Buy Juniper Hotels Ltd For Target Rs.400 By JM Financial Services Ltd

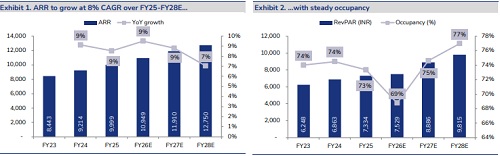

Juniper reported revenue of INR 2.3bn (+7% YoY; +4% QoQ, in-line) driven by a 7% increase in portfolio ARR. The company’s flagship assets, Andaz and GHM witnessed 12% and 6% growth in ARR while operating at 80%/62% occupancy respectively. EBITDA was 7% higher than JMFe at INR 826mn (+28% YoY; +3% QoQ) as margin stood at 36% (+6pps YoY) led by higher through-put and energy cost savings. It continues to make good progress on the development pipeline of c. 850 keys across the three under construction assets in Bengaluru, Guwahati and Kaziranga. With an extremely comfortable leverage position and steady cash flows from its existing portfolio, Juniper is well positioned to fund the addition of c. 2,000 rooms over the next 3-4 years, which will be primarily sourced through ROFO assets, organic expansion and new acquisitions. While the development pipeline is largely tied up, progress on ROFO remains the key positive trigger for the stock in the near term. Basis the performance in 1HFY26 and a small delay in commissioning of the Bengaluru asset, we trim our revenue and EBITDA estimates by 3%/7% for FY26E, which has also resulted in a marginal cut in FY27E. We estimate a revenue CAGR of c.15% and an EBITDA CAGR of c.23% over FY25-28E and maintain BUY with a reduced TP of INR 400, valuing the company at 18x Mar’27 EBITDA.

* Topline growth driven by ARR: Juniper reported revenue of INR 2.3bn (+7% YoY; +4% QoQ), which was in line with our estimates. F&B and MICE revenue was up by 2% YoY to INR 700mn and annuity assets contributed INR 345mn to total revenue (+2% YoY). Occupancy during the quarter was steady at 72% (flat YoY) and portfolio ARR increased 7% YoY to INR 10,599. The company’s flagship assets, Andaz and GHM witnessed 12% and 6% growth in ARR while operating at 80%/62% occupancy respectively. In 1HFY26, revenue and EBITDA increased 9%/28% YoY to INR 4.5bn/INR 1.6bn respectively.

* Beat on EBITDA: EBITDA was 7% higher than JMFe at INR 826mn (+28% YoY; +3% QoQ) as margin stood at 36% (+6pps YoY). Margin expansion was primarily driven by higher flowthrough resulting from 7% YoY increase in ARR and was also supported by HLP cost savings due to rising share of green energy to 29% vs. 25% in 2QFY25.

* Ongoing developments: The construction and development of Phase I at the Marriott, Bengaluru asset is on track and is expected to commence operations by 4QFY26. With all approvals received in 1Q, the ground work commenced at Kaziranga in Sep’25. It has also completed the design work and approvals are in process for the Bengaluru Phase II and Guwahati assets, both of which are expected to be completed by FY29E.

* Expansion pipeline: Beyond these four developments, Juniper remains active in identifying expansion opportunities and has submitted bids for a greenfield development in Port Blair and Neil Island at Andaman and Nicobar. Given the improved connectivity by way of frequent flights, along with vast untapped tourism potential, company sees an opportunity to develop a leisure asset at this location, catering to both domestic and international travellers. Additionally, Juniper has also bid for a new development at Yashobhumi and Dwarka (New Delhi). It also intends to participate in an opportunity in Bihar.

* Maintain BUY with a TP of INR 400: Basis the performance in 1HFY26 and a small delay in commissioning of the Bengaluru asset, we reduce our revenue and EBITDA estimates by 3%/7% for FY26E, along with a marginal cut in FY27E. We maintain BUY with a reduced TP of INR 400, valuing the company at 18x Mar’27 EBITDA.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361