Hold Bajaj Finance Ltd For Target Rs.1,030 by Prabhudas Liladhar Capital Ltd

Lower growth in FY26; credit cost elevated

Quick Pointers:

* AUM to grow 22%-23% in FY26 due to curtailment in MSME

* Credit cost continues to be elevated at 2% due to stress in captive auto and MSME portfolio

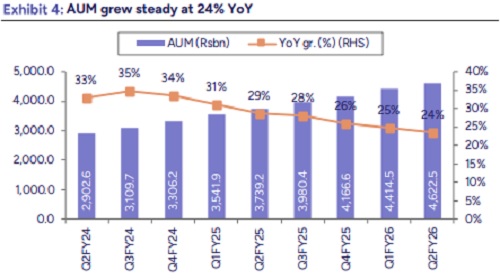

AUM grew steady at 24% YoY to Rs 4,622.5bn. While festive season spend saw a strong uptick of 29%, BAF has lowered its overall growth guidance to 22% - 23% in FY26 due to cutdown in the MSME portfolio. While the company is seeing strong traction in new verticals (Cars, Gold, MFI) and new customer addition, we revise our growth outlook to 23%/ 24% for FY26/ FY27E. Expect FY26 NIM to remain stable aided by a lower cost of borrowing. Credit cost remained elevated in the quarter (~2%) on account of continued stress in the captive auto/ MSME portfolio. While commentary indicated a healthy trend in earlystage delinquencies, we remain wary and build a higher credit cost of 2% for FY26E. We cut our FY26/FY27E estimates by 4%/5% and assign a multiple of 4.2x on Sep’27 ABV with a TP of Rs 1,030. Maintain HOLD.

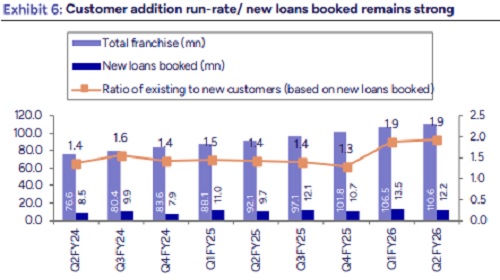

* Expect AUM growth of ~23% in FY26: AUM grew 24% YoY/5% QoQ to Rs 4,622.5 bn, driven by Mortgages (+25% YoY), Sales Finance (+23% YoY), Consumer B2C (+25% YoY) and commercial lending (+27 YoY%). New businesses- car loans, MFI and gold continue to see strong traction. While company has seen a strong momentum in consumption finance during the festive season (+29% YoY), it has lowered overall AUM growth guidance to 22%- 23% in FY26E (vs. 24% -26% earlier). This is on account of (1) curtailing disbursements in the MSME portfolio due to higher stress -cut 25% of unsecured MSME volumes resulting in lower AUM growth of ~10%-12% (2) slower growth anticipated in the mortgage portfolio. New loans booked in 2QFY26 were +26% YoY to 12.2 mn and BAF added 4.1 mn new customers in the quarter, taking the total number of customers to 110.6 mn. Company remains confident of adding ~17 mn new customers in FY26. Expansion in new verticals (Gold/MFI/Cars), partnership with Bharti Airtel and strong customer addition run-rate is likely to aid growth. However, it will be offset by lower disbursements in the MSME portfolio. We lower our AUM growth guidance to ~23% (in-line with guidance) for FY26E to account for the slowdown in MSME. Post FY26E, we expect AUM to growth 24%/ 23% in FY27E/ FY28E led by new business verticals.

* Expect NIM to remain stable in FY26: NII grew 22% YoY/ 5% QoQ and NIM (calc.) remained stable QoQ at 9.5%. Cost of funds (reported) improved by 27 bps QoQ to 7.52% and company expects it to trend between 7.55%- 7.60% in FY26. We expect NIM to remain stable in FY26E, aided by a lower cost of borrowing. Cost/ Income Ratio stood at 32.6% (+8 bps QoQ) and we build some improvement in FY26/ FY27E led by higher operating efficiencies (GenAI capabilities, service and contact centers). With a focus on growth in new and secured verticals, we expect BAF to deliver RoA/RoE of 4.4%/ 21% by FY28E.

* Credit costs elevated; continued stress in auto/ MSME: Headline GNPA/NNPA deteriorated to 1.24%/ 0.6% vs. 1.03%/ 0.50% in Q1FY26 and PCR stood at 52%. Given over-leveraging and elevated stress in MSME lending, company has cut 25% of its unsecured MSME volumes and expects a lower growth of 10%- 12% for this portfolio. It has also cut exposure to the captive 2W/3W segment (contributing ~2% of AUM) currently. While credit cost stood elevated in the quarter (~2%), company is seeing an improvement in early-bucket delinquencies (ex-MSME) and expects it to range between 1.85%- 1.95% for FY26E. We remain conservative and build a higher credit cost of 2% for FY26E. Post FY26E, we expect a moderation to 1.8%, as the stress in MSME subsides and the share of captive 2W/3W in the portfolio runs down.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

Top News

Insurance Sector Update : Q2FY26 Preview ? Noisy and uninspiring quarter by Emkay Global Fin...