Buy CreditAccess Grameen Ltd for the Target Rs. 1,485 by Motilal Oswal Financial Services Ltd

Pivoting from stress to stability

Operational resilience driving recovery; diversification in progress

We met with the management of CreditAccess Grameen (CREDAG) to gain insights into evolving trends in the microfinance industry, the company’s approach to addressing challenges, and its strategy to sustain growth while managing credit costs through this fiscal year.

* CREDAG has effectively navigated a challenging operating environment, supported by strong operational discipline and proactive risk management. Its robust execution is expected to drive a steady recovery as the company shifts its focus toward expanding and diversifying its loan portfolio.

* While credit costs are expected to remain slightly elevated in 1HFY26 due to provisioning for legacy stress pools—including the impact of the Karnataka ordinance—fresh slippages have largely normalized. Loans disbursed in the past three months (3 MOB) are performing in line with expectations, and the Karnataka originated portfolio has shown a marked improvement since Mar’25, indicating that the worst of the asset quality cycle may be behind.

* Unlike many of its peers that faced high attrition due to aggressive incentive structures, CREDAG has maintained workforce stability through a fixedheavy compensation model complemented by employee wellness initiatives.

* CREDAG is proactively diversifying its portfolio by leveraging its existing customer base. The company views the introduction of the 60% qualifying asset criteria (QAC) for MFIs as a structural positive, encouraging players to build broader and more resilient retail lending franchises. Importantly, the company aims to execute this diversification strategy without compromising on yields and margins.

* A trend reversal is on the horizon in the MFI sector and is expected to play out over the next couple of quarters, with the sector likely nearing normalization by 2HFY26. That said, we strongly believe that the upcoming three months present an opportunity to separate high-quality franchises from weaker ones, with performance divergence across the MFI sector expected to be increasingly evident.

* Backed by a strong capital position (Tier-1 of ~24%), CREDAG is well-placed to embark on a healthy loan growth trajectory as delinquency trends show further signs of normalization. CREDAG trades at 2.0x FY27E P/BV, and its premium valuation over MFI peers is likely to sustain, driven by stronger confidence in its ability to return to normalcy ahead of its peers. Reiterate 700 BUY with a TP of INR1,485 (based on 2.5x Mar’27E P/BV).

Industry overview: Crisis triggers and current trends

* Over the past year, the MFI industry has undergone a cycle of stress, triggered by borrower overleveraging and rising delinquencies. After two years of COVIDinduced losses, lenders entered an aggressive credit expansion phase to recover losses. This resulted in an oversupply of loans, particularly through MFIs and unsecured personal loans, with several borrowers taking on excessive debt. Defaults began surfacing around Nov-Dec’23 and became more widespread in the following months.

* MFIs bore the brunt of the crisis due to their monoline exposure, unlike diversified NBFCs and banks. In the latter part of the credit cycle, region-specific regulatory challenges also added to the pressure, such as the Karnataka ordinance, which temporarily disrupted operations and led to additional provisioning. In contrast, the Tamil Nadu microfinance bill has had no material impact at the ground level. While issues such as duplicate KYC entries, including voter IDs, were present, they were not significant contributors to asset quality deterioration, especially for CREDAG, which maintains robust verification systems.

Robust collection processes and due diligence to drive faster normalization

* CREDAG maintains a strong focus on operational discipline, with over 90% of collections driven by center meetings, reflecting consistent borrower engagement and timely repayments. Doorstep collections remain minimal at 2- 3%, with stable daily collection trends. Key processes, including average attendance at center meetings, are closely monitored at the Board level to ensure consistency and control.

* Additionally, a regulatory change effective Jan’25—reducing credit bureau reporting frequency from monthly to every 15 days—is expected to significantly strengthen credit discipline by limiting borrowers’ ability to avail multiple loans from different lenders within a short span.

Effective employee management backed by stronger incentive structure

* Unlike some MFI lenders that witnessed high employee attrition due to aggressive incentive structures tied to disbursements and collections, CREDAG has maintained a relatively lower employee attrition. Its employees receive a significantly higher fixed salary compared to peers, with incentives accounting for less than 10% of their overall salary. These incentives are linked to new customer acquisition and audit ratings rather than disbursement volumes or collection efficiency, making payouts less sensitive to market stresses.

* At CREDAG, employee attrition was primarily limited to Tamil Nadu and parts of Bihar (where it had previously undertaken some lateral hiring). Notably, ~2k former employees expressed interest in re-joining, and CREDAG has rehired ~1k experienced personnel.

Strategic diversification and cross-sell opportunities

* CREDAG is proactively diversifying its portfolio by leveraging its existing customer base. The company views the introduction of the 60% qualifying asset criteria (QAC) for MFIs as a structural positive, encouraging players to build broader and more resilient retail lending franchises.

* With ~10% of its current customer base already holding non-MFI retail loans, CREDAG is focused on cross-selling housing loans/LAP where the ATS is less than INR300k. For higher vintage customers (with at least three years of history with CREDAG) holding a strong credit track record, the company is also offering unsecured business loans and other products.

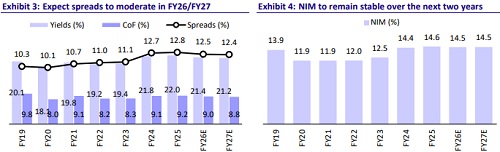

Building non-MFI business without compromising on NIMs

* Even in the secured business loan segment, CREDAG aims to maintain strong yields. With interest rates of ~21%, these loans are broadly in line with its MFI lending rates, indicating that the company is building its non-MFI business without compromising on blended yields.

* Going forward, as CREDAG’s loan book becomes more diversified, it may explore dedicated funding avenues for housing loans or pursue co-lending arrangements with banks. This diversification will help balance its high-risk microfinance business with more secure offerings.

Valuation and view: Driving normalization; building resilience

* CREDAG has successfully navigated a period of industry-wide challenges, demonstrating remarkable resilience and a return to normal operational efficiency. New stress formation (ex-Karnataka) has largely normalized, supported by robust internal processes such as rigorous daily collection monitoring, detailed audit reports, and consistent tracking of center attendance. While some residual stress from recent headwinds is still being managed, the core business is now operating as expected, reinforcing confidence in the company’s fundamental strength.

* The updated regulatory framework, particularly the revised qualifying asset criteria, offers a clear opportunity for CREDAG to invest in and expand its nonqualifying asset portfolio. This will enable the company to strengthen its microfinance foundation while building a more resilient and diversified balance sheet, paving the way for long-term value creation.

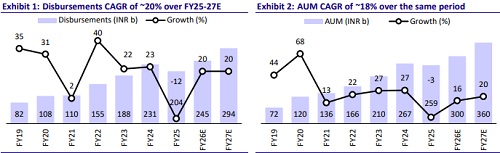

* The upcoming three months present an opportunity to separate high-quality franchises from weaker ones, with performance divergence across the MFI sector expected to be increasingly evident. We expect CREDAG to deliver AUM/PAT CAGR of ~18%/75% over FY25-FY27 and RoA/RoE of 4.9%/19% in FY27. Reiterate our BUY rating on the stock with a TP of INR1,485 (based on 2.5x Mar’27E P/BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)