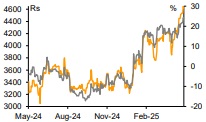

Add Navin Fluorine Ltd For Target Rs. 4,800 By Emkay Global Financial Services Ltd

In-line quarter; Chemours tie-up offers decent optionality

NFIL posted in-line results, with Q4 EBITDA at Rs1.8bn (+62% YoY/+21% QoQ). Earnings improved on a) higher volume growth and a better pricing environment in the HPP business, led by refrigerant gases; b) strong growth in the CDMO business owing to campaign-based sales in late-stage molecules. Tie ups—with Chemours for 2-phase immersion cooling fluid (capex of USD14mn) and Buss ChemTech AG for Solar and Electronic Grade HF—are new steps taken by NFIL for entry into the advanced materials business. We turn constructive on NFIL owing to optionality from new businesses and scale up in capacity utilization of existing business. We increase our target multiple to 40x vs 35x earlier (5Y avg at 55x) to factor in 1) higher ref gas pricing globally leading to better margin; 2) optionality from scale up of the advanced materials business. We retain ADD while raising our TP by 20% to Rs4,800, at 40x Mar-27E EPS.

High Performance Product (HPP) saw higher volume/pricing

The HPP segment posted revenue of Rs12.1bn in FY25 (+26% YoY) on higher volume, led by improved utilization of the HFO plant (Honeywell contract) and the R32 plant (lower base in FY24). Ref gas prices have seen an uptick in the domestic/exports market and are expected to be firm for CY25. Exports as well as domestic sales for this segment saw similar growth on an absolute basis, of ~Rs1.2bn each. The new R32 plant was commercialized in Q4FY25 and is expected to fully ramp up by FY26E. AHF capex of Rs4.5bn is scheduled for commissioning by Q2FY26. NFIL has exclusively tied up with Buss Chemtech AG for manufacturing high end solar and electronic grade HF.

Specialty Chemicals and CDMO to witness higher capacity utilization

Specialty Chemicals reported revenue of Rs8bn in FY25 (-6% YoY) on delayed commissioning of fluorospecialty capex and slower-than-expected ramp-up in H1FY25, while utilization at other plants in Dahej and Surat improved. The company is working toward selling commercial quantities for two new molecules in Q1FY26. NFIL dispatched an order for its Rs300mn Surat capex in Feb-25 (peak revenue: 1.4x). Its CDMO business vertical saw revenue of Rs3.4bn (+31% YoY) owing to growth in RFQs and order book (scale up order delivered to a US major customer). cGMP-4 capex is on track for commissioning by end-Q3FY26 and will help achieve the FY27/28E USD100mn guidance.

Chemours tie-up for data center cooling fluid (two-phase immersion)

NFIL signed a strategic partnership agreement with Chemours to establish initial capacities for a two-phase immersion cooling fluid, to cater to the needs of data-center cooling and next-gen chips. Total project capex is Rs1.2bn, of which Chemours will contribute ~36%. The project is expected to commission by Q1FY27. Total addressable market size for the liquid cooling fluid is USD500mn, which is set to increase to Rs3bn by CY35. Such a growth opportunity is a significant optionality to earnings, given the scalability of the product. We build in revenue of Rs0.5bn/Rs1bn FY27E/28E onward.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354