Indian Dairy Sector Report : Expert Call Takeaways - Expert Session on Dairy industry by Systematix Institutional Equities

Indian Dairy Sector

Expert Session on Dairy industry – key takeaways

We hosted a group discussion with an expert in the Indian dairy industry, with 17+ years of experience across dairy and FMCG sectors, currently associated with one of India’s leading dairy cooperatives as Head of Operations. The expert acknowledged a recent firming-up of milk procurement costs (due to factors outlined below) and opined that cost corrections would manifest in April or so with the Ramzan period, noting product prices have been stable over the last few months (post-GST cut) except in few regions like Bihar and Andhra Pradesh. The expert provided a context to recent industry developments on consumption growth, inventory, procurement costs and product prices – outlining how the industry journeyed from (1) the postCovid period (2022-23) of low milk production and drop in prices, to (2) a 25% jump in production during the flush of October’24 through March’25 resulting in milk surplus accumulation, to (3) the current year 2025 wherein industry surplus has been impacted by disruptions including early rains, geopolitical conflict (Operation Sindoor) affecting northern milk belts of Punjab, Haryana, J&K, and robust festive demand. Expecting robust consumption demand over 1HCY26, the expert believes dairy players will need to nimbly balance demand-supply in the backdrop of limited milk surplus.

Noting that industry demand has benefited from reduced prices/ increased grammage post the recent GST cut, the expert emphasized that margins have been impacted from disruption in channels and supply chains, and players would now seek to hike product pricing/ roll back higher post-GST volumes in a bid to recover margins. He highlighted a sustained demand upsurge in value-added products (VAP), mainly in curd, ice creams (consumption graduating from summer-intensive to an advanced/ wider demand window), paneer and ghee. The expert remarked that dairy products are now becoming impulse-purchase, with consumers moving from fizzy drinks to alternatives such as milkshakes. On distribution, the expert emphasized the increasing sales’ salience of E/Q-comm channels amid a clear consumption shift happening from general trade (GT). While GT and E/Q-comm together account for c.80% of industry sales, he noted the conundrum of dairy players in modern trade (MT) – while MT makes up c.20% of industry sales, it provides lower margins.

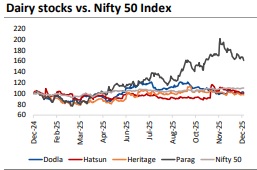

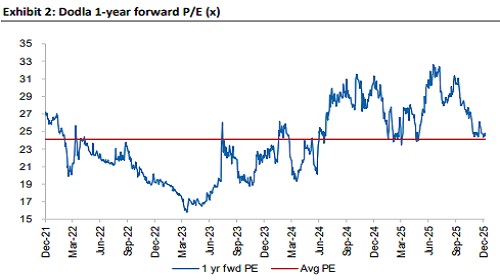

We prefer Dodla Dairy (BUY, TP Rs 1,530) in the space, noting its (1) strong growth momentum in low-teens spearheaded by India VAP and Africa businesses (FY25- FY28E revenue CAGRs of 15%+ and 18% respectively), (2) sustained product-mix improvement leading to firm realizations, (3) incremental revenue visibility from the greenfield Maharashtra plant, (4) accretion from recent Osam acquisition and (5) sustenance of medium-term margins near-10% with better mix (VAP/ Africa growing faster vs base milk business) and lower bulk sales (sold at breakeven) despite higher expansion-related costs. We expect overall revenue/ PAT CAGR of 13%/ 16% over FY25-FY28E; we value the stock on a P/E of 26x on September-2027E EPS. We maintain confidence on growth, sustainability of margins, enduring return ratios and deft geographic expansions opening up additional levers of growth.

Key Takeaways from the session

Recent sector context & challenges

* Dairy sector growth generally sees a downtrend every 5-7 years, largely due to demand-supply imbalances or climatic changes.

* The post-Covid period (2022-23) saw large-scale disturbance in the supply chain, with unreasonable drop in milk prices, farmer unwillingness to invest in cattle farming (production cost not being met) and a steep decline in milk production.

* From mid-2023, farmer-engagement efforts from players like Amul led to renewed farmer confidence and interest in cattle induction with sustainable fodder programs restarted.

* From mid-2024 (peaking over Oct’24-Marc’25 flush season), rapid cattle induction led to 25% jump in milk production, resulting in milk surplus accumulation. Dairies had to judiciously deploy the produce into product mixes. Amul stepped up A&P activities, energized its ground force, further developed its cold chain and backend, stepped up dark-store distribution to deploy the surplus.

* In 2025, certain disruptions impacted the earlier industry surplus – early rains breaking the summer pattern; war-related disturbance (Operation Sindoor) affected northern milk belts of Punjab, Haryana, J&K.

* Dairy players had to balance demand-supply in advance of the flush of 2025 (Oct onwards), due to shortages with not much surplus left post-festive of 2025.

* Now, with surplus eroded, players are exploring ways to meet expected strong demand around occasions like Makar Sankranti, Basant Panchami and Id in early2026 next year. • In this backdrop, milk procurement costs have firmed up. The industry would likely see cost corrections coming in around April or so with Ramzan.

* Product prices have been stable over last few months, except for a few regions like Bihar and Andhra which saw an increase of Rs 1-1.5 per ltr.

GST-cut impact

* Post GST-cut, industry demand has benefited from reduced prices or increased grammage (c.10% higher volumes on small SKUs). But margins were impacted to an extent from disruption in channels and supply chains.

* Dairies are now looking to roll back the higher volumes or return to pre-GST pricing. Margins should improve once either of these happens.

Value-added products (VAP)

* Demand is surging in curd, in the drum/ tub/ bucket SKUs. In East India (Bihar region), massive consumption of 400 MT per day expected over Sankranti in Jan’26.

* Ice cream used to be summer-intensive, but the demand window has now broadened. From earlier consumption peaks over end-April/May/June, the peak has advanced to Ramzan (starting in March mid-Ramzan period).

* Dairy products are now becoming impulse-purchase, with consumers moving from fizzy/ carbonated drinks to alternatives such as milkshakes.

* Milk is most optimally utilized (based on per-litre production cost) in making yogurt and curd, which fetch higher margins vs milk. Thereafter, paneer, milk shakes, cheese allow better utilizations. Conventionally, dairies are tempted to make ghee, which fetches the best margins for most conventional players.

* Distribution of milk and curd is limited to a radius of 50-500km due to perishability; paneer, yogurt, milkshakes, ghee, butter can be preserved and served over larger regions.

UHT Milk

* UHT seen as alternative to fresh milk, esp. in East/North-East where fresh milk availability was historically constrained. However, the share of UHT in milk consumption has come down from 75% to 50% over the past 5 years as fresh milk availability improved.

* In Metros, consumers persistently perceive UHT as ‘safest’ for household consumption (despite availability of fresh milk) due to hygiene attributes. • Overall growth of UHT milk category is slow, but growth in value-added UHT (fresh cream, milkshakes) is stronger vs plain UHT milk.

Distribution

* Salience of E/Q-comm (Zepto, Blinkit, Swiggy) increasing for dairy sales. Amul, Mother Dairy earlier had 20-30% workforce in front-end sales (door-to-door). These have now been reduced; resources redeployed to E/Q-comm. Channel incentives expanded to include data or insights like product/SKU demand by region, inventory movement, competitor presence).

* Clear consumption shift happening from GT to E/Q-comm. Modern Trade (MT) becoming a bit redundant with direct shift from GT to E/Q-comm.

* GT + E/Q-comm covers 80% of sales with stronger margins.

* MT has 20% sales salience, offers 25% visibility, but margins are lower (by c.16% of other channel margins) with free-of-cost promotions and shelf-life constraints. So dairy companies need to make channel-balancing calls.

Prominent players

* Established legacy players - Amul, Mother Dairy, Nestlé (long-standing national presence).

* Strong regional / cooperative / private players - Heritage, Hatsun, Dodla, Nandini, Dairy Day (mid-generation, now well established).

* Next-generation regional challengers like Red Cow (Kolkata), Milky Mist (Tamil Nadu), Namaste India (Kanpur), Lotus (Jaipur) which are innovating via packaging, A2/ antioxidant concepts, nutrient re-creations, and localized insights.

* Foreign players: Lactalis still there with offshoots of Thirumala Dairy, Sunfresh Agro, Prabhat Dairy, Anik. Now branding their products in Lactalis. Trying to Indianize their foreign preparations.

Above views are of the author and not of the website kindly read disclaimer