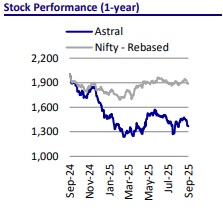

Buy Astral Ltd for the Target Rs. 1,650 by Motilal Oswal Financial Services Ltd

Turning efforts into enduring rewards

We interacted with the management of Astral (ASTRA) to discuss the industry outlook, growth prospects for its business, profitability outlook, and other focus areas. Here are the key takeaways from the discussion:

* The company plans to start its CPVC resin plant in Sep’26, leveraging low-cost operational capacity in India, where supply is currently limited. This backward integration is expected to boost margins, create barriers to entry for new competitors, and support the doubling of CPVC volumes over the next five years.

* OPVC pipes are experiencing muted demand in 1HY26 due to heavy rainfall and lower government orders, but it's expected to pick up post-Diwali. Demand in the long term is expected to come from contractors and government projects. BIS certification requirements are likely to benefit organized players by keeping inferior products out of the market.

* The adhesives business is expected to double in size over the next five years. The bathware segment, currently at a nascent stage, is poised for significant growth as builders and contractors increasingly adopt the product. Meanwhile, the paints business faced short-term disruption from aggressive pricing by a new competitor; however, price rationalization is likely to restore stability and normalize operations in the near future.

* Significant capex already completed, along with full vertical integration through CPVC resin capacity, is expected to generate positive returns within the next 2–3 years. Additionally, the potential imposition of anti-dumping duty (ADD) may increase realizations, enhancing margins further.

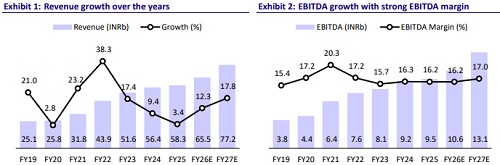

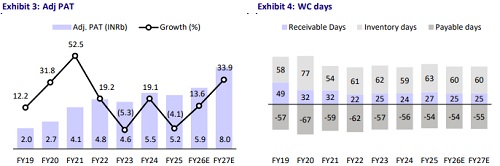

* We model a 15%/17%/22% CAGR in sales/EBITDA/Adj. PAT over FY25-28E, led by an increase in capacity, backward integration of CPVC resins, levy of ADD on PVC resins, and gradual scale-up of new businesses. We reiterate our BUY rating on the stock with an SoTP-based TP of INR1,650.

Backward integration of CPVC resin to aid margin expansion

* CPVC polymers have become very competitive in the last few years due to the increasing use of the product in the plumbing segment.

* With the commercialization of the CPVC resin capacity (~45,000MT) by Sep’26, the company expects this to improve the overall margins and CPVC market share.

* Operational capacity for CPVC resins in India is negligible. As the company plans to set up capacity at a very low cost (as compared to its peers), it expects to gain ample margin accretion in CPVC.

* This is expected to create entry barriers for new competitors, as ASTRA may be able to transfer some of its margins to its customers, thereby putting margin pressure on its competitors.

* With a strengthened market position, the company aims to double its volume in CPVC over the next five years. Overall, backward integration is expected to bolster the company’s margin prospects in the long term.

OPVC demand likely to pick up in 2HFY26

* New players in the OPVC segment are required to get their products certified as per the BIS norms. This will stop inferior products from getting into the market, which in turn will benefit the organized players.

* OPVC pipes are experiencing muted demand in 1HFY26, largely led by lower orders from the government (being a newer segment) and heavy rainfall. The company expects OPVC pipe demand to revive post-Diwali (as rainfall is likely to subside by then).

* Over the long term, larger orders for OPVC pipes are expected from contractors (L&T and others) or the government (while a lesser share is anticipated from private players).

New businesses set for gradual scale-up

* Newer businesses are expected to take time to flourish. The company expects the adhesives business to double in size over the next five years.

* The bathware business is expected to see a sharp uptick in the business after 4-5 years. The business is in the trial stage as of now. Once the builders and contractors are comfortable with the product, the company expects the business to grow multifold.

* On the other hand, the paint business was hampered by the entry of a fierce competitor. This led to disruption in the market (due to selling paints at extremely low prices).

* However, going forward, the company expects rationalization of paint prices – this may bring the paint business back in line.

Capex and ADD to propel margin expansion

* With a significant amount of capex already done, the company expects positive returns to accrue within the next two to three years. As mentioned above, with the CPVC resin capacity to become operation in Sep’26, the company will have a complete vertically integrated structure.

* In addition, the government may levy an anti-dumping duty (ADD) for the import of PVC resins, which will further benefit the entire pipes industry and for ASTRA. Organized players like ASTRA benefit the most with implementation of ADD and also BIS (tentative) as this will eliminate smaller players who rely on inferior quality PVC resin imports.

* The ADD is expected to improve realizations for the company, resulting in improved margins.

Valuation and view

* ASTRA is well-positioned for healthy growth and margin expansion, driven by backward integration in CPVC resins and scale-up of new businesses like adhesives, paints, and bathware. With significant capex done recently, antidumping duty support, and capacity doubling, profitability is set to improve, and the company aims to sustain industry-leading growth rates over FY25-28E.

* We forecast a 15%/18%/23% CAGR in sales/EBITDA/Adj PAT over FY25-28E fueled by an increase in capacity, backward integration of CPVC resins, the possibility of a levy of ADD on China (for import of PVC pipes), and gradual scaleup of new businesses.

* We reiterate our BUY rating on the stock with an SoTP-based TP of INR1,650

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412