Neutral Indus Towers Ltd For Target Rs.400 by Motilal Oswal Financial Services Ltd

Core performance in line; FCF generation picks up

* Indus Towers’ (Indus) 3QFY25 reported financials were ahead of our estimates, largely due to the higher-than-estimated reversal of prior-period bad debt provisions (INR30.2b vs. our estimate of INR12.5b).

* Operationally, the core performance was in line, with Indus’ recurring EBITDA rising 4% QoQ to INR39.3b (+8% YoY) as tower/tenancy additions picked up, while ARPT remained stable QoQ.

* Given significant prior-period collections and moderation in capex, Indus’ 9M FCF was robust at ~INR60b (of which INR27.5b was used for buyback).

* Further, with the clearance of pending bad debt provisions in 4Q, we expect Indus’ FCF to sustain at elevated levels, which should enable the company to declare INR20+/share as dividend for FY25.

* According to media reports, the GoI is considering a partial waiver of telcos’ AGR dues. If the waiver is approved, we expect Vi’s debt raise to close, which should be positive for Indus as well, as it: 1) helps sustain 100% collections, and 2) improves comfort on incremental business from Vi’s network expansions with minimal capex.

* Our FY25-26 estimates are broadly unchanged. We continue to assume ~INR20b bad debt provisions from FY27.

* We maintain a Neutral rating on Indus with a revised DCF-based TP of INR400 (bull: INR480, bear: INR340).

In-line core operational performance

* Consolidated reported revenue was up ~1% QoQ to INR75.5b (+5% YoY, ~2% miss).

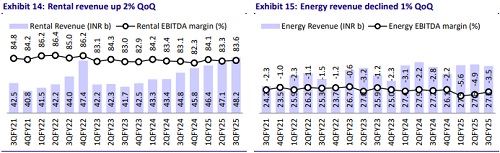

* Service revenue at INR48b (+2% QoQ, +8% YoY) was in line with our estimate.

* Energy reimbursements at INR27.3b (-1% QoQ, flat YoY) were ~6% below our estimate on lower power and fuel expenses.

* Consolidated reported EBITDA was up 43% QoQ to INR69.6b (1.94x YoY) and was 34% ahead of our estimate, largely on higher prior-period reversals.

* Adjusted service EBITDA at INR40b (+3% QoQ, +8% YoY) was broadly in line with our estimate.

* Energy spreads further recovered QoQ to negative INR944m (vs. INR1.35b loss QoQ), but was marginally higher than our estimate of loss of INR750m.

* Indus reversed a bad debt provision of INR30.2b in 3QFY25 (vs. bad debt provision reversals of INR10.8b QoQ and provisions of INR640m YoY), which was higher than our estimate of INR12.5b. This was driven by the company recognizing ~INR19b in 3Q (though the payment was received after Dec’24).

* Adjusted for bad-debt provision reversals, recurring EBITDA at INR39.3b (+4% QoQ, +8% YoY) was in line with our estimate.

* Reported PAT at INR40b (+80% QoQ, 2.6x YoY) was 66% above our estimate, largely due to higher provision reversal.

* Recurring PAT at INR17.4b (+23% QoQ, +10% YoY) was ~18% above our estimate, driven by higher other income (largely on payment of INR1.8b interest receivables by Vi), lower depreciation, and lower tax rate on tax reversals pertaining to favorable court judgments.

Net tower adds improve QoQ; ARPT broadly stable QoQ

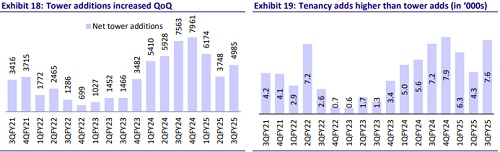

* Net macro tower adds improved to 4,985 QoQ (though lower than our estimate of 5,500; vs. 3,748 net adds in 2Q).

* Indus also added 132 net leaner towers QoQ (vs. 182 QoQ).

* For the third successive quarter, net macro tenancy additions were higher than tower adds at 7,583 (though lower than our estimate of 9,500; vs. 4,308 net adds in 2Q).

* The end-period tenancy ratio was stable QoQ at 1.65X as the incremental tenancy ratio improved to ~1.52X (vs. ~1.1X QoQ).

* Reported sharing revenue per macro tenant (ARPT) at INR41.4k (+0.7% QoQ, flat YoY) was broadly in line with our estimate.

Receivables temporarily rise QoQ; net debt (ex-leases) moderates

* Receivables increased sharply by ~INR16.9b QoQ to INR73.2b, likely due to the company accounting for the INR19.1b payment made by Vi in Jan’25.

* The company reversed ~INR30.2 in bad debt provisions, implying a net surplus collection of ~INR13.3b during 3QFY25 (vs. ~INR27b in 1H).

* Over the past few quarters, Indus has recovered INR52.5b toward past dues from Vi, with prior period bad debt provisions now at modest ~INR5.3b (vs. INR35.5b/INR53.9b at Sep’24/Mar’24).

* In addition, Vi has also paid INR1.8b toward interest on overdues in 3QFY25 (INR2.05b in 9MFY25).

* Reported capex further moderated ~19% QoQ to INR12.3b (vs. INR15.2b QoQ) on account of INR6.6b write-back pertaining to Input Tax Credit.

* Net debt including lease liabilities declined ~11% QoQ to INR189b (vs. ~INR210b QoQ); net debt excluding lease liabilities declined to modest ~INR10b (vs. ~INR37b QoQ).

* Indus’ reported 3Q FCF improved to INR26.6b (from INR33.1b in 1H). Its 9MFY25 FCF stood at ~INR60b due to the collection of prior-period dues and a moderation in capex.

Highlights from the management commentary

* Tower/tenancy additions: Tower and tenancy additions improved due to a pickup in rollouts by Bharti and Vi. The order book is likely to remain healthy for the next 3-4 quarters and management expects to maintain a dominant share in Vi’s network rollouts.

* Prior-period due collections and receivables: Indus reversed bad debt provision of INR30b during 3Q, while receivables temporarily increased and has subsequently normalized on receipt of payments from Vi. Outstanding bad debt provisions stood at modest ~INR5b.

* Dividends: Management reiterated that its dividend policy remains linked to FCF generation and it will take a call on reinstating dividends at FY25-end, based on FY25 FCF generation.

* EV charging: Management indicated that Indus will opt for a measured approach in its EV foray and would look to leverage its expertise in providing space, power, and O&M solutions in the EV charging space.

Valuation and view

* According to media reports, GoI is considering a partial waiver of telcos’ AGR dues. If the waiver is approved, we expect Vi’s debt raise to close, which should be positive for Indus as well, as it: 1) helps sustain 100% collections, and 2) improves comfort on incremental business from Vi’s network expansions at minimal capex.

* An AGR waiver would be a near-term positive for Vi as well as Indus. However, we remain concerned about long-term risks from the shortfall in Vi’s payments, given its large cash shortfall (INR200b+ annually over FY27-31E).

* We build in modest bad debt provisions of ~INR20b (25% of Vi’s annual service rentals) over FY27-31 (NPV impact of ~INR27/share) in our base case.

* Our FY25-27 estimates are broadly unchanged. We value Indus on a DCF-based TP of INR400 (implies ~8x FY27E EBITDA). We maintain our Neutral rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412