Life Insurance Sector : Strong show in Nov-25; sustained growth key for re-rating by Emkay Global Financial Services Ltd

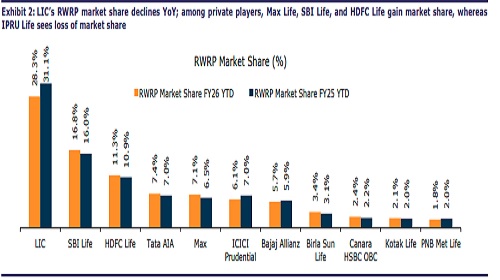

As expected, the life insurance industry reported strong performance during Nov25, with Retail APE growing ~27%, driven by GST rate exemption tailwinds, lower base effect given the festivities during Nov-24, and normalization of the base due to the impact of surrender regulations in Nov-24. The private sector clocked in a strong 28% growth in Nov-25, whereas LIC posted a robust ~23% growth. On 2Y CAGR basis, the industry’s retail APE grew ~16% led by the private sector clocking a solid ~22% growth while LIC posted a muted ~4% growth. YTDFY26, the industry’s retail APE grew ~7%, driven by ~12% growth in the private sector while LIC witnessed a ~2% decline. Among private listed players, SBI Life remained the fastest growing player, logging a sturdy ~33% Retail APE growth, followed by Axis Max Life at ~23% growth. ICICI Pru Life’s reported Retail APE grew ~25% in Nov-25, while RWRP grew ~13%, indicating strong sale of monthly and quarterly premium paying policies. HDFC Life saw ~20% Retail APE growth in Nov-25, while Canara HSBC Life clocked a strong ~26% growth. Group APE for the industry declined 8% in Nov-25, mainly due to ~48% drop seen in the private sector, offset by LIC’s strong 111% growth. Resultantly, overall APE for the industry grew ~16%, with LIC logging a strong ~49% growth, while the private sector reported a muted ~5% growth. With growth expected to pick up in H2FY26, we expect the industry to log ~9-10% Retail APE growth in FY26E, backed by private-sector growth of ~11-12% and LIC likely growing ~4-5%.

Industry reports strong retail APE growth in Nov-25 During Nov-25, the life insurance industry reported a robust retail APE growth of ~27%, driven by the private sector clocking a strong 28% growth, while LIC reported a sturdy ~23% growth on a favorable base (Nov-24: -12% YoY, impacted by the new surrender regulations). The strong growth in Nov-25 was driven by a) GST rate exemption tailwinds, b) festivities in Nov-24, c) normalization of the base impacted by the new surrender regulations. Individual policies sold during Nov-25 grew ~49%, backed by a strong 70% growth for LIC on a favorable base (Nov-24: -41% YoY), while the private sector clocked a strong 23% growth. YTDFY26, retail APE for the industry grew a modest ~7%, led by healthy ~12% growth for private players, while LIC posted a ~2% decline. Group APE in Nov-25 declined 8%, primarily due to ~48% decline seen for private players, offset by LIC growing 111%. YTDFY26, group APE for the industry grew ~19%, led by LIC clocking a strong 25% growth, whereas the private sector reported a modest ~12% growth. Resultantly in Nov-25, the industry’s overall APE grew ~16%, with LIC clocking a strong 49% growth, while the private sector witnessed a muted ~5% growth owing to a decline in Group APE. YTDFY26, total APE for the industry grew ~10%, with the private sector growing ~12% while LIC posted an ~8% growth.

SBI Life – Fastest-growing private listed player for the 2nd consecutive month Among private listed players, SBI Life remained the fastest-growing player, clocking a strong ~33% growth in retail APE in Nov-25. Axis Max Life logged a strong ~23% growth in Retail APE, whereas HDFC Life witnessed ~20% growth. ICICI Pru Life’s reported Retail APE grew ~25% as against ~13% RWRP growth, indicating strong sales of monthly and quarterly premium paying policies. Canara HSBC Life posted a strong ~26% Retail APE growth in Nov-25. Private listed players continued to report strong trends in Individual Regular Premium Sum Assured with SBI Life (+89% YoY), leading the peer pack, followed by HDFC Life (+74% YoY), Axis Max Life (+72% YoY), and ICICI Pru Life (+50% YoY). Canara HSBC Life reported a strong 175% growth in Individual Regular Premium Sum Assured. The strong growth in Individual Regular Premium Sum assured indicates relatively strong growth in protection and higher attachment of riders. YTDFY26, Axis Max Life topped the charts, clocking ~18% Retail APE growth, followed by SBI Life (+12% YoY), HDFC Life (+11% YoY), and ICICI Pru Life (reported Retail APE: down 3% YoY). Among other private players, Bajaj Life clocked a strong ~39% Retail APE growth in Nov-25, while Tata AIA Life reported ~29% growth.

We expect the industry to deliver ~9-10% Retail APE growth in FY26E With growth expected to bounce back in H2FY26 (on GST tailwinds and normalization of new surrender regulations base impact), we expect the industry’s Retail APE to grow ~9- 10% in FY26E. Private insurers are expected to outpace the broader sector, at growth of ~11–12%, while LIC is expected to see a comparatively modest growth of 4–5%

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Pharma Sector Update : Hypercholesterolemia market?opportunities and risks by Kotak Institut...