Add Niva Bupa Health Insurance Ltd For Target Rs. 84 By JM Financial Services

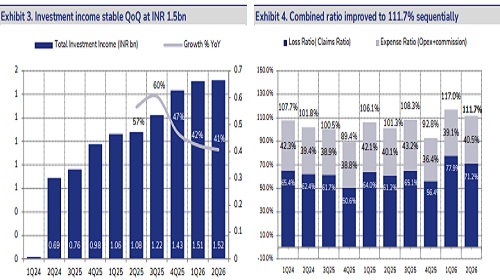

Niva Bupa reported a loss of INR 353mn (against INR 903mn JMFe), led by strong Claims Ratio of 71.2%, against JMFe 75.0%. The company had built additional IBNR (Incurred But Not Reported) in 1Q seeing volatile claims, which has been reduced by a factor of 3.4% of 2Q NEP – resulting in the positive surprise in Claims Ratio. Like-to-like growth was limited to 19% YoY with demand weak in September (expected and reported to GIC – General Insurance Council) – the company has seen that reverse with strong 50%+ retail growth in October. Based on reported financials, we expect another quarter of loss in 3Q before it reports strong profits in 4Q. Meanwhile, IFRS profitability remains on track. We largely maintain our Claims and Combined Ratio estimates over FY26-FY28e, cut FY27/FY28e EPS by 3%/4% to get a revised target price of INR 84, valuing the company at an unchanged 35x FY28e EPS of INR 2.4 (earlier INR 2.5). We maintain ADD.

* Weak growth was known, led by an expectation of GST cut: 2Q has seen Niva Bupa report growth of 10%/5%/0% for July/August/September to General Insurance Council. Like-to-like growth for 2Q came in at 19% (1H at 23%). In October, the company has seen growth in retail premiums jump to 50%+, led by a ticket size increase of 15% in new retail policies. This ticket size expansion implies that the lives insured have used the GST 2.0 to increase the product benefits (like riders) or increased Sum Assured, and the share of wallet has not leaked to other financial products / consumption. While the 50%+ growth will normalize, this consumer behaviour bodes well for the sector. Further, from 3Q onwards, the base normalizes (For 1.n accounting) and we can expect stronger reported growth.

* Miss on Opex Ratio led entire by denominator, expenses growth limited to 5% YoY Net commissions were flattish on a YoY basis at INR 2.8bn while opex growth was limited to 10% YoY, both below JMFe. Miss on opex ratio was led by weak premium growth. The company mentioned that it will meet the regulatory EOM cap (35% of Gross Written Premiums) in FY26. We maintain our EOM estimates for FY26e at 36.0% and cut FY27e by 40bps. We expect the company to report strong profits in 4Q, after another quarter of reported losses in 3Q. Meanwhile, fundamentals remain strong with a like-to-like growth of 19%, flattish commissions, benefits of operating leverage and steady investment income. On the incidence of ITC post GST 2.0, the company has passed on the impact to distributors.

* Valuations and view – growth and claims trajectory on track, maintain ADD:The Niva Bupa stock has corrected post losses in 1Q, however, we thump the table and say the company’s fundamentals remain strong, and the reported losses are only on account of the accounting treatment. Based on reported financials, we expect another quarter of loss in 3Q before it reports strong profits in 4Q. We largely maintain our Claims and Combined Ratio estimates over FY26-FY28e, cut FY27/FY28e EPS by 3%/4% to get a revised target price of INR 84, valuing the company at an unchanged 35x FY28e EPS of INR 2.4 (earlier INR 2.5). We maintain ADD.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)