Buy Eternal Ltd For Target Rs. 320 By JM Financial Services

Eternal once again surprised us positively on Blinkit. This time though, the surprise was more on management commentary than the reported numbers, as it was quite a contrast to the cautious tone post 4QFY25 results. Remarks that stood-out were: 1) Adj. EBITDA losses in Blinkit have peaked out, not only in margin terms but also on an absolute basis; 2) a move to inventory-led model (over the next 2-3 qtrs) can expand margins by ~100bps (as % of NOV), while needing limited working capital investments (18 days or 5% of NOV); and 3) visibility to double dark store count from 1,544 currently to 3,000. In terms of reported numbers, Blinkit’s GOV growth of c.140% YoY was ahead of JMFe of c.129% while Adj. EBITDA loss narrowed from INR 1.78bn in 4QFY25 to INR 1.62bn, albeit it was tad higher than JMFe of INR 1.54bn. There were however, a few misses as well - 1) food delivery Adj. EBITDA margin contracted for the first time (on a sequential basis) after 14 qtrs and 2) there was an unexpected rise in investments in ‘Bistro’ (operated by Blinkit). Having mentioned that, we believe the positives in Blinkit are likely to outweigh the misses in other businesses. We, reiterate Eternal as our preferred pick with an unchanged Jun’26 TP of INR 320 (PER of 75x).

* Blinkit – absolute losses peak; transition to inventory-led model likely to ensure breakeven by 3QFY26:

Blinkit’s GOV grew a robust 140% YoY (+25% QoQ) to INR 118.2bn, a beat on JMFe of INR 112.6bn. Growth was mainly driven by 124% YoY expansion in orders (+25% QoQ), which in turn was driven by strong MTU expansion to 16.9mn from 13.7mn/7.6mn in 4QFY25/1QFY25. AOV too was up 7% YoY (+1% sequentially). Adj. EBITDA margin (% of GOV) stood at -1.4% (+52bps QoQ), in-line JMFe. As a result, Adj. EBITDA loss narrowed to INR 1.62bn from a loss of INR 1.78bn in 4QFY25, albeit it was a tad higher than JMFe loss of INR 1.54bn. During the quarter, the company added 243 stores (294/216 stores in 4Q/3Q), with total store count reaching 1,544. Blinkit also saw addition of 0.4mn sqft of warehousing space in 1Q (earlier it had added 1.3mn/1.0mn capacity in 3Q/4QFY25). Management re-iterated guidance of ~2,000 active stores by the end of CY25 with a potential of expansion to 3,000 stores eventually (though timeline was not shared). Management also noted that even in Tier 2+ cities, profitability looks promising as the difference in Net AOV (NAOV) of large and small cities is ~10% and hence after accounting for lower cost of operations in smaller cities, margins will be attractive even in smaller cities. Importantly, the company will almost entirely transition to inventory ownership model over the next 2-3 quarters, which in turn will lead to incremental margin improvement by ~100bps. In 1QFY26, about 3% of Blinkit's NOV was already on its own inventory (as a result revenue grew faster than its NOV at 155% YoY). Management expects net working capital (NWC) requirement to be ~18 days (~5% of NOV) once it fully transitions to inventory-led model whereas for the current marketplace model NWC is 3-4 days (~1% of NOV). Assuming, total investment of 9% of NOV (includes capex of ~4% of NOV and NWC of ~5% of NOV) and an EBIT margin of 4% of NOV, the inventory-led business model can generate ROCE of 40%, as per management. We believe the benefits of inventory-led model will start accruing immediately post implementation, and therefore remain confident that Blinkit will turn Adj. EBITDA break-even by 3QFY26 itself.

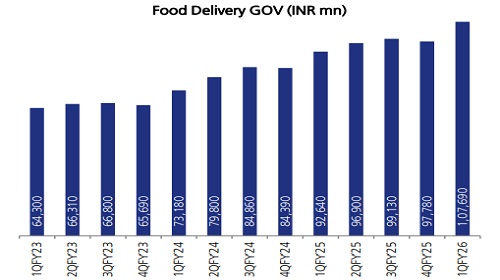

* Zomato (Food delivery) – Marginal beat on GOV but profitability below expectations: Zomato’s GOV grew 16% YoY (+10% QoQ) to INR 107.7bn, marginally ahead of JMFe of 15% YoY. Management believes that YoY growth is likely to have bottomed out. Having mentioned that, in FY26, Food delivery NOV growth will be 15%+ instead of 20%. GOV expansion was largely driven by MTU expansion to 22.9mn from 20.3mn in 1QFY25 (20.9mn in 4QFY25). GOV-NOV conversion dipped 70bps QoQ to 83.3% in 1Q due to increase in restaurant funded discounts in response to sluggish demand environment. Take-rate excluding customer delivery fees remained flattish sequentially at 21.0%. Similarly, take rate including delivery fees too was flat QoQ at 24.7%. Reported revenue was up 16% YoY (+10% QoQ) to INR 22.6bn, ahead JMFe by 0.7%. Contribution margin (% of GOV) was down ~40bps QoQ to 8.2% (JMFe of 8.4%) while Adj. EBITDA margin also declined ~20bps QoQ to 4.2%, a miss on JMFe of 4.5%. Margins got impacted in 1Q due to lower availability of delivery partners and adverse weather conditions in different parts of the country. Overall, Adj. EBITDA in 1Q stood at INR 4.51bn vs. INR 4.28bn/INR 3.13bn in 4QFY25/1QFY25 respectively, and was below JMFe by c.5%.

* Hyperpure – Inventory-led QC model will lead to decline in B2B business: Revenue grew 25% QoQ (+89% YoY) to INR 22.9bn, ahead of JMFe of INR 20.6bn. Adj. EBITDA margin (as % of revenue) for this business stood at -0.8% vs. -1.2% in 4Q. Going-ahead, as Blinkit transitions to inventory-led model, Hyperpure revenue will decrease due to scale down of non-restaurant business as most of the B2B buyers in that business were sellers on Blinkit. However, this shift in Blinkit’s business model will have no impact on Hyperpure’s restaurant business. Hyperpure’s Adj. EBITDA loss stood at INR 180mn vs. loss of INR 220mn in 4Q. ? Going-out (District app) – currently in investment phase but could be a USD 150mn Adj. EBITDA opportunity: Going-out GOV grew c.87% YoY to INR 23.7bn in 1QFY26 (c.9% QoQ). The segment reported Adj. EBITDA loss of INR 540mn vs loss of INR 470mn in 4QFY25. In 1QFY26, Going-out business had ~2mn average monthly transacting customers transacting two times a month on an average with a net AOV (NAOV) of INR 1,700+. Management believes that this business has the potential to scale to USD 3bn in annual NOV with USD 150mn of Adj. EBITDA over the next 5 years. ? Others segment – losses will sustain in near term: Other segment which primarily includes 1) Bistro – 10 minute food delivery service 2) Nugget – AI driven customer support platform 3) Greening India – agroforestry initiative, reported an increase in quarterly losses due to investments in Bistro. In Bistro, Blinkit operates the company owned kitchen infrstructure. It has 38 such kitchens live in Delhi-NCR and Banglore currently. Management noted that it will continue to invest in Bistro expansion and it has budgeted INR 1.5bn of loss funding for FY26, across all the three businesses included in Others segment.

* Other key takeaways from Shareholders' letter: 1) Company will henceforth disclose only net order value (NOV) numbers while discounting GOV reporting. Here, NOV equals to GOV minus all types of discounts (funded by the platform or by partners like brands, sellers, restaurants, among others). 2) The company added ~ 1000 net new stores and ~2.5mn sq.ft. of warehouse capacity incurring a capex of INR 10bn in the last 5 quarters. 3) A large portion of Blinkit’s business is already profitable with some cities at 2.5%+ Adjusted EBITDA margin (as a % of NOV). 4) Capex investments in Bistro kitchens and IT hardware and other requirements across businesses stood at INR 0.6bn.

* Maintain ‘BUY’ on Eternal with an unchanged TP of INR 320: We raise our GOV estimates for Zomato (food delivery) by 1-2% over FY26-28 on the back of management commentary that growth is likely to have bottomed out. Blinkit GOV estimates are also raised by 8-17% over FY26-28 to factor in very strong growth trends in the business, aided by accelerated store expansion. Importantly, our revenue estimates for Blinkit do not consider a change in business model to inventory led on account of various uncertainties associated with the business model change. We, however, make downward adjustments in Zomato’s Adj. EBITDA margin by ~30-50bps (% of GOV) which leads to 6- 9% cuts in food delivery Adj. EBITDA estimates over FY26-28. While Blinkit’s Adj. EBITDA margin (as % of GOV) estimates remain broadly unchanged as we were already building incremental benefit of working on an inventory led model, higher growth assumptions leads to an increase in absolute Adj. EBITDA by 13-15% over FY27-28 (FY26 Adj. EBITDA is a bit lower due to miss on contribution margin in 1Q). Overall, our EPS estimates are cut in FY26 by 4.9% with only nominal changes in FY27 and FY28. We continue to assign a target multiple of 75x on Eternal’s Jun’27 EPS to arrive at unchanged Jun’26 TP of INR 320. Eternal continues to be one of our preferred picks in the listed Internet space as we believe it is well positioned to benefit from robust industry tailwinds for the hyperlocal delivery businesses. Its balance sheet also remains strong with net cash of INR 189bn as of Jun’25 (INR 188bn in Mar’25). We maintain ‘BUY’.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

2.jpg)