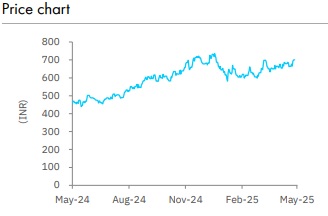

Accumulate Fortis Healthcare Ltd for Target Rs. 749 by Elara Capitals

Strong show; solid guidance

Fortis Healthcare’s (FORH IN) Q4FY25 results came in better than our estimates. Revenue and EBITDA beat our estimates by 1% and 4%, respectively. PAT came in 18% ahead of our estimate, helped by higher other income and lower tax rate. Strong growth continued in the hospitals segment. The management has guided for continued growth and further 150-200bps margin expansion in FY26. Performance has started picking up in the diagnostics business as well – the management guided for double-digit growth in FY26, with margin recovering to ~23% levels. We raise FY26E and FY27E core EPS estimates by 15-17%, on strong guidance in both the business segments. So, we raise out TP to INR 749 from INR 686 – Retain Accumulate.

Hospitals – Growth and margin expansion to continue: Revenue and EBITDA from the Hospitals segment grew at 15.5% and 26.6%, respectively in FY25, helped by better occupancy and growth in average revenue per operating bed (ARPOB). FORH is targeting 14-15% growth in FY26, helped by new brownfield additions in bed capacity. The management has guided for further 150-200bps improvement in margins in FY26, on top of a similar improvement in FY25, which is commendable, in our view.

Diagnostics – Pick-up in growth and margin: Rebranding exercise-related issues and associated marketing costs plagued growth and profitability in the diagnostics segment, in FY25. Initial signs of normalization were visible in Q4, with revenue growth of 4% and margin expansion of 400bps YoY and QoQ each. FY26 guidance – double-digit growth and margin expansion to ~23% from ~18% in FY25 – indicates a sharp improvement in performance. Rebranding related expenses and other one-off costs are behind us. FORH is targeting 24-25% margin in the next 2-3 years.

Hospitals – Actively seeking opportunities: The management indicated that FORH is actively considering expansion plans, both through new greenfield hospitals and via M&As. It currently has a target to reach 6,000 beds by FY28, only through brownfield bed addition. FY26 will see addition of ~1,000 beds, most of them brownfield. The recent acquisition at Manesar has been operationalized and will contribute to growth in FY26. The recentlyannounced acquisition of a hospital in Jalandhar will also contribute to growth in FY26.

Retain Accumulate; TP raised to INR 749: We raise FY26E and FY27E core EPS estimates by 15-17%, on the back of strong guidance for both Hospitals and Diagnostics segments. FORH trades at 49.5x FY26E core earnings and 27.1x FY26E EV/EBITDA (pre-IndAS). We raise our TP from INR 686 to INR 749, which is 44x FY27E core P/E plus cash per share – Retain Accumulate. Delay in bed addition and further cost escalation are key risks. Any unexpected adverse outcome from legacy litigation around liabilities of ex-promoters is another risk.

Please refer disclaimer at Report

SEBI Registration number is INH000000933