Neutral Prudent Corporate Advisory Ltd for the Target Rs. 2,300 by Motilal Oswal Financial Services Ltd

Higher margins and other income drive a beat on PAT

* Prudent Corporate Advisory (Prudent) posted an op. revenue of INR2.8b, +18% YoY (in line) in 4QFY25. Revenue growth was fueled by an 18% YoY jump in commission & fees income to INR2.8b. For FY25, operating revenue grew 37% YoY to INR11b.

* EBITDA grew 13% YoY to INR686m (15% beat), reflecting an EBITDA margin of 24.3% (vs. 25.4% in 4QFY24 and our est. of 21.7%). Operating expenses rose 20% YoY to INR2.1b (in line), with fees & commission expenses/employee expenses growing 29%/5% YoY, while other expenses dipped 9% YoY.

* Prudent’s PAT at INR516m rose 16% YoY (16% beat). For FY25, PAT grew 41% YoY to ~INR2b. Barring the impact of the shift in AUM mix towards the partner channel (that carries a higher payout), FY25 PAT growth would have been 55% YoY.

* In FY26, net equity sales are expected to broadly mirror SIP inflows. Management highlighted that while long-term trends point to a close alignment between net sales and SIP contributions, YoY variations may still occur.

* We cut our earnings estimates by 8% each for FY26/27 due to a decline in blended yields and higher commission payouts. However, we expect Prudent to deliver a revenue/EBITDA/PAT CAGR of 19%/17%/21% over FY25-27, fueled by growing MF AUM and a focus on increasing the share of non-MF business in the overall mix. The company is expected to maintain an RoE of >28% for FY26/FY27. We reiterate our Neutral rating with a TP of INR2,300 (based on 33x EPS FY27E).

Robust growth in gross equity sales backed by strong SIP flows

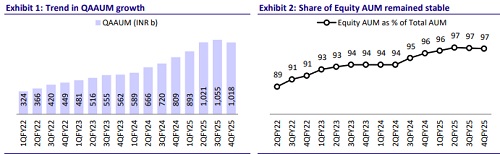

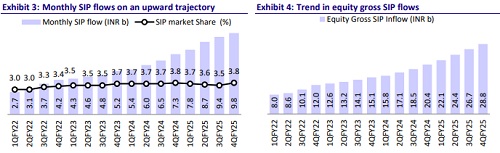

* Prudent’s QQAUM stood at INR1t, up 26% YoY. Monthly SIP flow grew to INR9.81b from INR7.26b in 4QFY24, despite weak markets.

* Total premium for the quarter came in at INR2.6b (+17% YoY), of which life insurance premium stood at INR2.1b (+15% YoY) and general insurance premium stood at INR494m (+29% YoY).

* Commission and fees income for the quarter rose 18% YoY to INR2.8b, of which INR2.3b (+26% YoY) was contributed by the distribution of MF products and INR402m (+2% YoY) by insurance products, respectively.

* Revenue from the distribution of MF grew 26% YoY, fueled by strong SIP inflows and active participation from MFDs. However, it dipped 5% QoQ because of fewer trading days and MTM impact due to weaker markets.

* Revenue from the sale of insurance products increased 2% YoY and 41% QoQ. The life insurance fresh book grew 88% QoQ in 4QFY25, benefiting from a low base in 3Q due to the impact of the surrender charges regulation. Meanwhile, the general insurance fresh book rose 40% YoY in FY25, although yields were subdued due to deferred revenue recognition, pushing some earnings into the following quarter.

* Revenue from the stockbroking segment dipped 46%/16% YoY, mainly due to reduced market activity amid weak sentiment.

* Revenue from other financial and non-financial products declined 18% YoY, mainly due to the discontinuation of P2P product flows since Aug’24 (RBI regulations); however, it is expected to be offset by the healthy traction in the AIF/PMS/FD segments.

* Other income rose 37% YoY to INR85m (11% beat) in 4QFY25.

* Commission and payout expenses rose ~300bp in FY25, of which ~180bp increase was due to the 3% shift in AUM mix toward the partner channel (higher payout), while the rest was attributed to an additional trail scheme aimed at boosting net sales. Total payout for the year was up at 64.1% from 61.1% in FY24. Management guides for payout to remain in the range of 64%.

* Employee expenses fell 19% sequentially to INR243m due to reduced provisioning for variable costs, while the fixed component rose by 14.5% YoY.

* The company has submitted a new ESOP plan for shareholder approval. About 1.65m shares (about 4% of total shares) are proposed to be issued under this plan over the next 10 years. For FY26, ESOP-related costs are expected to be 2.5-2.75% of PBT, with the financial impact beginning in 2QFY25.

Key takeaways from the management commentary

* Three to four AMCs have reduced trail commissions, which Prudent has passed on. About 12% of the overall AUM and 10% of the equity AUM have been repriced, with an expected impact of ~1.3-1.4bp on gross yields.

* Management estimates that for every 1% rise in AUM, payout is likely to increase by ~65bp.

* AIF and PMS AUM for FY25 grew 80% YoY in FY25, with the book at INR12b as of Mar’25 (10% higher than average FY25). Fixed deposit mobilizations rose 43% YoY, with two new bank FDs being added.

Valuation and view

* We expect the revenue growth momentum to be sustained in the medium to long term, primarily because of the following reasons: 1) rising MF AUM mainly led by improving SIP participation, 2) focus on a one-stop-shop solution, which should result in a rise in distribution revenue from higher-margin products such as insurance, and 3) healthy traction in the AIF/PMS/FD segments.

* We cut our earnings estimates by 8% each for FY26/27 due to a decline in blended yields and higher commission payouts. However, we expect Prudent to deliver a revenue/EBITDA/PAT CAGR of 19%/17%/21% over FY25-27, fueled by growing MF AUM and a focus on increasing the share of non-MF business in the overall mix. The company is expected to maintain an RoE of >28% for FY26/ FY27. We reiterate our Neutral rating with a TP of INR2,300 (based on 33x EPS FY27E).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412