Buy Adani Ports and Special Economic Zone Ltd For Target Rs.1,876 by Prabhudas Liladhar Capital Ltd

NQXT in, strong volume & EBITDA/t continue

Quick Pointers:

* Adds a high-margin (~65%+ EBITDA), long-life (~85 years) NQXT port with stable, dollar-linked cash flows.

* Acquired at ~17x FY25 EV/EBITDA, strengthening ADSEZ’s East–West trade corridor presence and long-term growth profile.

Adani Ports & SEZ (ADSEZ) has completed the acquisition of North Queensland Export Terminal (NQXT), marking a key milestone in its international expansion strategy and strengthening its long-duration, dollar-linked cash flow base. The acquisition adds a high-quality, cash-generative export terminal with take-orpay contracts, a long remaining lease life (~85 years) and strong growth visibility, while remaining largely balance-sheet neutral given the equityfunded structure. Strategically located along the East–West trade corridor, NQXT meaningfully enhances ADSEZ’s international portfolio and is expected to drive a higher contribution from overseas assets toward incremental growth. With EBITDA margins of ~65%+, NQXT is margin-accretive and should aid a steady improvement in international ports EBITDA margins as the overseas portfolio scales up.

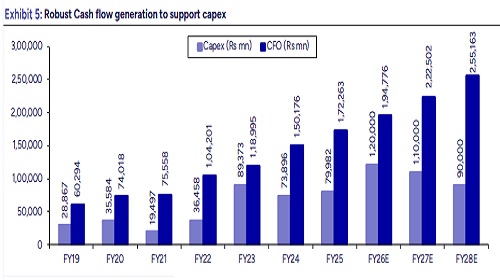

Although we had assumed consummation of NQXT in FY26, we had built in conservative volume numbers at few other ports and logistics business considering overall uncertainty led by US tariffs and few issues at domestic ports. Seeing ADSEZ’s monthly volume run-rate and H1 profitability, we have raised our FY26/27/28E estimates by ~5-6%; as a) we raise volumes at KP & Gangavaram ports, b) adjust margins as per H1 run-rate for few others and c) increase revenue run-rate for its Harbour and logistics businesses considering ADSEZ’s elevated focus on these businesses. INR has depreciated 5% since Apr’25 against AUD which would aid NQXT consolidation. We maintain ‘Buy’ with revised TP of Rs1,876 (earlier Rs1,777) valuing at 18x EV of Sep’27E EBITDA. At CMP, the stock is trading at EV of 13.8x/11.4x FY27/28E EBITDA. Maintain Buy.

* Balance-sheet neutral, equity-funded transaction: The acquisition has been executed via preferential allotment of equity shares, with no cash outflow at the APSEZ level. While NQXT’s existing net debt is consolidated, it is fully reflected in the transaction EV and supported by stable contracted cash flows. Management has also indicated monetisation of non-core assets and liabilities at the acquired entity, keeping consolidated leverage broadly stable post-acquisition. Board Approved 153 equity shares of ADSEZ for 1000 shares of APPH which will lead to issuance of new 143.8mn equity shares (6.7% dilution).

* High quality with strong earnings visibility: NQXT is a 50mtpa natural deepwater export terminal, with ~40mtpa already tied up under long-term take-orpay contracts, providing high revenue and EBITDA visibility. The asset delivered ~AUD228mn EBITDA in FY25 and is expected to scale EBITDA to ~AUD400mn over the next 4 years, driven by higher contracted capacity, renewals and operating leverage. This implies an attractive ~10x EV/EBITDA on FY29E, which we view as competitive for a long-life, infrastructure asset with dollar-denominated cash flows

* Strategic fit strengthens international platform: NQXT enhances APSEZ’s presence across the East–West trade corridor, adding to its international ports portfolio of Haifa, Colombo and Tanzania, while adding exposure to resourcerich Queensland with strong demand linkages to Asian markets. Over the medium term, the asset provides optionality for capacity expansion and diversification into new export streams, supporting APSEZ’s long-term international growth roadmap. The transaction values NQXT at an enterprise value of ~AUD3.975bn, implying ~17x FY25 EBITDA and ~10x EV/EBITDA on FY29E EBITDA, which we view as attractive relative to comparable international port transactions.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271