Buy Ajanta Pharma Ltd For Target Rs.3,200 by Prabhudas Liladhar Capital Ltd

Strategic fit – Adds Semaglutide to RoW portfolio

Ajanta Pharma (AJP IN) signs an in-licensing agreement with Biocon for marketing semaglutide in 26 countries across RoW markets. Given that AJP will be involved in the registration process to get approvals across these markets, we expect it to generate healthy margins. Further, AJP’s strong franchise and field force across these markets will enable it to garner higher market share. We expect semaglutide to provide additional ~Rs2bn of sales for AJP with healthy margins in FY28E. Strong annual free cash flow of Rs8–10bn further supports sustained investments and potential inorganic opportunities, reinforcing medium-term growth visibility.

Overall, we expect EBITDA/PAT CAGR of 17%/ 14% over FY25-28E with healthy RoE/RoCE of 28.1%/35.5% in FY27E. At CMP, AJP is trading at 24x P/E and 17.1x EV/EBITDA as of Sep’27E. We value AJP at 30x P/E as of Sep’27E EPS based on its ability to generate higher RoE/RoCE compared to peers and strong exposure to BGx markets. Maintain ‘BUY’ rating with TP of Rs3,200/share.

Contours of transaction: AJP has tied up with Biocon under an in-licensing arrangement to commercialize semaglutide across 26 emerging markets. As part of the agreement, Biocon will act as the manufacturing and supply partner, while AJP will undertake commercialization with exclusive rights in 23 markets and semiexclusive rights in the remaining, covering Africa, the Middle East, and Central Asia. Patent expiry for semaglutide in most of these territories is expected by Mar’26. The management has indicated that revenue contribution should commence post Q3FY27, contingent on securing regulatory approvals across key markets.

Strategic fit with existing franchise: AJP has presence in 30 countries across Asia and Africa with over 2,000 MRs and leadership positions in several geographies. The company has been a pioneer in introducing field force in some of these markets. This will aid AJP to garner higher market share for semaglutide. Addressable semaglutide market stands at USD35–45mn across 26 countries (innovator-led), which is expected to expand 10–20x over the next 2–3 years with the entry of generic players. We expect AJP to garner Rs2bn of sales in FY28E with healthy margins from semaglutide franchise across RoW markets

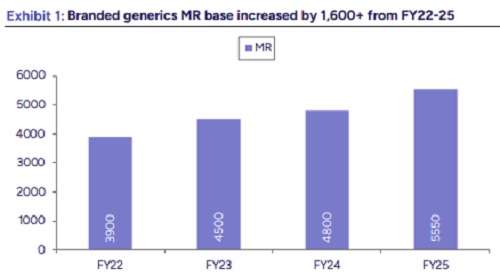

Play on BGx business: AJP’s BGx business enjoys healthy OPM of 30%. The business contributed to ~74% of overall revenue in FY25 and delivered 12.5% CAGR in revenue over FY22-25. During the period, AJP added 1,600+ MRs across India and RoW markets. We believe the growth momentum will continue on the back of new launches, geographic expansion, new therapeutic addition, MR productivity increase and volume growth. We expect the BGx business to see 13- 14% revenue CAGR over FY25-28E.

New therapies scaling up well: During FY25, the company entered nephrology and gynecology segments in the domestic pharma market. IPM size for these 2 segments stands at Rs160bn. AJP also added 200+ MRs and launched 12 products in these segments. AJP offers a wide range of innovative products in its nephrology portfolio that support patients through all stages. Overall, it has a strong product pipeline across its key segments, which are expected to contribute to growth, followed by newer therapies.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271