Neutral Bosch Ltd for the Target Rs.35,967 by Motilal Oswal Financial Services Ltd

Strong earnings beat led by improved margins

2W order wins impress

* Bosch (BOS)’s 1QFY26 PAT at INR6.7b was well above our estimate of INR4.9b, fueled by better-than-expected operational performance and higher other income. The key highlight of 1Q was a 75% YoY growth in the 2W segment.

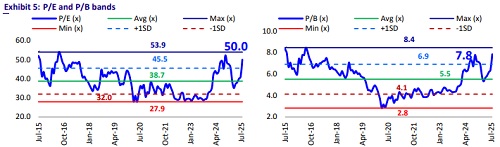

* Given the better-than-expected operational performance in 1Q, we raise our FY26/FY27 estimates by 13%/12%. While BOS continues to work toward the localization of new technologies, given the long gestation of projects, its margin remains under pressure with no visibility of material improvement, at least in the near term. Following the recent run-up, the stock at ~50x FY26E/42.4x FY27E EPS appears fairly valued. We reiterate our Neutral rating with a TP of INR35,967 (based on ~36x Jun’27E EPS).

Strong earnings beat fueled by improved margins

* BOS’s net revenue grew ~11% YoY to INR47.9b (est. INR46.2), driven by 14.3% YoY growth in the mobility solutions business, while the consumer goods division grew 9% YoY.

* Within mobility solutions, the power solutions business was up 13.7% YoY, driven by healthy demand for diesel components from OHVs and PVs. The 2W segment posted a robust 75% growth YoY, led by new order wins for OBD2 NOx sensors. The mobility aftermarket division grew 5% YoY, led by demand for lubricants, filters, and wiper systems.

* Gross margin expanded 220bp YoY to 37.7%, driven by a favorable mix and lower raw material costs. Manufactured components mix was higher in Q1.

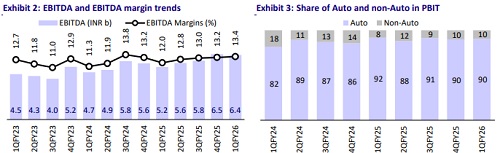

* EBITDA margin improved 140bp YoY to 13.4% and was ahead of our estimate of 12.3%. Absolute EBITDA grew 23% YoY to INR6.4b, aided by revenue growth and improved margins.

* On a segmental basis, the auto segment margin improved 70bp to 14.2%. The non-auto segment’s margin improved 410bp YoY to 12%.

* Other income was also higher at INR2.9b vs. our estimate of INR1.9b.

* PAT included a gain from the sale of the “video solutions, access and intrusion, and communication systems” business worth INR5.56b.

* Adj. PAT grew 44% YoY to INR6.7b, ahead of our estimate of INR4.9b.

Highlights from the management commentary

* The NOx sensor required for the OBD2 application has been localized and is produced from its Bidadi facility. It would also use this line for exports.

* For the EV business, BOS is in discussion with many OEMs for various solutions, and the company hopes to see some order wins soon.

* Several developed regions continue to experience a weak demand outlook for autos currently, given the uncertainty led by tariffs and an overall slowdown in their respective economies.

* The deadline for TREM V emission norms for tractors is currently on hold.

Valuation and view

* Given the better-than-expected operational performance in 1Q, we raise our FY26/FY27 estimates by 13%/12%. While BOS continues to work toward the localization of new technologies, given the long gestation of projects, its margin remains under pressure with no visibility of material improvement, at least in the near term. Following the recent run-up, the stock at ~50x FY26E/42.4x FY27E EPS appears fairly valued. We reiterate our Neutral rating with a TP of INR35,967 (based on ~36x Jun’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)