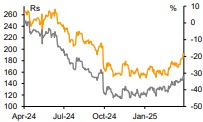

Buy RBL Bank Ltd For Target Rs. 225 By Emkay Global Financial Services Ltd

RBL continued with its clean-up drive in Q4 as it fully provides for the MFI NPA portfolio leading to historically lower NNPA at 0.3%. However, the bank utilized its contingent provision buffer of Rs2.7bn which along with nearly flat margins and strong card fees helped manage profitability, albeit negligible at Rs0.7bn. Overall collection efficiency has improved in the MFI space, while SMA pool has reduced to Rs3.8bn/6.6% of the MFI book. RBL carries healthy provision on this SMA pool as well. Stress in the card portfolio too is easing, and the bank expects growth to recover gradually. The bank guides to better credit growth in FY26E, with heavy lifting to be done by the secured portfolio which may have some impact on margins. With CET 1 at 14.1% after the recent relaxation by the RBI on MFI risk-weights, RBL may not raise capital in a hurry. We retain BUY and our TP at Rs225, valuing the bank at 0.8x FY27E ABV. Further re-rating will be contingent on better visibility on its planned transformation toward the retail cum SME bank delivering sustained RoA/RoE of over 1%/10%.

Guides to growth acceleration with focus on expanding the secured portfolio

Credit growth moderated to 10% YoY/2% QoQ due to planned slowdown in unsecured loans, particularly cards/MFI, as guided by the management. RBL also securitized the PL portfolio worth Rs4.5bn. Deposit growth too was soft, at 7% YoY/4% QoQ, while CASA ratio improved by 134bps QoQ to 34%, leading to lower CoD, aiding in sustaining margins at 4.9%. RBL continues to focus on growing its secured portfolio, incl retail and SME, by 25-30% in FY26; it will maintain MFI share at 6.5-7% of the overall book to support healthy RaRoC. The mgmt believes the cards portfolio has shown meaningful stabilization and shall thus pursue qualitative growth (mid-single digit) in this segment from Q2FY26

GNPA eases amid strong recoveries/write-offs despite elevated MFI stress

Gross slippages moderated QoQ, but remain elevated at Rs10.6bn/4.6% of loans (though lower than Rs13bn/5.8% in Q3), given higher stress in the MFI and card portfolios. However, higher recoveries/write-offs (especially in the wholesale segment), led to 32bps QoQ improvement in GNPA ratio to 2.6%, while higher PCR (incl accelerated provisions of Rs2.5bn in Q4 on the MFI portfolio to take MFI PCR to 100%) led to a decline in NNPA ratio to a historical low of 0.3%. The overall MFI SMA pool has reduced to Rs3.8bn/6.6% from Rs5.5bn/8%. The bank expects MFI and Card stress to ease in FY26, unless macros deteriorate meaningfully and thus expects credit cost to reduce, leading to better RoA.

We retain BUY on RBL with unchanged TP of Rs225

We expect the bank’s credit growth to be better in FY26E, while rate cut could provide tailwind to its margins, partly offset by portfolio shift toward the secured portfolio. This coupled with better asset quality/lower LLP should drive-up RoA, from 0.5% in FY25 to 0.8-1.2% over FY26-28E. We retain BUY with an unchanged TP to Rs225 (valuing at 0.8x FY27E ABV).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)