Buy Titan Company Ltd for the Target Rs. 4,000 by Motilal Oswal Financial Services Ltd

Growth trend to persist; superior margin delivery

* Titan Company (TTAN) posted consolidated sales growth of 19% YoY in 4QFY25. Standalone jewelry sales (excl. bullion) rose 25% YoY, driven by a rise in ticket size due to an increase in gold prices. Studded jewelry grew 12% YoY, while the mix declined 300bp YoY to 30%. Net jewelry store additions stood at 36 in 4Q, bringing the total count to 1,091. Standalone Jewelry LFL growth was 14%, and CaratLane jumped 23% YoY.

* Standalone jewelry EBIT margin (excl. bullion) contracted 20bp YoY while expanded 90bp QoQ to 11.9% (est. 11.2%) due to the elimination of primary sales to subsidiaries. Adjusting for this elimination, EBIT margin stood at 11.6%, aided by operating leverage and the marginal hedging gain. CaratLane’s EBIT margin expanded 90bp YoY to 7.9%. Management reiterated its standalone EBIT margin guidance of 11-11.5%.

* The watches segment grew 21% YoY. Analog watches saw strong traction, with Fastrack, TTAN, and Helios growing 20%, 18%, and 38% YoY, respectively. Eye care revenue grew by 16% YoY.

* With the jewelry industry seeing faster formalization, we continue to believe TTAN will keep leveraging the same, driven by store additions, multi-format presence, better designs, customer understanding, and a strong recall of trust. Jewelry EBIT margin has been under pressure, but the beat in 4Q margin renders better margin visibility for FY26. We reiterate our BUY rating with a TP of INR4,000.

Strong revenue growth; Jewelry’s EBIT margin higher than estimated

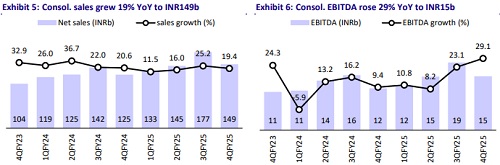

* Healthy revenue growth: TTAN’s consolidated revenue grew 19% YoY to INR149.2b (est. INR142.1b). Consolidated Jewelry sales grew 20% YoY to INR132.5b (est. 125.4b) (ex-bullion sales grew by 25% to INR122.7b). Standalone Jewelry sales (ex-bullion) grew by 25% to INR112.3b (est. INR106.4). Bullion sales declined 23% YoY to INR8.6b. The growth is led by higher ticket size due to an increase in gold prices. CaratLane’s sales grew 23% YoY. The number of jewelry stores grew 16% YoY to 1,091. Watches/Eyewear clocked revenue growth of 21%/16% YoY, while Others declined 17% YoY.

* Beat on margins: Consol. gross margin expanded 50bp YoY to 22.8% (est. 22.4%). EBITDA margin expanded 80bp YoY to 10.3% (est. 9.9%). Standalone jewelry EBIT margin (excl. bullion) contracted 20bp YoY while expanded 90bp QoQ to 11.9% (est. 11.2%). However, there is some impact of the elimination of primary sales on its subsidiary. Adjusting for that impact, EBIT margin came in at 11.6%. CaratLane’s EBIT margin expanded 90bp to 7.9%. Watches’ margin improved 360bp to 11.7%, and eye care margin expanded 560bp YoY to 9.8%.

* Double-digit growth in profitability: EBITDA grew 29% YoY to INR15.4b (INR14.1b). PBT was up 23% YoY at INR12.2b (est. INR11.4b), and Adj. PAT rose 13% YoY to INR8.7b (est. INR9.2b).

* In FY25, net sales grew 18% YoY, EBITDA (adjusted) rose 18% YoY, and APAT was up 8% YoY.

Highlights from the management commentary

* The jewelry division delivered strong ~23% YoY revenue growth, driven by ~27% growth in plain gold jewelry and ~64% growth in gold coins.

* High gold prices weighed on sentiment, especially in the sub-INR50k price band, with consumers trading down to lower caratage and lighter-weight products with lower making charges.

* The finance cost has increased more due to the gold price impact than from higher GML rates. While GML rates more than doubled YoY in 4Q due to the US tariff volatility, they have started to stabilize.

* In FY26, TTAN plans to open 40–50 new Tanishq stores and refurbish 50–60 existing stores across all formats (expansion, relocation, or area addition).

Valuation and view

* We maintain our EPS estimates for FY25/FY26.

* TTAN, with its superior competitive positioning (in sourcing, studded ratio, youth-centric focus, and reinvestment strategy), continues to outperform other branded players. The brand recall and business moat are not easily replicable; therefore, Tanishq’s competitive edge will remain strong in the category. The store count reached 3,312 as of Mar’25, and the expansion story remains intact. The non-jewelry business is also scaling up well and will contribute to growth in the medium term.

* We model a revenue/EBITDA/PAT CAGR of 16%/18%/22% during FY25-27E. TTAN’s valuation is rich, but it offers a long runway for growth with a superior execution track record. Reiterate BUY with a TP of INR4,000.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)