Buy PG Electroplast Ltd For Target Rs. 950 By JM Financial Services

Strengthening its grip over the Indian RAC market

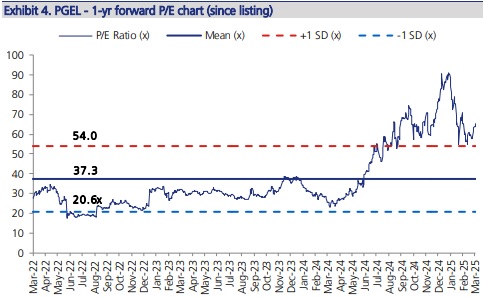

We interacted with the management of PG Electroplast, and conclude that: (1) focus remains on providing the entire solution to clients and not on selling components, as it believes that is RoCE dilutive, (2) the AC compressor shortage needs to be addressed, else GMCC can have a disproportionately high bargaining power post Jul’25 and if summer demand remains very strong, a compressor shortage cannot be ruled out, and (3) PGEL has made sufficient provisions w.r.t. its inventory to meet incoming demand, and plans for its compressor facility are on track; the company aims to commence operations in 2HFY26. The macro story for RACs is intact with penetration as low as 10% and an expected CAGR of ~20% until FY30. We believe that while uncertainty lingers over which brand/OEM will manage compressors this season, a backward integrated manufacturer like PGEL, investing in deeper capabilities, may be worth a look. We maintain BUY with a target price of INR 950 at 45x Mar’27E EPS.

* Focus to remain on providing the full solution: PGEL’s focus will remain on providing the entire solution, and not on individual components. Its aspiration has been to become a leading product company, and hence, it has backward integrated only to levels sufficient for internal use. Components are a lower asset turn business vs. assembly, and in most cases (barring components such as compressors and motors), margins are barely 40- 50bps higher than assembly, limiting RoCEs to <12-13%. Seasonality for components is also as strong as RACs, but unlike ACs, wherein manufacturing lines are fungible with other durables, component lines are fungible only for plastics/sheet metals.

* Compressor shortage an industry-wide challenge: India was massively dependent on Sanyo, GMCC and Highly for its compressor imports. Of this, Sanyo’s BIS licence expired in Oct’24, creating a void of ~20% in compressor imports. Further, GMCC and Highly have been supplying less than the committed volumes to India as they prioritise selling to the US, and Highly’s BIS certificate expires in Jun/Jul’25, while GMCC’s licence is valid until Jan’26. This will give GMCC a disproportionately high bargaining power post July. While domestic capacities do exist, the key question to be answered is whether they are sufficient to meet the resultant void. All industry participants are aggressively lobbying with the gvernment to take necessary steps, in the form of BIS renewals or extensions. PGEL has created sufficient inventories to help it cater to incoming demand and is also investing in its own compressor capacities, which should be operational by 2HFY26.

* Plans for compressor facility intact; expect to be largely self-sufficient next summer: PGEL's initiatives will include compressors assembly, while key sub-components will be sourced through imports. The target is to be able to meet a majority portion of internal requirements for the 2026 summer through internal capacities. We understand that while agreements are expected to be signed soon, construction of the building has begun and should be ready by May. Upon finalisation of the agreement, order for the equipment will be placed, the lead time for which is ~4 months, which suggests delivery by Jul-Aug’24. Upon installation of machinery, trial runs might commence by September/October. And for the upcoming manufacturing season (starting Nov-Dec'25), for the 2026 summer, the compressor facility should be ready.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345