Neutral JSW Cement Ltd for the Target Rs. 138 by Motilal Oswal Financial Services Ltd

Strong volume growth; operating performance improves

Positive cement demand outlook; capacity expansion on track

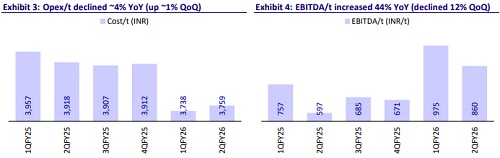

* JSW Cement’s (JSWC) 2QFY26 EBITDA was above our estimates, driven by higher volume and lower opex/t vs. our estimates. EBITDA increased ~65% YoY to INR2.7b (~40% beat). EBITDA/t surged ~44% YoY to INR860 (vs. est. INR657). OPM increased 5.4pp YoY to ~19% (vs. est. ~14%). It posted PAT of INR864m (~115% beat) vs. a loss of INR368m in 2QFY25.

* Management indicated that in 1HFY26, demand was impacted by extended monsoons and GST-related transitions. It remains confident of achieving mid-teen volume growth for full year. Cement prices have corrected in south and east markets due to weak demand. JSWC has achieved cost savings of INR200/t in 1H, and a similar level of cost saving is expected in 2H through various cost-saving measures. Its expansion in north region is progressing well, and Phase-I is expected to be commissioned in early 4QFY26.

* We broadly maintain our earnings estimates for FY26-28. At CMP, the stock is trading fairly at 14x/12x FY27E/FY28E EV/EBITDA. We value JSWC at 13x (earlier at 14x) Sep’27E EV/EBITDA to arrive at our revised TP of INR138 (earlier INR150). Maintain Neutral.

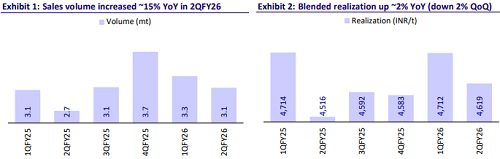

Sales volume up 15% YoY; blended realization/t up 2% YoY

* Consolidated revenue/EBITDA stood at INR14.4b/INR2.7b (up 17%/65% YoY and up ~7%/40% vs. estimates). Net profit stood at INR864m (115% above estimates) vs. a loss of INR368m in 2QFY25. Sales volume increased 15% YoY to 3.1mt (+7% vs. our estimates). Of this, cement volume stood at 1.7mt (up 7% YoY) and GGBS was at 1.4mt (21% YoY). Blended realization/t was up 2% YoY (down 2% QoQ) at INR4,619/t (in line).

* Opex/t declined ~4% YoY (~5% below our estimate), driven by a ~5%/1% YoY decline in variable/freight cost per ton. Other expenses/t remained flat YoY. Employee cost/t declined ~17% YoY. EBITDA/t surged ~44% YoY to INR860.

* In 1HFY26, revenue/EBITDA stood at INR30.0b/INR5.9b (up ~12%/50% YoY). Adj. PAT stood at INR2.0b vs. net loss of INR276m in 1HFY25. EBITDA/t grew ~35% YoY to INR919. OCF stood at INR5.1b vs. INR1.9m in 1HFY25. Capex stood at INR9.6b vs. INR4.8b in 1HFY25. Net cash outflow stood at INR4.6b vs. INR3.0b in 1HFY25.

Highlights from the management commentary

* Cement realization declined ~5% QoQ, while GGBS realization dipped ~1% QoQ. JSWC believes GGBS realization may remain stable, while cement realization may weaken further in Oct’25 due to weak demand.

* Premium product sales were ~58% of the trade mix in 2QFY26 vs. ~57% in 1QFY26, reflecting the company’s continued thrust on premiumization.

* JSWC has guided for a total capex of INR23b for FY26, of which INR5.1b, including maintenance capex, was incurred in 2Q, taking the cumulative spending to INR9.6b in 1HFY26.

Valuation and view

* JSWC reported strong earnings in 2QFY26, led by robust volume growth and improved operating performance. Weak cement realization remains a near-term challenge. The company’s variable cost/t is significantly lower than that of peers given the higher share of GGBS in its overall production (+40%). The company has achieved cost savings of INR200/t in 1H and expects another INR200/t of cost savings in 2H, led by increasing green power/AFR share, logistics optimization and positive operating leverage. Management reiterated its longterm capacity target of ~42mtpa (~34mtpa by CY28) vs. ~22mtpa currently.

* We estimate a CAGR of ~18%/31% in revenue/EBITDA over FY25-28, driven by higher sales volume, pricing improvement and cost efficiency. EBITDA/t is estimated to be INR919/INR957/INR1,001 in FY26/FY27/FY28 vs. INR699 in FY25. We estimate debt to remain elevated due to higher capex of INR56b over FY25-28E. Net debt is estimated to be INR57.2b in FY28E vs. INR32.3b as of Sep’25. Net debt-to-EBITDA ratio is estimated at similar levels of 3.0x by FY28E. We value JSWC at 13x (earlier at 14x) Sep’27E EV/EBITDA to arrive at our revised TP of INR138 (earlier INR150). Maintain Neutr

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412