Add Info Edge India Ltd For Target Rs. 1,450 By JM Financial Services Ltd

Ltd.jpg)

Hiring uncertainties to continue to weigh on performance

INFOE’s 2Q operating performance was broadly in line, with standalone revenue and EBITDA growing 13.7% and 7.7% YoY, respectively. Segment wise, while recruitment profitability was a tad lower than expected, 99acres margin was a miss due to elevated marketing spends. INFOE had already reported standalone billings growth of 12.1% YoY with Recruitment/99acres/ Jeevansathi and Shiksha businesses growing 10.8%/14.0%/29.3%/12.9% YoY, respectively. Recruitment billings growth was driven by healthy traction in GCC clients (+18% YoY), while trends in non-tech/consultant/IT Services clients were relatively muted at 11%/9%/7%, respectively. Importantly, the management suggested continued uncertainties in hiring trends across a broad set of clients owing to a wide range of macro factors. We moderate our EPS estimates by 3–4% over FY26–28 and revise down our SOTP-based Sep’26 TP to INR 1,450.

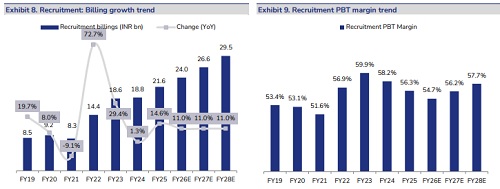

* Broadly in-line operating performance: Standalone revenue grew 13.7% YoY (+1.3% QoQ) to INR 7.66bn, a beat on JMFe by 1.6%. Recruitment / 99acres / Jeevansathi / Shiksha segments’ revenue grew 12.8% / 12.8% / 29.4% / 17.8% YoY, respectively. EBITDA margin and operating PBT margin stood at 39.6% and 35.9%, respectively, a slight miss on JMFe by 86bps and 79bps, respectively. Consequently, EBITDA and operating PBT growth was limited to 7.7%/6.5% YoY, broadly in-line JMFe. Segment-wise, recruitment PBT margin contracted to 55.8% vs. 57.8% in 2QFY25 (52.5% in 1Q) while 99acres margin deteriorated to -20.3% from -13.9%/-16.9% in 2QFY25/1QFY26. Jeevansathi margin stood at +1.5% vs. -2.7%/+0.3% in 2QFY25/1QFY26.

* Hiring trend uncertainties continue: INFOE had already reported billings trends. Recruitment billings were up 10.8% YoY vs. 9.0% in 1Q, led by continued traction in GCC clients (+18% YoY), trends in non-tech/consultant/IT Services clients were relatively muted at 11%/9%/7%, respectively. While Naukri Gulf remained strong at 22% YoY, there was sequential moderation in iimjobs and Naukri FastForward. The management highlighted that while the broader hiring environment remains uncertain owing to a wide range of macro factors, GCCs, Tier-2/3 cities, and non-IT verticals continue to provide some comfort.

* Focus on market share gains in 99acres: 99acres billings grew 14.0% YoY in 2QFY26 vs. 16.5%/21.9% in 1QFY26/4QFY25, respectively. The company ramped up marketing spends during the quarter to drive market share gains, which led to PBT margin sequentially contracting by 642bps (-340bps YoY) to -20.3%. Going ahead, these spends are likely to continue as INFOE intends to prioritise growth over profitability, limiting any visibility on sustainable break-even.

* Jeevansathi outlier once again: Jeevansathi billings grew a robust 29.3% YoY in 2QFY26, led by improving monetisation of customers. It also reported a PBT of INR 5mn with margin improving to 1.5% from -2.5%/0.3% in 2QFY25/1QFY26. The business continues to deliver an enhanced platform experience to customers by leveraging AI and launching new features, leading to improvement in metrics such as profile acceptances and frequency of two-way chats.

* Maintain ‘ADD’, Sep’26 TP revised to INR 1,450: We cut standalone FY26-28E EPS by 3-4% as we expect slower margin expansion in Recruitment / 99acres. While we continue to value the stock basis SOTP valuation method, our revised Sep’26 TP stands at INR 1,450, in which the NTM PER for recruitment is maintained at 40x. While the standalone business valuations of 42x/37x FY27/28 PER are within our comfort zone given that historically INFOE has commanded much higher multiples, meaningful upside is contingent on some stability in macros

* Artificial intelligence (AI) integration deepens across platforms: The management reiterated that AI continues to be a core focus area, with ongoing initiatives aimed at enhancing search quality, user personalisation, productivity, and monetisation opportunities across platforms. In Naukri, the company has upgraded its database products using AI and machine learning, which has led to measurable gains in recruiter productivity and a 15–20% YoY improvement in job seeker engagement. New AI models are also being piloted, including AI-Rex, an AI-powered recruitment co-pilot currently in commercial beta with select customers. These models are designed to automate candidate shortlisting, outreach, and interview scheduling while improving matching accuracy. Beyond recruitment, Info Edge is leveraging generative and agentic AI tools for content creation, marketing campaign automation, pricing optimisation in Jeevansathi, and operational efficiency across functions such as coding and tele-calling. The management emphasised that while monetisation remains at an early stage, AI-driven improvements are already enhancing user experience and internal productivity, and are expected to contribute indirectly to higher renewals and better pricing over time.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361