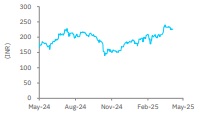

Accumulate Manappuram Finance Ltd For Target Rs. 250 By Elara Capital

Underwhelming show; eyes on Bain deal

While Manappuram Finance (MGFL IN) Q4 earnings came as a disappointment, the two significant developments,namely the Bain acquisition (refer to our Turning pointnote released:20 March 2025) and the lateral appointment of new CEO, and resultant positive outcomes would keep the stock momentum range-bound. FY25 concluded on a weak note, primarily due to regulatory constraints dragging MFI (17% of consolidated book) and gold loan (59%) segments. While current valuation have factored in anticipated benefits of new management and capital injection, future rerating will be contingent upon effective execution. We retain Accumulate with a TP of INR 250 on 1.4x FY27E P/ABV,. But risks of kitchen-sinking post new Mngt takeover and another challenging year remain.

Weak core, elevated provisions mar PAT: MGFL reported a loss of INR 2.0bn in Q4FY25, reversing a INR 2.7bn profit in Q3, as weak core, operating inefficiency, and elevated credit cost weigh on earnings. Provisions rose 65.7% QoQ and 389.4% YoY to INR 9.1 bn, reflecting broad asset quality stress, especially in the unsecured segments. NII declined to INR 14.4bn, dragged by muted AUM growth and a 91bp QoQ drop in NIM, due to rate rationalization. Opex rose 11% QoQ, pushing the cost-to-income to 53.4% vs 43.2%, driven by higher MFI opex from retention incentives. While near-term yield may compress, easing funding cost and improved leverage are likely to support ROE recovery from Q1FY26.

Regulatory constraints impede growth traction: Consolidated AUM was at INR 442bn, down 3.3% QoQ but up 9.5% YoY, led by gold loans, which rose 4.4% QoQ and 18.7% YoY to INR 255.9bn, forming 59.5% of book. Gold loans added 0.3mn new customers, with 82% sourced digitally. MFI was a key drag, down 21.1% QoQ and 34.1% YoY, due to borrower over-leverage and operational disruptions. Vehicle finance (VF) fell 6.1% QoQ and 16.1% YoY to INR 47.7bn amid stricter norms in subsegments. Home loans grew 2.6% QoQ and 20.8% YoY. The book remains secured, with FY26 AUM growth target at ~20%, led by 20% growth in gold loans.

Asset quality challenges closer to peak: GNPA rose ~30bp QoQ to 2.8% with credit cost spiking ~350bp to 8.4%, driven by stress in MFI and VF. MFI GNPA surged to 8.5% from 5.8%, due to post-August delinquency, with Q4 write-offs of INR 5.7bn. VF GNPA rose to 6.7% from 5.2% amid stress in tractors and equipment finance, prompting tighter underwriting. Housing GNPA improved to 2.4% from 3.9%, while standalone GNPA rose 30bp to 2.8%. Gold auctions stood at ~INR 1.1bn. Credit cost are set to ease as MFI book tapers off.

Execution is key; retain Accumulate with a TP of INR 250: We pare down EPS estimates by 6% each for FY26 & FY27 to factor in persistent earnings pressure, given structural weakness led by regulatory constraints. We introduce FY28E. We reiterate Accumulate on announcement of the Bain acquisition deal and the stock has witnessed a price uptick of >5% in past a month. We retain our view despite continued downside risks to earnings as MGFL undergoes constructive transformation with new management. Return ratios have weakened, with an average ROA of 4% and ROE to climb to 18% only by FY28E. While execution is key catalyst to rerating trigger, we retain our price target of INR 250 based on 1.4x FY27E P/ABV.

Please refer disclaimer at Report

SEBI Registration number is INH000000933