Neutral Muthoot Finance Ltd for the Target Rs. 2,400 by Motilal Oswal Financial Services Ltd

Operationally healthy quarter with strong growth in gold loans

Draft gold lending guidelines will keep growth outlook uncertain in near term

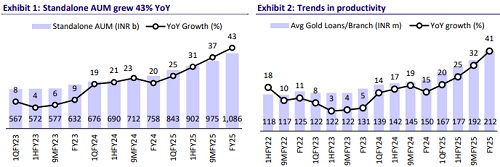

* Muthoot Finance’s (MUTH) strong operating performance in 4QFY25 was characterized by: 1) strong gold loan growth of ~41% YoY to ~INR1.03t, 2) improvement in GS3 by ~80bp leading to a sequential decline in credit costs; and 3) an increase in gold tonnage by ~3% QoQ to 208 tons.

* MUTH’s 4QFY25 PAT grew 43% YoY to ~INR15.1b (in line). FY25 PAT grew ~28% YoY to INR52b. Reported RoA/RoE in 4QFY25 stood healthy at 5.9%/22%.

* Net total income grew 37% YoY to ~INR30.1b (in line). Opex grew ~25% YoY to INR8.6b (in line), resulting in a cost-to-income ratio of ~29% (PY: 31%). PPOP grew 42% YoY to ~INR21.5b (in line). Provisions stood at ~INR1.3b (vs. MOFSLe of ~INR1.8b) and translated into annualized credit costs of 0.5% in 4QFY25 (PY: ~0.5% and PQ: ~0.9%).

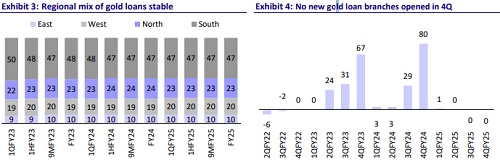

* Gold loan growth was supported by growth in gold tonnage (up 3% QoQ), along with an increase in the customer base (up 2% QoQ) to ~6.37m. Gold loan LTV declined ~5pp QoQ to ~61%.

* For FY26, MUTH maintained its conservative guidance of ~15% growth in gold loans. We model a standalone AUM CAGR of ~13% over FY25-27E. This, we believe, will result in a PAT CAGR of ~22% over this period. We model RoA/RoE of 5.2%/21% in FY27.

* LTV norms published in the draft guidelines, if implemented, will have a near-term impact on the disbursement LTV of MUTH and its peer NBFCs. Until the final gold lending guidelines are published by the RBI, the growth outlook on gold loans will remain uncertain.

* MUTH now trades at 2.3x FY27E P/BV and, in our view, has benefited from the tailwinds of: 1) a sharp rise in gold prices; 2) an improvement in gold loan demand due to the industry-wide rationing in unsecured credit; and c) a lower competitive intensity in gold loans. MUTH is indeed one of the best franchises for gold loans in the country, which is evident from its ability to deliver industry-leading gold loan growth and best-in-class profitability. However, we believe that its valuations are rich for the deep cyclicality in its gold loan growth, which will remain vulnerable to any sharp volatility in gold prices. Reiterate our Neutral rating with a revised TP of INR2,400 (based on 2.4x Mar’27E P/BV).

Draft gold lending guidelines: Near-term impact on disbursement LTV

* MUTH shared that the Gold Lenders Association has conveyed to the RBI that any changes to the gold loan LTV norms may not be in the best interest of customers, as it could potentially drive borrowers back to the unorganized sector.

* MUTH acknowledged that if the proposed LTV guidelines (in the draft) are implemented as they are, the disbursement LTV would need to factor in the potential accrued interest over the loan's tenor (of up to one year) to ensure compliance with the 75% LTV threshold. For instance, with an interest rate of 20%, the effective disbursement LTV would be around 55%, and with a 10% interest rate, the LTV would be ~65%.

Belstar: Sequential decline in AUM; new branches opened in 4QFY25

* MUTH’s microfinance subsidiary, Belstar, reported an ~8% QoQ decline in AUM to ~INR80b. Reported loss stood at ~INR1.2b during the quarter (vs. PAT of INR240m in 3QFY25)

* Asset quality deteriorated, with GS3 rising ~210bp QoQ to ~5%. Management shared that there could be an initial impact on collections in Tamil Nadu despite the fact that the TN Bill is not applicable to NBFC-MFI.

* Belstar opened ~57 new branches in 4QFY25, and its CRAR stood at ~25%.

Highlights from the management commentary

* MUTH Finance (standalone entity) has approval for 115 branches, which it will open in FY26.

* MUTH Money has recently completed 1,000 branches. The company aims to sweat its existing branches and will seek RBI approval for opening new branches as and when required.

* Other income included some recoveries from the ARC transaction and treasury income from investment in MFs. There are still some more recoveries remaining from the ARC transaction.

* Interest spreads will remain in the range of 9-10%. MUTH shared that there is a significant drop in the borrowing costs from Apr'25 onwards and it should start seeing the benefits in its CoB from 1QFY26 onward.

Valuation and View

* MUTH delivered a healthy operational performance, driven by strong gold loan growth, supported by an increase in gold tonnage and decent customer additions. However, margins declined sequentially, primarily due to a rise in the cost of borrowings but without any significant pressure on yields. Asset quality improved during the quarter, driven by gold auctions, which led to a reduction in credit costs.

* With a favorable demand outlook for gold loans driven by reduced competition from banks and limited availability of unsecured credit, the company is wellpositioned to maintain its healthy loan growth momentum.

* Until clarity emerges from the final gold lending guidelines, the outlook on gold loan growth will remain clouded, which will remain a near-term overhang on MUTH’s stock price and valuations. We believe that the positives are already factored into its valuations of 2.3x FY27E P/BV. Reiterate our Neutral rating with an unchanged TP of INR2,400 (based on 2.4x Mar’27E BVPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412