flows, a healthy cash balance of INR169b, and net debt to EBITDA at 1.8x, Adani Ports is well-positioned for further expansion. Capacity enhancements at key ports, ongoing infrastructure projects, and global port acquisitions provide visibility for sustained growth in FY26 and beyond.

* We broadly maintain our estimates for FY26/27 and expect APSEZ to report a 10% growth in cargo volumes over FY25-27. This would drive a revenue/ EBITDA/PAT CAGR of 16%/16%/21% over FY25-27E. We reiterate our BUY rating with a TP of INR1,700 (premised on 16x FY27 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412