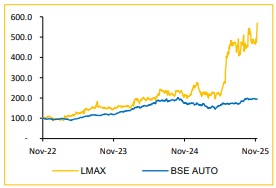

Add Lumax Auto Technologies Ltd For Target Rs. 1,480 By Choice Broking Ltd

Strong Order Book Ensures Multi-Year Visibility

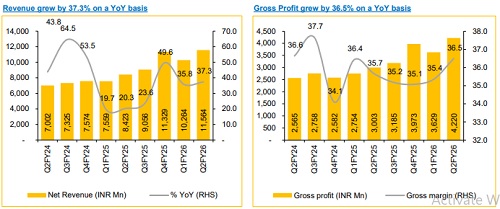

Strongest Quarterly Numbers Supported by Robust Demand: LUMAX delivered its best-ever quarterly performance, with Q2FY26 consolidated revenue rising 37% YoY to INR 11,564 Mn. This was driven by strong domestic demand, new product launches, and successful integration of the alternate fuel business. We believe the company’s revenue trajectory remains resilient, supported by strong OEM relationships, expanding product lines, and structural tailwinds in EV and clean mobility components. Management revised FY26E revenue growth guidance upward to 25% (from 20%), reaffirming confidence in achieving its 20% CAGR target over the medium term.

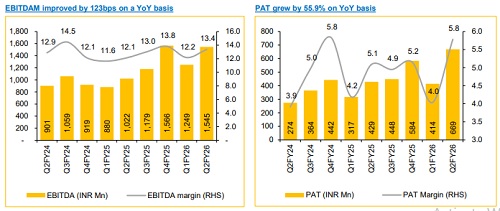

Margin Performance in Line with Guidance: EBITDA margin (Incl. Other income) improved 70 bps YoY to 14.7% in Q2FY26, aided by retrospective realization of customer price increases and cost optimization efforts. We expect the margin profile to remain within the guided 14–15% range, supported by operating leverage, product mix improvement, and continued localization initiatives

Healthy Order Book and Product Diversification Drive Visibility: LMAX robust order book stood at INR 13,570 Mn, providing strong visibility over the next few years. ~7% of this order book is projected to materialize in FY26E, 35% in FY27E, 48% in FY28E, and the remaining 10-12% in FY29E. Notably, 40% of the order book is aligned with future and clean mobility solutions, underscoring the company’s strategic pivot toward EVs and alternate fuel technologies. We believe LMAX’s focus on high-growth, new products launches, partnerships initiatives and technology-driven segments, positions LMAX for sustainable growth in the evolving mobility landscape.

View and Valuation: We revise our FY26/27E EPS estimate upward by 6.2%/7.0%, factoring the robust Q2FY26 performance and improved growth outlook. The company remains on track to deliver sustainable double-digit growth, driven by operational synergies from acquisitions and increasing exposure to clean mobility. We value the company at 25x (maintained) on the average FY27–28E EPS, arriving at a revised target price of INR 1,480. Considering the recent stock price run-up, we downgrade our rating from BUY to ADD, while remaining constructive on the company’s medium-term growth potential.

In Q2FY26 LMAX Reported numbers beat our estimate across the board

* Revenue was up 37.3% YoY (+12.7% QoQ) to INR 11,564 Mn (vs CIE est. at INR 10,612 Mn).

* EBITDA was up 51.2% YoY and (+23.7% QoQ) to INR 1,545 Mn (vs CIE est. at INR 1,401 Mn). EBITDA margin was up 123 bps YoY (+119 bps QoQ) to 13.4% (vs CIE est. at 13.2%).

* APAT was up 55.9% YoY (+61.4% QoQ) to INR 669 Mn (vs CIE est. at INR 545 Mn).

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)