Pharma Sector Update : Hypercholesterolemia market—opportunities and risks by Kotak Institutional Equities

Hypercholesterolemia market—opportunities and risks

The global hypercholesterolemia market is witnessing ample activity, with launches such as Bempedoic Acid (Blue Jet) as well as ones in the pipeline, including Obicetrapib (recent win for PPL). We factor in the medium-to-longterm risk for Blue Jet from lower efficacy of Bempedoic Acid versus Obicetrapib, Merck’s MK-0616 and AstraZeneca’s AZD0780, apart from the imminent one of Neuland’s new capacity. Nevertheless, after the sharp ~35% stock price correction in the past three months, we upgrade Blue Jet to BUY from ADD with an FV of Rs825 (Rs900 earlier). We also factor in the Obicetrapib opportunity for PPL (BUY) to derive an FV of Rs325 (Rs305 earlier).

New molecules to spice up the hypercholesterolemia space

Current treatments (ex-statins) for hypercholesterolemia, including Ezetimibe (Zetia), Bempedoic Acid (Nexletol, Nexlizet) and older PCSK9 inhibitors, offer varying degrees of LDL-C reduction but come with limitations in efficacy, administration and safety. Emerging therapies aim to address these gaps. New Amsterdam’s Obicetrapib, an oral small molecule currently under investigation, demonstrates a ~35-40% LDL-C reduction and is well-tolerated. MK-0616, a novel oral peptide in Phase-3 being developed by Merck, shows a remarkable ~50-59% LDL-C reduction and a favorable safety profile, although it requires eight hours of fasting. AZD0780, another investigational oral small molecule in Phase 2b trials being developed by AstraZeneca, has shown ~35-51% LDL reduction in trials. These new agents promise to expand the therapeutic landscape by offering potent LDL-C reduction, improved tolerability and greater convenience through oral dosing.

Obicetrapib—PPL’s gain is Blue Jet’s loss

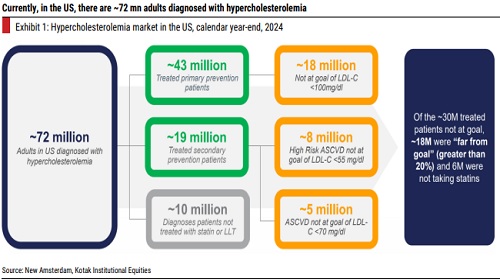

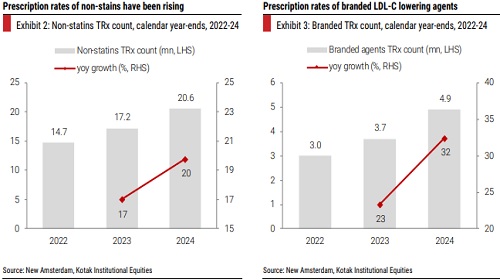

In light of stiff competition from Leqvio (recent label update of monotherapy), Obicetrapib and newer PCSK9 inhibitors such as Merck’s MK-0616 as well as the imminent impact of Neuland’s expanded capacity, we revise downwards Bempedoic Acid estimates for Blue Jet, leading to an ~8% cut in FY2026-28E EPS. On the other hand, PPL has signed a contract with New Amsterdam for commercial manufacturing of FDC of Obicetrapib and Ezetimibe at its lossmaking Sellersville facility. Owing to the large market opportunity (see Exhibits 1-5), we expect this to be a key molecule for PPL. We believe PPL could generate annual peak sales of ~US$50 mn from this contract, which would primarily accrue after FY2028E. We note Sellersville is a highly underutilized facility (CY2024 EBITDA loss of US$15 mn) and this contract should also help lower losses at this facility for PPL. We factor in incremental benefit from Obicetrapib and raise PPL’s FY2026-28E EBITDA by 2-3%.

Retain BUY on PPL and upgrade Blue Jet to BUY from ADD earlier

We raise our DCF-based FV for PPL to Rs325 (Rs305 earlier) and retain BUY. Owing to lower earnings estimates, we cut our FV for Blue Jet to Rs825 (Rs900 earlier). After the recent sharp stock price correction, we upgrade Blue Jet to BUY from ADD earlier.

A bunch of new candidates under development in the hypercholesterolemia space

The hypercholesterolemia (high blood cholesterol levels) space is a fast-growing market globally, with the statins having a dominant share. Atherosclerotic Cardiovascular Disease (ASCVD)-related conditions are one of the most frequent causes for morbidity among patients suffering from high cholesterol levels due to plaque build-up in the arterial walls. Drug candidates such as statins, Ezetimibe, Bempedoic Acid and PCSK9 inhibitors have demonstrated meaningful reduction in ASCVD risk for patients with high cholesterol. However, there are several patients, who are either statin-intolerant, or do not witness any significant LDL-C reduction despite taking the maximum dose of a statin. For such patients, the available alternatives before CY2020 were Ezetimibe (Zetia) and older PCSK9 inhibitors such as Alirocumab (Praluent) and Evolocumab (Repatha). Since CY2020, the US FDA has approved two more molecules, Bempedoic Acid (Nexletol by Esperion) and Inclisiran (Leqvio by Novartis) for treatment of hypercholesterolemia. In addition, there are a number of molecules undergoing development, including promising candidates such as Obicetrapib (New Amsterdam) and Enlicitide decanoate (Merck’s MK0616). Moreover, these innovators have also been working on combination therapies, in addition to the existing primary molecule, which further enhance the efficacy of lowering LDL-C levels. In essence, the hypercholesterolemia space is set to witness further breakthroughs, over the next decade, with more drug candidates gradually becoming commercial.

New drugs under development are looking to address gaps in existing therapies

Current treatment options (excluding statins) for hypercholesterolemia, including Ezetimibe, Bempedoic Acid and older PCSK9 inhibitors, offer varying degrees of LDL-C reduction but come with limitations in efficacy, administration and safety. Ezetimibe, an oral small molecule approved for use, reduces LDL-C by ~25% with a 7% major adverse cardiovascular event (MACE) benefit and no effect on lipoprotein [Lp(a)]. Nexletol, also oral and approved, shows a ~17% LDL-C reduction and 13% MACE benefit but carries safety warnings for tendon rupture and gout. PCSK9 inhibitors provide the highest LDL-C reduction of ~45-50% and Lp(a) lowering of ~15-30%, with a 15% MACE benefit, although they require biweekly or monthly injections and may cause injection site reactions.

Emerging therapies aim to address these gaps. New Amsterdam’s Obicetrapib, an oral small molecule currently under investigation, demonstrates a ~35-40% LDL-C reduction and is well-tolerated. When combined with Ezetimibe, LDL-C reduction increases to ~49-54%, marginally surpassing PCSK9 inhibitors while maintaining oral administration. MK-0616, a novel oral peptide in Phase-3 being developed by Merck, shows a remarkable ~50-59% LDL-C reduction and favorable safety profile, representing a significant innovation in peptide-based oral delivery, although it requires eight hours fasting. AZD0780, another investigational oral small molecule in Phase 2b trials, being developed by AstraZeneca, has shown ~35-51% LDL reduction in trials. These new agents promise to expand the therapeutic landscape by offering potent LDL-C reduction, improved tolerability and greater convenience through oral dosing.

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137

.jpg)

More News

Auto Sector Update : Retail & Dispatch Sales Pulse: October 2025 by Choice Broking Ltd