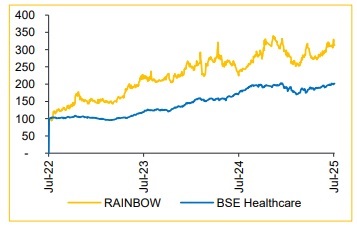

Add Rainbow hospitals Ltd For Target Rs. 1,685 By Choice Broking Ltd

Driving Growth Through Strategic Expansion:

Strategic expansion via the hub-and-spoke model, entry into new markets, increased focus on tertiary (complex treatments) and quaternary (highly specialized) care, along with the continued scale-up of the IVF business, are expected to drive strong and sustainable overall growth.

View and Valuation:

We anticipate growth to be driven by strong momentum in IVF services, higher ARPOB, and expansion into new geographies through organic and inorganic growth. However, performance could be affected by a reduction in the share from international patients and an increase in average length of stay (ALOS). With no significant changes to management guidance, we maintain our estimates and introduce FY28E projections. We forecast revenue/EBITDA/PAT to grow at a CAGR of 21.5%/23.9%/34.9% over FY25–FY28E. Valuing the stock at an EV/EBITDA multiple of 21x on the average of FY27 and FY28 estimates, we arrive at a revised target price of INR 1,685 (earlier INR 1,475), maintaining our ADD rating.

Revenue came in below estimates and saw strong YoY growth on all fronts

* Revenue came at INR 3.5 Bn (vs. CIE estimate: INR 3.6 Bn), up 6.9% YoY and down by 4.6% QoQ.

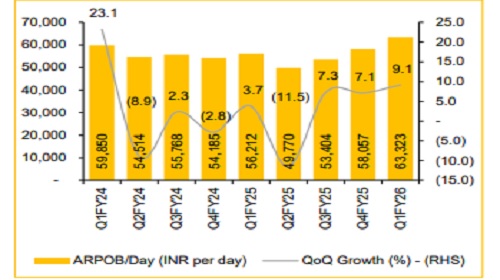

* Highest ever ARPOB at INR 63,323, up 12.7% YoY and 9.1% QoQ, while occupancy dropped to 40.2% from 42.4% in Q1FY25.

* EBITDA came at INR 1.0 Bn (vs. CIE estimate: INR 1.1 Bn), up by 10.6% YoY and down 9.7% QoQ. EBITDA margin came at 29.4% (vs. CIE estimate of 29.7%), improved by 98 bps YoY, but contracted by 164 bps QoQ.

* PAT came at INR 0.5 Bn (vs. CIE estimate: INR 0.5 Bn), up 35.4% YoY and down 4.9% QoQ, with a PAT margin of 15.2% (vs. 12% in Q1FY25).

Expanding with ~950 Beds Across High-Demand Pediatric Markets

Rainbow is rapidly expanding its capacity by adding ~950 beds through greenfield and brownfield projects across multiple geographies. Recent developments include a 100-bed Rajahmundry hospital awaiting final approvals, two 450-bed NCR projects with progressing excavation, and a strategic entry into Pune via a 50-bed facility using a cost-efficient model. The company has also acquired a 76% stake in Prashanthi Hospital (100 beds), tapping into a 3Mn population area. The company invested INR 41.5 Cr in capex during the quarter and plans to fund all expansion through internal accruals. It is entering into underpenetrated pediatric markets with rising demand for tertiary and quaternary care. Expansion under the hub-and-spoke model allows Rainbow to scale rapidly while maintaining clinical quality.

Focus on complex care drives strong ARPOB performance

Despite operating at lower occupancy levels of 40–50%, versus the 60–70% typically seen in multi-specialty hospitals (refer exhibit 1), Rainbow sustains a healthy ARPOB of ~INR 60K, on par with larger peers. This is driven by a strategic focus on high-end tertiary and quaternary care, a shorter ALOS of 2.7 days allowing faster patient turnover, and a well-diversified revenue mix with strong outpatient contribution. Looking ahead, this continued emphasis on complex care is expected to drive ARPOB growth to approximately INR 63K over the next 2-3 years.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131