Buy Aditya Birla Sun Life AMC Ltd for the Target Rs.1,050 by Motilal Oswal Financial Services Ltd

PAT beat led by higher other income and lower employee expenses

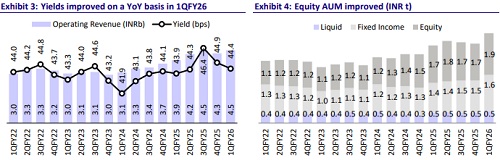

* Aditya Birla Sun Life AMC’s (ABSLAMC) 1QFY26 operating revenue grew 16% YoY to ~INR4.5b (in line), leading to YoY improvement in yields to 44.4bp from 43.9bp in 1QFY25 (vs. our est. of 44.7bp).

* Total opex grew 9% YoY to INR1.8b (in line), with a cost-to-income ratio of 40.5% (vs. 43% in 1QFY25). EBITDA rose 21% YoY to INR2.7b (in line), with margins at 59.5% (vs. 57% in 1QFY25 and our est. 58.2%).

* Higher other income and lower employee costs led to a 7% beat on PAT to INR2.8b, up 18% YoY/22% QoQ.

* 1Q net sales witnessed strong growth, surpassing full-year sales of FY25, driven by improved fund performance across categories and strategic initiatives. Equity schemes continued to deliver consistent and strong returns, supported by process enhancements. Fixed income performance also remained solid across segments, with plans to expand the product suite through one or two new fund launches to meet the evolving needs of investors.

* We have kept our estimates largely unchanged, factoring in favorable market conditions, improved fund performance across categories, stable AUM growth leading to improvement in yields, and strong traction in the passives segment. Reiterate a BUY rating with a TP of INR1,050, based on 35x Mar’27E core EPS.

Strong fund performance across categories:

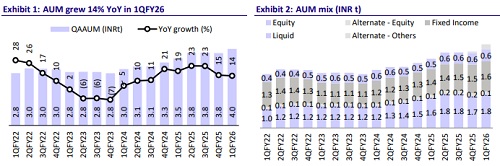

* Total MF AUM grew 14% YoY/6% QoQ to INR4t, led by 8%/20%/26%/19%/21% YoY growth in Equity/Debt/ETF/ Hybrid/Index funds. The market share stood at 6.24% as of Jun’25, largely stable.

* Overall average AUM increased 21% YoY to INR4.4t in 1QFY26, with the asset mix comprising Equity at 41%, Debt at 36%, Liquid at 14%, and Alternate Assets at 9%.

* Total Alternate AUM rose 67% QoQ to INR398b, led by a sharp 154% QoQ increase in AIF & PMS AUM to INR287b. Real estate AUM remained flat at INR5b, while offshore AUM declined 12% QoQ to INR106b.

* Revenue from the Alternate business came in at ~INR320m.

* Passive AUM grew 22% YoY and 5% QoQ to INR364b, driven by strong growth across categories—Index Funds rose 18% YoY to INR240b, ETFs grew 18% YoY to INR86b, and Fund of Funds (FoFs) surged 73% YoY to INR38b. The product suite expanded to 52 offerings from 44 as of Jun’24, spread across equity and fixed income segments.

* Under the GIFT City platform, fundraising is in progress for the ABSL Flexi Cap Fund (internal remittance) and ABSL Bluechip Fund (external remittance). Some large client withdrawals were observed due to portfolio restructuring.

* SIP contributions rose 4% YoY to INR11.4b, with SIP accounts increasing to 3.86m from 3.42m in Jun’24. Notably, 95% of total accounts are older than five years, and 90% are older than 10 years.

* The distribution mix remained largely stable in overall AUM. The direct channel continued to dominate the mix with a 42% share, followed by mutual fund distributors or MFDs (34%), national distributors (16%), and banks (8%). However, in equity AUM, MFDs contributed 54% to the distribution mix.

* Investor folios rose to 10.7m from 9.4m in 1QFY25, while the number of MFDs increased by ~2.2k to a total of 89k.

* Opex, as a percentage of QAAUM, stood at 18bp in 1QFY26 vs. 18.9bp in 1QFY25 (est. 18.7bp). Employee costs grew 4% YoY to INR926m (7% lower than estimate), while other expenses grew 13% YoY to INR753m (in line).

* ESOP expenses for the quarter stood at INR16m.

* Other income improved 24% YoY/64% QoQ, mainly due to MTM gains.

Key takeaways from the management commentary

* No near-term plans for rationalizing distribution commissions.

* On the SIF front, the board has approved the creation of a separate brand. Product opportunities have been identified across fixed income, credit, arbitrage, and long-short strategies.

* On the passives front, the company aims to build significant AUM by launching innovative products across ETFs, Index Funds, and FoFs. On the Alternatives side, it intends to hire leadership to drive accelerated growth.

Valuation and view

* ABSL AMC’s mutual fund business is witnessing strong and broad-based growth, supported by improved fund performance across equity and fixed income segments, a steady rise in SIP traction, and continued expansion of its distribution network. Strategic initiatives to strengthen market share, along with enhanced product offerings and operational efficiencies, are driving business momentum.

* The company’s focus on innovation, including the launch of a separate SIF platform and increasing focus on growth of non-MF segment via innovative product launches, positions it well for sustainable growth.

* We have kept our estimates largely unchanged, factoring in favorable market conditions, improved fund performance across categories, stable AUM growth leading to improvement in yields, and strong traction in the passives segment.

* Reiterate a BUY rating with a TP of INR1,050, based on 35x Mar’27E core EPS.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412