Buy Avalon Technologies Ltd for the Target Rs. 1,330 by Motilal Oswal Financial Services Ltd

Strong execution continues to drive growth

Earnings beat our estimate

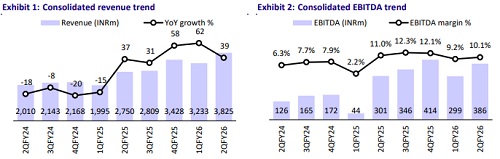

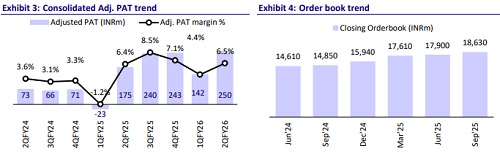

* Avalon Technologies (AVALON) reported a robust quarter, with revenue growing 39% YoY in 2QFY26, fueled by a strong performance in both the India (up 31% YoY) and US businesses (up 44%). However, EBITDA contracted (+90bp) due to lower gross margins YoY (down 250bp), driven by a change in the product mix. Employee costs as a % of sales also increased 130bp YoY to support the addition of new programs. This was offset by lower other expenses YoY (down 290bp), driven by favorable operating leverage.

* The company is witnessing growth across all business segments, with the order book growing ~25.5% YoY (INR18.6b). Supported by a robust order book visibility and strong performance in 1HFY26, management has further increased its FY26 guidance for revenue growth to 28-30% (vs. 23-25% earlier), with a sequential improvement in EBITDA margin. This marks the second consecutive quarter in which management has raised guidance.

* We largely maintain our FY26/FY27/FY28 earnings estimates as we have already built in similar growth for the company. We reiterate a BUY rating with a TP of INR1,330 premised on 45x Sep’27E EPS (rolled forward from FY27E EPS).

Margins impacted by expenses related to future growth initiatives

* AVALON’s consolidated revenue grew 39% YoY to INR3.8b (est. INR3.3b), driven by growth in both the domestic (up 31% YoY) and US (up 44% YoY) businesses. Consolidated EBITDA surged 28% YoY to INR386m, while EBITDA margin contracted 90bp YoY to 10.1% (est. 11.1%).

* The segmental mix for Clean Energy/Mobility/Transportation/Industrials/ Communication/Medical and Others stood at 18%/28%/36%/10%/8% in 2QFY26 compared to 20%/27%/30%/8%/15% in FY25.

* The total order book stood at INR30.3b, with the short-term order book (executable within 14 months) at INR18.6b (up 25.5% YoY & 4.1% QoQ) and the longer executable order book (from 14 months up to three years) at INR11.7b.

* Gross debt as of Sep’25 was INR1.3b vs. INR1.4b as of Mar’25. Net working capital days increased to 131 from 124 as of Mar’25, on account of higher inventory days (up 15 days).

* In 1HFY26, consolidated revenue/EBITDA/adj. PAT grew 49%/99%/2.6x to INR7.1b/INR685m/INR392m. For 2HFY26, implied revenue/EBITDA/PAT growth is ~23%/24%/29% YoY.

Highlights from the management commentary

* Working capital: Inventory levels were temporarily elevated (by 15 days) to support the ramp-up of new programs scheduled in 3Q and 4Q FY26. Large upcoming programs include: Energy storage systems (ESS) in the US, locomotive engine subsystems, and aerospace cabin sub-assemblies. The company expects working capital days to be ~120-130 in 2HFY26.

* Segments: AVALON’s growth is well-diversified across sectors. Energy storage is scaling rapidly, contributing 20-25% of revenue. Aerospace and railways posted 59% and 58% YoY growth in 1HFY26, with major ramp-ups due in FY26. Semiconductor prototyping starts in FY27, marking the company’s entry into advanced tech manufacturing. Industrial and mobility segments continue to drive the domestic momentum, ensuring strong, multi-year growth visibility.

* US tariffs: The company has paid over 50 unique tariffs over the last six months on account of different products supplied to the US. Of this, it was able to recover over 99% of the tariffs from customers. The dual-shore (US + India) model provides resilience and flexibility amid tariff changes for the company.

Valuation and view

* With the company witnessing growth across both the Indian and US businesses, we expect its revenue and profitability to maintain a robust momentum, as reflected in its revised guidance and strong margin commentary for the near term.

* Further, the company’s long-term revenue trajectory is anticipated to remain strong, backed by: 1) its entry into the semiconductor equipment manufacturing space, 2) strategic collaborations leading to higher margins, 3) strong order book visibility across segments, and 4) India’s emergence as a manufacturing base, supported by structural reforms and government policies.

* We estimate AVALON to post a 30%/39%/53% CAGR in revenue/EBITDA/adj. PAT over FY25-FY28 on account of strong growth and healthy order inflows. Reiterate BUY with a TP of INR1,330 (premised on 45x Sep’27E EPS)

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412