Add Eicher Motors Ltd For Target Rs. 5,837 By Yes Securities Ltd

Valuation and View – Focus on volumes over margins start to reflect

Eicher Motors (EIM) 3QFY25 consolidated results were operational weak with EBITA/margins miss of 10-14%/2-3% to our/street. This was led by lower-thanexpected margins in standalone (led by lower ASP and inflated other expense partly due to one off related to EV brand launch expense (~40bp impact), new ICE launches and heightened market activation spends (to continue). RE's margins expansion ahead will be guided by stable RM, higher share of non-motorcycle revenues, platform related VAVE and exports. The demand outlook is positive as domestic volumes are expected to see full benefits of new launches, undergoing market activation projects, conversion of pent-up demand in few states and upcoming marriage season. Exports on the other hand should continue to see gradual volume build-up.

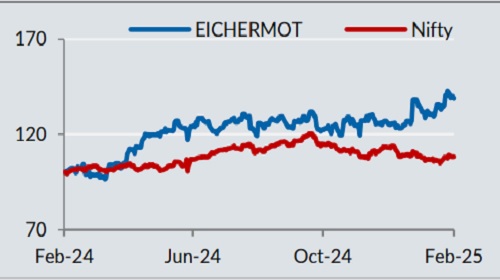

The management sounded confident to improve RE’s volume trajectory backed by healthy response to new launches. Further, it has re-iterated slew of launches (in exports) and wider branding/market activation projects, which should help expand overall mid-size market. We expect RE’s overall volumes to grow at ~7% CAGR over FY24-27E. Recent launches could be an inflection point for RE as a completely new and improved platform should drive efficiencies. However, we remain watchful of domestic average monthly run-rate as exports volumes can be volatile. On the other hand, VECV likely to maintain the momentum, in turn leading to consolidated revenue/EBITDA/Adj.PAT CAGR to 9.6%/10.7%/12.3% over FY24-27E. We cut FY26 EPS by ~4% to reflect upon lower RE ASP and higher other expenses while maintain FY27 EPS. With recent outperformance, the stock trades at 28.2x/25.8x FY26E/FY27E consol EPS make risk reward slightly unfavourable. Hence we downgrade the stock to ADD (vs BUY) with SoTP based TP of Rs5,837 (vs Rs5,667 earlier). We value S/A at 28x P/E and VECV at 12x EV/EBITDA.

Result Highlights – Weak RE ASP; higher other expenses dent margins

* Consol revenues grew 19% YoY (+16.7% QoQ) at Rs49.7b (est Rs51b). RE’s volume grew 19.4% YoY/+19.5% QoQ at ~272k and ASPs came in at Rs180.2k/unit (est Rs187.3k/units, +1.4% YoY/-2.3% QoQ), led by product mix.

* Consol gross margins contracted 90bp YoY (-140bp QoQ) at 45.1% (est 46.5%) while RE’s gross margins contracted 170bp YoY/-120bp QoQ at 44.5% (est 46.2%). Consol EBITDA grew 10.2% YoY (+10.4% QoQ) at Rs12b (est ~Rs14.1b) with margins at 24.2% (-190bp YoY/-140bp QoQ, est 24.2%). S/A margins contracted 260bp YoY (-130bp QoQ) at 24.9% (est 28%), leading to EBITDA/vehicle at Rs44.9k/unit which de-grew by 8.1% YoY (-7.3% QoQ).

* VECV performance - Revenues grew 5.8% YoY at Rs58b (est ~Rs56.7b), EBITDA grew 16.1% to ~Rs5.1b (est ~Rs4.3b) with margins at 8.8% (est 7.5%). PAT grew 42.6% YoY at Rs3b (est ~Rs2.2b).

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632