Buy Five Star Business Finance Ltd for the Target Rs. 840 by Motilal Oswal Financial Services Ltd

Disruption in Karnataka affects AUM growth and collections

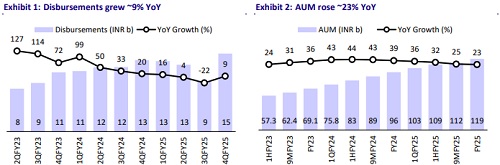

AUM growth moderated to ~23% YoY; asset quality deteriorated

* FIVESTAR’s 4QFY25 PAT grew 18% YoY to INR2.8b (in line). FY25 PAT grew ~28% YoY to INR10.7b.

* 4Q NII grew ~21% YoY to INR5.6b (in line), while PPoP rose ~19% YoY to INR4b (in line). Other income grew 26% YoY to INR250m, primarily due to higher fee income. Opex grew 26% YoY to INR1.9b (in line). Credit costs stood at INR254m (~9% lower than MOFSLe). Annualized credit costs were largely stable QoQ at ~73bp (PY: ~85bp and PQ: ~71bp).

* AUM rose ~23% YoY to INR118.8b. AUM growth fell short of ~25% growth guidance primarily due to disruptions in Karnataka. Given the current uncertain situation, it guided for AUM growth of ~25% in FY26.

* Overall collection efficiency (CE) stood at 97.7% (PQ: 98%). Unique loan collections (due one, collect one) stood at 96.2% (PQ: 96.7%). FIVESTAR noted that from mid-Jan’25 to mid-Mar’25, collections were affected by disruptions in Karnataka; however, they rebounded from mid-Mar’25. Management has guided for GS3 to remain below 2% and expects credit costs in the range of ~75-100bp in FY26.

* FIVESTAR expressed confidence that the Tamil Nadu Bill would not impact (if any) collections to the extent as was seen in Karnataka. However, the company shared that it would get better clarity over the next 15-20 days, after which it will assess the situation and take appropriate actions.

* Given high stress in the INR300K ticket size segment, the company has made a conscious decision to focus more on the INR300k-INR1.0m ticket size segment. Given that the INR500K-INR1.0m ticket-size micro-LAP faces a higher competitive intensity, there could be some pressure on incremental yields in the subsequent quarters.

* Despite a gradual deterioration in asset quality over the last one quarter, FIVESTAR is navigating the current mini credit cycle (due to unsecured retail), with a lot of resilience and (still) benign credit costs. Developments in TN will have to be closely monitored even as management shared that the general weakness (because of customer overleveraging) will take two more quarters to get normalized.

* FIVESTAR has developed strengths and capabilities in its business model that are difficult for peers to replicate. We anticipate that the company should deliver a CAGR of ~26%/~14% in AUM/PAT over FY25-27E. FIVESTAR will command premium valuations relative to its NBFC/HFC peers due to its ability to deliver strong RoA/RoE of 6.9%/17% in FY27E. Reiterate BUY with a TP of INR840 (based on 2.8x Mar’27E BV).

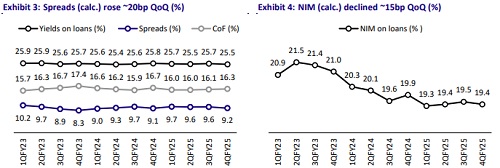

Reported NIMs rise ~30bp QoQ; Yields decline ~30bp QoQ

* Reported yield declined ~30bp QoQ to 23.7%, while CoB was stable QoQ at 9.6%. Reported NIM expanded ~30bp QoQ to ~16.85%. Incremental CoF declined ~25bp QoQ to ~9.3%.

* FIVESTAR does not expect any further reduction in lending yields. However, if CoB declines significantly and on a sustained basis, the company may consider passing on a portion of the benefit to its customers. We model NIMs to decline to 18.3%/17.1% in FY26/FY27E (FY25E: 19.6%).

Asset quality deteriorates; non-cash collections continue to improve

* GS3/NS3 rose ~15bp/5bp QoQ to ~1.8%/0.9%. PCR rose ~1pp QoQ to ~51.3%.

* The current portfolio declined to 84.3% (PQ: 84.9%). Stage 2 rose ~30bp QoQ to ~7.9%. 30+ dpd rose ~50bp QoQ to 9.65% and 1+dpd increased ~65bp QoQ to 15.7%. We model credit costs (as a % of gross loans) of ~80bp/75bp in FY26/27E.

* Cash proportion in collections declined to ~20% (PQ: ~24% and PY: ~53%) due to strong efforts made by the company to reduce cash collections.

Disbursements up ~9% YoY; Capital adequacy strong at ~50%

* Disbursements rose ~9% YoY to ~INR14.6b; AUM grew 23% YoY/6% QoQ to ~INR119b.

* 4QFY25 RoA/RoE stood at 8%/18.4%. The board has declared a dividend of INR2 per share. Capital adequacy stood at ~50% as of Mar’25.

Highlights from the management commentary

* During the quarter, 2/3rd of the incremental stress originated from Karnataka, while the remaining 1/3rd was more broad-based. The challenges related to overleveraging and general financial weakness, especially among lower middleclass customers, are expected to persist over the next two quarters.

* The increase in ticket sizes during the quarter was a deliberate strategic decision by FIVESTAR. The company is de-focusing on INR300k ticket segment and focusing more on the INR300-500k ticket segment.

* Affordable housing is seen as a complementary extension of FIVESTAR's core business. The company may look to start this segment organically by 3Q/4QFY26, leveraging its existing workforce and branch network to establish and scale operations.

Valuation and view

* While the earnings were in line with our estimates, FIVESTAR delivered a relatively weaker AUM growth and a slight deterioration in asset quality because of the disruptions in Karnataka. As a result, GS2 and GS3 increased QoQ, but credit costs remained broadly stable.

* The stock currently trades at 2.4x FY27E P/BV. We believe that FIVESTAR’s premium valuations will remain intact, given its niche market position, superior underwriting practices, resilient asset quality, and (still) high return metrics.

* We estimate FIVESTAR to deliver a CAGR of ~26%/14% in AUM/PAT over FY25- FY27, along with RoA/RoE of 6.9%/17% in FY27E. FIVESTAR’s asset quality is expected to remain relatively resilient compared to the stress that was witnessed in the unsecured segment. We reiterate our BUY rating on the stock with a TP of INR840 (premised on 2.8x Mar’27E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412