Buy Restaurant Brands Asia Ltd For Target Rs. 100 By Elara Capital Ltd

Sequential recovery in SSSG

Restaurant Brands Asia’s (RBA IN) Q3 was largely as estimated. RBA witnessed a sequential recovery, with same stores sales declining 0.5% YoY versus 3.0% in Q3. Gross/EBITDA margins rose by 68bps/88bps QoQ, led by efficiency measures, despite inflationary pressure. Expect store addition at BK India to remain healthy, which may weigh on ADS in the near term. The focus on Indonesian arm is on strengthening the current network (rather than expansion). Rising inflationary pressure amidst muted macro environment and elevated A&P investments for new stores, resulting in cut in EBITDA estimate. However, the stock has fallen 23% in the past three month, trading at reasonable valuations. Thus, we upgrade RBA to BUY from Accumulate, with TP pared (led by EBITDA estimate cut) to INR 100 from INR 110.

Sequential recovery in SSSG, ADS dragged revenue growth:

BK India’s revenue grew 6.4% YoY, led by store additions, inched up same store sale growth and modest recovery in dinein channel, though broader demand environment was cautious. RBA witnessed a sequential recovery in same store sales (down 0.5% YoY in Q3 from 3.0% in Q2), led by festivals and modest pick up in dine-in (up 2.4% YoY). A flat SSG in Q3,though encouraging, has been lower than estimates. Expect SSSG to be flat in FY25E and 3.0% each in FY26E/27E. With healthy store addition in Q3, the count stood at 510, but that has hit average daily sales (ADS), down 3% QoQ. Channel-wise, the share of dine-in was 58% and may continue to recover. On digitalization, 90% of in-store orders placed via self-kiosks.

Recovery continues at Indonesian operations:

Revenue for the Indonesian arm declined by 9.5% YoY, largely on account of store closure by RBA in past quarters. SSS declined to 4.1% from 15.0% in Q2. This was arrested by increased footfall, led by continued A&P investments, and the full roll-out of its chicken menu. In Q3, RBA closed two stores with count at 147 (Burger King). Also, RBA aims to continue with its current store network. So, we cut our store addition estimate to nil for FY26E/27E. The momentum in current SSSG is subject to normalization of geopolitical environment, a key monitorable in the near term.

Margins defy underlying inflationary pressure:

Gross margin for the Indian operations rose by 34bps QoQ, led by various efficiency initiatives, despite inflationary pressures. Cost calibration also led to a QoQ recovery in EBITDA margin (post-Ind AS) to 15.7% in Q3, but rising inflationary pressure and increased A&P spends on new store may cap margin gains ahead. For Indonesian operations, 9MFY25 losses stood at INR 141mn, and with no stores additions in the near term, profitability will largely be led by prudency on general costs, rental negotiation and healthy traction in present market.

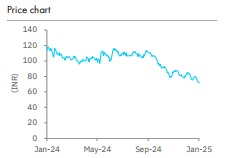

Upgrade to Buy; TP pared to INR 100:

We continue to monitor SSSG at India operations and operating performance of Indonesian operations. With inflationary regime, muted macro environment and A&P investment in new stores, we cut FY26E/27E EBITDA estimates by 10.0%/8.6%. However the stock has fallen ~23% in past three months – We upgrade RBA to BUY with a pared TP of INR 100 as we value BK-India at 27x EV/EBITDA (pre-Ind As) and Indonesian business at 2x EV/sales with roll-over to FY27E. Subject to completion of approved QIP issue (up to INR 5.000), equity shares may dilute by 12-14%.

Please refer disclaimer at Report

SEBI Registration number is INH000000933