Reduce Azad Engineering Ltd For Target Rs. 1,865 - Choice Broking Ltd

A strong order book of INR 60.0 Bn (~13x TTM Sales) and Global OEM backing provide exceptional revenue visibility.

Azad Engineering is exceptionally well-positioned to capitalize on strong sectoral demand, backed by a robust order book exceeding INR 60.0 Bn, which translates to ~13x its FY25 revenue, providing multi-year revenue visibility. The company has secured long-term contracts spanning 3-6 years from global OEMs such as GE Vernova, Mitsubishi, Baker Hughes, and Rolls-Royce, which underscores its reputation as a reliable supplier of precision engineering components in energy, aerospace, and defense.

Furthermore, Azad’s role in developing India’s first indigenous gas turbine engine highlights its strategic importance in defense. Backed by strong global OEM ties and multi-sector exposure, it offers a high-visibility growth story with long-term upside potential.

Operationally sound quarter, but PAT fell short of our expectations;

* Revenue for Q4FY25 up by 36.8% YoY & up by 5.3% QoQ at INR 1,269 Mn (vs CEBPL est. INR 1,330 Mn).

* EBIDTA for Q4FY25 up by 45.4% YoY and up 6.5% QoQ at INR 456 Mn (vs CEBPL est. INR 405 Mn). The EBITDA Margin stood at 35.9%, improved by 213bps YoY (vs CEBPL est. of 30.4%).

* PAT for Q4FY25 up by 66.2% YoY and up 4.6% QoQ at INR 248 Mn (vs CEBPL est. INR 302 Mn). PAT Margin improved by 346bps YoY, reaching 19.5% (vs CEBPL est. 22.7%).

View & Valuation:

Historically, Azad has maintained an order book exceeding 10x its annual revenue and is now undertaking a 10x capacity expansion from the current 20,000 sq. mts to 200,000 sq. mts to meet future demand. While management has guided for 30% topline growth, we believe the company is wellpositioned to exceed this, given its strong order visibility and upcoming capacity ramp-up.

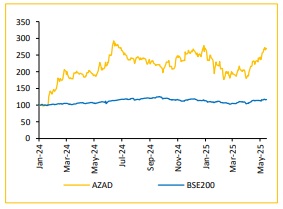

However, factoring in near-term execution timelines and the recent sharp rally in the stock limits’ upside. In light of this, we have trimmed our FY26E/FY27E revenue growth estimates downward by 6.2%/12.5%, and revised our EPS estimates downward by 4.6%/13.4%, respectively. As a result, we downgrade our rating to REDUCE (from Buy) and revise our target price downward to INR 1,865 (from INR 2,150), maintaining a multiple of 55x FY27E EPS.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131