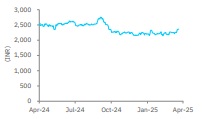

Sell Nestle India Ltd For Target Rs. 2,200 By Elara Capital

High valuation in a low-demand reality

Nestlé (NEST IN) delivered mixed Q4 – instant noodles sales revived but milk nutrition sales were weak. Volume growth was better than in Q3 but in low single-digit due to subdued urban demand and high inflation impacting consumption. We largely maintain our FY26E and FY27E earnings estimates and revise NEST to Sell from Reduce as the stock has rallied 10% in the past three months with TP unchanged at INR 2,200, on 60x (unchanged) FY27E P/E.

Milk products and nutrition continued to drag performance: NEST reported a 3.7% YoY rise in Q4 revenue to INR 54.5bn, slightly below estimates, with 4.2% domestic sales growth offset by an 8.7% drop in exports. Strong double-digit growth in beverages and confectionery drove Q4, while FY25 domestic sales rose 3.2% with modest volume growth (~1%). The powdered and liquid beverages segment led with robust double-digit gains, supported by Nescafé’s market share expansion. Confectionery saw high single-digit growth in both value and volume, driven by KitKat and improved distribution. Prepared Dishes and Cooking Aids segment delivered mid-single digit growth as Maggi returned to volume growth and MasalaAe-Magic maintained momentum. Milk products and nutrition lagged, although Milkmaid remained strong. e-commerce showed solid traction, contributing 8.5% to domestic sales, propelled by quick commerce, new consumer acquisitions, and premiumization.

Focus on premiumization, innovation and penetration: In its recent analyst meet, NEST indicated increased focus on premiumization, which is different from its earlier focus on penetration. NEST continues to strengthen its Rurban strategy, built on five key pillars — Enhanced infrastructure, diversified product portfolio, improved visibility, deeper consumer engagement, and advanced technology. As a result, its Rurban distribution network has expanded to 27.7k distribution touchpoints, now reaching 0.2mn villages across India.

Steep rise in input prices impacts profitability: Gross margin was at 55.7% in Q4, down 100bps YoY and down 50bps QoQ, led by high inflation in coffee, cocoa and wheat. EBITDA margin was down 120bps YoY to 23.8%, below our estimates of 24.8%, due to slower growth and negative operating leverage. The company remains cautious, citing persistently high coffee prices and stable but elevated levels in cocoa and edible oils. Milk prices have also firmed with seasonal trends. Despite these headwinds, NEST is focused on driving sustained volume-led growth while preserving profitability.

Downgrade to Sell; TP maintained at INR 2,200: We largely maintain our FY26E and FY27E earnings estimates and introduce FY28E estimates but we downgrade NEST to Sell from Reduce as the stock has rallied by 10% in the past three months and NEST is trading at high valuation of 65x P/E despite muted demand environment. We maintain our TP at INR 2,200, based on 60x (unchanged) FY27 P/E. Key upside risk is strong revival in milk and nutrition business.

Please refer disclaimer at Report

SEBI Registration number is INH000000933