Buy Aurobindo Pharma Ltd for the Target Rs.1,300 by Motilal Oswal Financial Services Ltd

Growth in EU/ARV; margin contraction drags PAT

Gearing up for scaling PEN-G/biosimilar production

* Aurobindo Pharma (ARBP) delivered lower-than-expected performance for 1QFY26. While revenue was in line with estimates, EBITDA/PAT missed our estimates by 7%/8% for the quarter. Higher operational costs related to newer plants and pricing headwinds in the API segment impacted earnings for the quarter.

* That said, the global specialty and injectables sales witnessed QoQ growth in 1QFY26.

* While the g-Revlimid-driven high base from the previous year led to a YoY decline in US sales for the quarter, ARBP continues to broaden its US generics portfolio by adding products across the peptides, respiratory, dermatology, oncology, and hormone categories. The company is also increasing its offerings in dosage forms like injectables, nasal sprays, and inhalers.

* ARBP has been delivering strong execution in the EU market, driven by a higher off-take of existing products and expanding offerings. Notably, with biosimilar approvals in place, the gradual uptake of these products is expected to drive growth momentum in the EU segment.

* ARBP is ramping up production at the PEN-G plant following encouraging yield results and clearance from the pollution control board.

* We cut our earnings estimates by 8%/7% for FY26/FY27, factoring in: a) initial operational costs associated with restarting the PEN-G and China plants and b) pricing headwinds in the API business. We value ARBP at 16x 12M forward earnings to arrive at a TP of INR1,300.

* ARBP is one of the most diversified players in the generics space, catering to developed markets of the US/EU. Recent hiccups related to manufacturing plant issues and tariff uncertainties have caused volatility in earnings and, subsequently, the stock price. However, with the plants now operational and limited scope of US tariffs on the generics space— coupled with an attractive valuation, we reiterate a BUY rating on the stock.

High base affects sales growth; margins impacted by product mix/opex

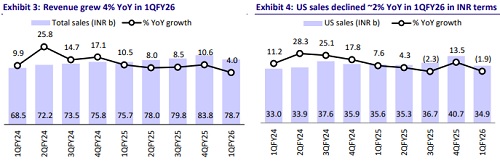

* ARBP’s 1QFY26 sales grew 4% YoY to INR78.7b (our estimate: INR79.3b).

* Overall formulation sales grew 7.4% YoY to INR69.5b. Europe’s formulation sales grew 18% YoY to INR23.4b (29% of sales + 9% YoY in CC). Growth market sales grew ~9% YoY to INR7.7b (10% of sales). US formulations revenue declined 1.9% YoY to INR34.9b (CC: -4.2% YoY to USD408m; 44% of sales). ARV revenue grew 55% YoY to INR3.6b (5% of sales).

* API sales declined 16.1% YoY to INR9.2b (11.6% of sales).

* Gross margin (GM) contracted 60bp YoY to 58.8% due to a change in the product mix.

* EBITDA margin contracted 200bp YoY to 20.4% (our estimate: 21.7%), led by a lower GM and increased employee costs (+145bp YoY as a % of sales).

* EBITDA declined 5% YoY to INR16b (our estimate: INR17.2b).

* PAT declined 8.5% YoY to INR8.3b (our est.: INR9b), led by a higher depreciation/tax.

Highlights from the management commentary

* On Ex-Revlimid basis, EBITDA grew 12% YoY for the quarter.

* ARBP maintained its EBITDA margin guidance of 20-21% for FY26.

* With the implementation of remediation measures at Eugia III, global specialty and injectables sales have normalized (pre-USFDA inspection level). In fact, ARBP has invited the USFDA for a re-inspection.

* ARBP is confident in improving Lanett’s profitability post-acquisition, driven by portfolio-level synergies and enhanced operational efficiency at Lanett’s manufacturing facilities.

* ARBP is scheduled to make its first biosimilar submission in the US in FY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)