Buy L&T Finance Ltd For Target Rs. 200 by Motilal Oswal Financial Services Ltd

Retail growth to accelerate; credit costs to normalize in 2HFY26

Guides for normalization in the MFI business from early 2QFY26 onward

* L&T Finance’s (LTF) reported 4QFY25 PAT grew 15% YoY to INR6.4b (in line). FY25 PAT grew ~14% YoY to INR26.4b.

* Consol. credit costs stood at INR6.2b (in line), translating into annualized credit costs of ~2.55% (PQ: 2.5% and PY: 3.2%). The company utilized macroprudential provisions of INR3b in 4QFY25 and ~INR4b in FY25. Before the utilization of macro-prudential provisions, credit costs for the quarter stood at ~3.8% (PQ: 2.9%). The company now has unutilized macro provisions of ~INR5.75b. Write-offs stood at ~INR7.4b (PQ: ~INR5.9b).

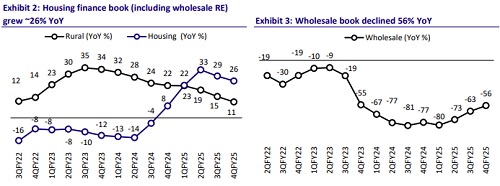

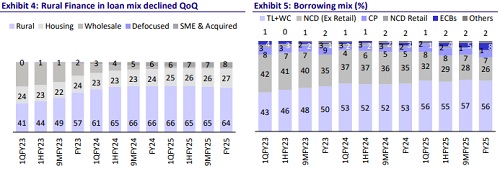

* Retail assets contributed ~97.4% to the loan mix. Retail loans grew ~19% YoY, led by healthy growth in HL, LAP, and Personal Loans. The company has resumed growth in its personal loans book, which grew ~11% QoQ. Rural Business Loans (MFI) were flat, while 2W declined ~3% QoQ.

* LTF highlighted that the stress in the MFI industry has likely bottomed out. The implementation of MFIN Guardrails 2.0 is expected to have a limited impact, as the company has a relatively low proportion of overleveraged customers. Management also highlighted that it expects a structural decline in credit costs after 1-2 quarters, with credit costs in 2HFY26 expected to be lower than in 1H.

* Management expects MFI industry growth at ~10%-15% and guided for LTF’s retail loan growth of ~20-25% in FY26. We estimate a CAGR of ~22% in total loans and ~23% in PAT over FY25-27E, with consolidated RoA/RoE of 2.6%/~14% in FY27E. While FY26 will be a year of transition toward the targeted loan mix and implementation of Cyclops in Tractors, PL and SME segments, we expect LTF to deliver a sustainable improvement in profitability and RoA expansion from FY27 onward. Retain BUY with a TP of INR200 (based on 1.6x Mar’27E BVPS).

NIMs + fees decline ~20bp QoQ; yields decline ~65bp QoQ

* Reported NIMs declined ~37bp QoQ to 8.15%. However, consol. NIMs + fees declined ~20bp QoQ to ~10.15%, driven by a fall in MFI in the loan mix.

* Spreads (calc.) declined ~45bp QoQ to ~8.4%. Yields (calc.) fell ~65bp QoQ to ~15.6%, while CoF (calc.) was down ~15bp QoQ at 7.2%.

* Management shared that it plans to expand the gold loans and micro LAP businesses, both of which are relatively high-NIM businesses. In addition, LTF plans to grow its PL portfolio, which delivers blended yields of over ~17%. The company will also focus on implementing several fee-generation initiatives throughout the year and has guided for NIM + fee of ~10.0-10.5% in FY26. We model NIMs of ~9.8%/9.7% in FY26/27E (FY25: 9.9%)

Minor deterioration in asset quality; retail GS3 stands at ~2.9%

* Consol. GS3 rose ~6bp QoQ to ~3.3% and NS3 was stable QoQ at ~1%. PCR was broadly stable at ~71%. Retail GS3 rose ~5bp QoQ to 2.9%.

* We model credit costs (as % of average loans) of ~2.9%/2.7% in FY26/FY27E (compared to ~2.8% in FY25).

Key highlights from the management commentary

* Management acknowledged that developments in Tamil Nadu (in the backdrop of the introduction of the bill to prevent coercive money recovery) were concerning; however, the impact is expected to be less widespread compared to what was observed in Karnataka. Currently, there are no prominent issues in any district of Tamil Nadu.

* As the Cyclops implementation is rolled out across products, the company expects a structural decline in credit costs. CIBIL bureau analysis for 2W loans indicates that the portfolio underwritten through Cyclops carries a lower risk, with overall credit costs projected to decline by ~100-150bp.

* Management guided for credit costs of 2.3-2.4% (as % of assets) in FY26, with credit costs declining from 2HFY26 onward. It expects continuous improvements in RoA trajectory as the problems in the MFI segment gradually dissipate.

Valuation and view

* LTF’s 4Q earnings were in line with expectations. Disbursements and loan growth remained modest, reflecting the company’s strategic focus on calibrated risk-based expansion. Asset quality saw a slight deterioration with sequentially higher credit costs, while NIMs continued to contract, primarily due to a reduced share of MFI in the loan portfolio.

* LTF has invested in process automation, security, and customer journeys. This, along with large partnerships in products like PL, should lead to stronger and more sustainable retail loan growth. While there are signs of stress in non-MFI retail segments like 2W, tractors and PL, we expect the stress to subside and be provided for over the next two quarters. Stress in the microfinance sector is a near-term headwind, which the company will navigate and come out stronger.

* We estimate a PAT CAGR of 23% over FY25-27E, with consolidated RoA/RoE of 2.6%/~14% in FY27. Reiterate our BUY rating on the stock with a TP of INR200 (based on 1.6x Mar’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)