Add Tech Mahindra Ltd For Target Rs. 1,604 - Centrum Broking Ltd

Tech Mahindra reported broadly in-line performance for Q4FY25. The company reported revenue of Rs233.8bn (up 0.7% QoQ in INR terms; down 1.2% QoQ in USD terms; down 1.5% QoQ in CC terms). On sequential basis in USD terms, Communications grew 1.0% QoQ; BFSI grew 2.4% QoQ while Manufacturing was down by 0.2% QoQ; Hi-tech & Media was down by 8.2% QoQ; Retail, Transport & Logistics was down by 0.4% QoQ and Healthcare was down 5.6% QoQ. In terms of geographical break-up, Americas was down by 5.9% QoQ while Europe was up by 6.3% QoQ with ROW up by 1.3% QoQ. EBIT margin improved by 34bps QoQ to 10.5%, led by operational efficiencies under Project Fortius. The company reported New Deal TCV of US$798mn. Total Headcount was down by 1,757 QoQ to 148,731 employees. Attrition increased by 60bps QoQ to 11.8%. Utilization remained flat QoQ at 86%. No. of active clients decreased by 13 QoQ to 1,162 clients. The Board declared a final dividend of Rs30/share. The near-term business environment continues to present challenges, with softness noted in Manufacturing and a cautious outlook in Hi-Tech during the second half. However, signs of stability are returning in Communications, particularly in Europe and APAC, supported by bookings and pipeline. We expect Revenue/EBITDA/PAT to clock CAGR of 7.4%/24.6%/29.0% over FY25-FY27E. We have revised our FY26E/FY27E EPS by -11.1%/-5.6%. We maintain ADD with a revised target price of Rs1,604 (vs Rs1,868 earlier) at a PE multiple of 20x (vs 22x earlier) on March’27E EPS. We have decreased the target multiple from 22x to 20x to account for near term uncertainties in the demand environment.

Revenue in line with estimate

Revenue stood at Rs233.8bn (up 0.7% QoQ in INR Terms; down 1.2% QoQ in USD terms; down 1.5% QoQ in CC terms). On sequential basis in USD terms, Communications grew 1.0% QoQ; BFSI grew 2.4% QoQ; while Hi-tech & Media was down by 8.2% QoQ and Healthcare down 5.6% QoQ, with other segments almost flat in USD terms. Full year FY25 revenue showed stability after absorbing reductions from scaling down non-core businesses. Growth is supported by focusing on profitable deals with proven solutions and expanding capabilities through a comprehensive suite of AI offerings.

EBIT margin improved sequentially

EBIT margin improved by 34bps QoQ to 10.5%, led by ongoing Fortius actions, Comviva seasonality and favorable FX, which offset the impact of recent wage hikes. Future plans involve executing the FY27 strategic roadmap, focusing on stabilization (achieved in FY25), growth and margin expansion. We expect EBIT margin to improve gradually to ~14.0-14.5% by FY27E.

Maintain ADD

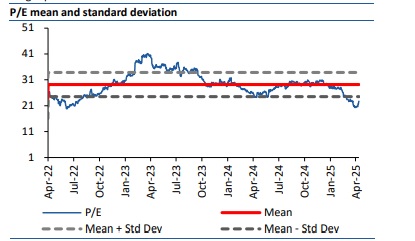

The near term demand environment remains challenging, with softness noted in Manufacturing and a cautious outlook in Hi-Tech during the second half. We expect near-term improvement in the BPS segment upon finalization of a delayed client renewal. We expect Revenue/EBITDA/PAT to clock 7.4%/24.6%/29.0% CAGR over FY25-FY27E. We have revised our FY26E/FY27E EPS by -11.1%/-5.6%. We maintain ADD with a revised target price of Rs1,604 (vs Rs1,868 earlier) at a PE multiple of 20x (vs 22x earlier) on March’27E EPS. We have decreased the target multiple from 22x to 20x to account for near term uncertainties in the demand environment.

Valuation

We value Tech Mahindra at a PE of 20x on March’27E EPS to arrive at a target price of Rs1,604.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331