Buy Syrma SGS Technology Ltd For Target Rs. 1,000 By JM Financial Services Ltd

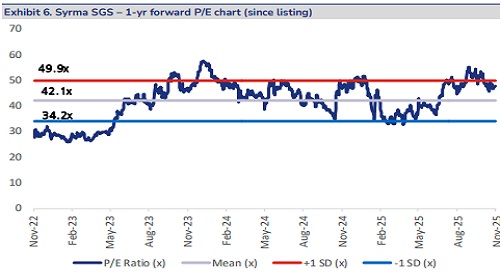

Syrma SGS reported a strong 2Q performance, beating our and consensus estimates. It retained its FY26E revenue growth guidance of 30% and is confident of surpassing its EBITDA margin guidance of 8.5-9% (1H EBITDA margin at 9.7%). Marking a foray into manufacturing of defence and maritime equipment, it announced the acquisition of a 60% stake in Elcome Integrated Systems. Syrma SGS will acquire Elcome for a consideration of INR 2.4bn, of which Elcome will utilise INR 500mn to acquire a 100% stake in Navicom Technology. On a consolidated basis, Elcome and Navicom reported revenue of INR 2.1bn in FY25, and revenue and EBITDA margin of INR 1.5bn and 17.7% respectively in FY24. With government approvals now in place, the PCB manufacturing business is also progressing well for commencement by 4QFY27, as indicated earlier. Our FY26-28E EPS estimates see an upgrade of 0-3%. We maintain BUY with a PT of INR 1,000, at 45x Sep’27E EPS.

* 2Q results surprise positively: 2Q revenue at INR 11.5bn, +38% YoY/+21% QoQ, was 7% ahead of our and consensus estimate. 2Q EBITDA at INR 1.2bn, +62% YoY/+33% QoQ, was 27% ahead of our estimate and 21% ahead of consensus. This was due to strong revenue growth and lower operating expenses. Gross margin expanded 60bps YoY, in line with expectations. EBITDA margin, at 10.1%, expanded 150bps YoY and was 160bps ahead of estimate of 8.4% and 120bps higher than consensus estimate of 8.9%. 2Q PAT, at INR 641mn, +77% YoY/+29% QoQ was a 21% beat on our estimate of INR 531mn and a 17% beat on consensus estimate of 547mn.

* FY26E revenue guidance retained; margin guidance likely to be surpassed: The management retained its ~30% revenue growth guidance for FY26E. It had earlier guided for 8.5-9%, but basis 1H performance (1H EBITDA margin at 9.7%), it expects to surpass this earlier guidance. Further, on exports, it guided for revenue of INR 10bn in FY26E (INR 5bn in 1H), which is a YoY growth of 17-18% YoY. Revenue from exports, ideally, should further ramp up as dust around tariffs settles. Lastly, on working capital and cash flows, it remains confident of reporting positive operating cash flow for full year FY26E, and net working capital days of 60-65.

* Acquisitions of Elcome & Navicom to mark a foray into manufacturing of defence equipment: Syrma SGS entered into an agreement to acquire a 60% stake in Elcome Integrated Systems for INR 2.35bn, by way of a mix of primary and secondary investment. The balance 40% stake will be acquired in tranches over 3 years, linked to earn-out based milestones. Further, Elcome will use INR 500mn out of these funds for acquiring Navicom. Products manufactured by these companies include navigation systems, maritime communication and network systems, and monitoring and safety systems. Elcome and Navicom reported revenue of INR 1.6bn and INR 520mn respectively in FY25 (consolidated INR 2.1bn). On a consolidated basis, in FY24, Elcome and Navicom reported revenue of INR 1.5bn, and consolidated EBITDA margin of 17.7%.

* Progress in PCB business on track; Central government approvals in place: Syrma’s proposed PCB business has a total capex layout of around INR 15bn-16bn spread across 2 phases. Phase 1 capex for multi-layer PCB is expected at ~INR 8bn with asset turn of 1-1.2x, and EBITDA margin of 12-15%. Syrma SGS has already received approval under the Component Manufacturing Scheme of the Indian Government for multi-layer PCB (Phase 1) and approvals for CCL and HDI PCB (Phase 2) are expected soon. Further, we note that progress in Phase 1 is on track with initial expectations, with commencement expected from Dec’26/4QFY27. End-use industries here will include consumer, automotive, industrial and healthcare.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361