Hotels Sector Update : The Hotels Healthy 1HFY26 performance with a strong 2H outlook by Motilal Oswal Financial Services Ltd

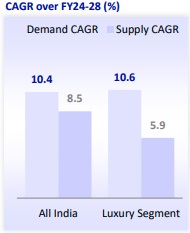

he Indian hotel industry witnessed a healthy performance in 1HFY26, and we expect 2HFY26 to be even better, led by renovated rooms (higher ARR), a YoY increase in MICE events, sustained travel trends, and improving infrastructure (e.g. the new airport). Our channel checks indicate that Oct’25 was a steady month due to multiple festivals, which paved the way for a strong Nov’25 (mid-to-high teens RevPAR growth YoY). Dec’25 is also showing similar strong visibility (despite temporary airline disruptions). We expect industry-level ARR/RevPAR for 3QFY26 to grow by 9-11%/12-15% YoY.

* The Indian hotel sector posted a healthy 1HFY26, with ~15% YoY growth in both revenue and EBITDA, led by ARR gains and stronger occupancy despite multiple industry headwinds. 3Q and 2HFY26 are expected to remain strong, driven by a busy wedding season, higher MICE activities, and global events.

* With the new Navi Mumbai International Airport (NMIA) set to commence operations on Christmas’25, the hotel demand-supply dynamics are set for a major shift. The limited supply of branded rooms (~1,539 keys) and strong demand (the first phase will enable 20m annual passenger capacity) will benefit players such as Chalet Hotels, IHCL, Park, LEMONTRE, and SAMHI, all of which have existing or soon-to-commence presence in the area.

* Even with the commencement of NMIA and temporary shutdown (phased manner) of the T1 terminal, demand in Mumbai is expected to continue improving, led by an increase in international events (concerts, sports, and cultural) and higher MICE activities (supported by the Jio Convention Center). According to HVS, Mumbai’s demand-supply dynamics will continue to remain favorable, supporting healthy performance for MMR hotels.

* We remain positive on the Indian hotel sector over the near to medium term, led by strong structural tailwinds, favorable demand-supply dynamics, and rising domestic travel—fueled by a healthy pipeline of MICE, weddings, cultural events, and corporate travel. We reiterate our BUY rating on IH (TP INR880) and LEMONTRE (TP: INR200).

3QFY26 to remain healthy, driven by MICE activities

* According to HVS Anarock, India’s hotel sector witnessed robust performance in Oct’25, with ARR rising by 10% YoY and the occupancy rate remaining flat YoY. Demand was driven by a surge in corporate and MICE travel, while the extended Diwali weekend significantly boosted leisure bookings.

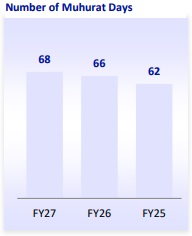

* On the contrary, listed hotel players experienced flat occupancies in Oct’25 as multiple festivals, such as Dussehra, Diwali, and Chhath Puja, fell in the same month (vs being well-spread across Oct and Nov last year), impacting performance due to a higher business hotel mix. However, Nov’25 was strong, with mid-to-high teen RevPAR growth driven majorly by the busy wedding season. Visibility for Dec’25 also appears positive, driven by MICE activities and the continuation of the wedding season in the first half of the month, coupled with leisure activities in the second half.

* Overall, we expect ARR/RevPAR to grow by 9-11%/~12-15% YoY in 3QFY26.

* In Oct’25, passenger air traffic improved 2% YoY to 14m. IndiGo contributed ~66% (the largest contributor) to the passenger air traffic in Oct’25.

* However, recent operational disruptions at IndiGo, due to multiple factors (primarily the implementation of Flight Duty Time Limit Rules – FDTL), have led to significant flight cancellations across cities. To date, over 4,200 flights have been cancelled (i.e. only ~2% of total flights in 3Q), but recent daily cancellations rose to ~500-700 flights over the last couple of days.

* According to our channel check, the impact of these cancellations has been minimal, as affected bookings (due to travel constraints) are being compensated with extended stays. In terms of ARR, hotels near the airport may witness a surge in demand due to extended bookings, which could be offset by a decline in OR across other hotels. While no disruptions have been seen in MICE activities, leisure destinations may experience a minor impact. Overall, we do not expect a major impact from the IndiGo disruption.

* In 1HFY26, aggregate revenue/EBITDA for the hospitality basket (including IHstandalone, LEMONTRE, EIH, CHALET, SAMHI, JUNIPER, PARK OBER, BRGD, PHNX, and ITC) grew 15% YoY each to INR103b/INR32b.

* Adj. PAT (excluding OBER, BRGD, and PHNX, as their segmental PAT is not available) grew 62% YoY to INR16.2b in 1HFY26.

* IHCL outpaced peers with the highest revenue growth in 1HFY26 (up 21%), while SAMHI recorded the highest EBITDA growth of 30% YoY, followed by JUNIPER/IHCL (up 28%/21% YoY) in 1HFY26.

* Going forward, 2HFY26 is expected to be robust for the hospitality sector, driven by a busy wedding season, high-profile diplomatic visits, room expansions, infrastructure improvements, large-scale events (Global AI Summit and T20 International World Cup), MICE activities, and improving leisure demand.

NMIA set to boost growth in Navi Mumbai

* NMIA, an SPE jointly promoted by the Adani Group and CIDCO, with an investment of ~INR197b for the initial operating phase (one runway and Terminal 1), is set to commence operations on 25th Dec’25, with 23 scheduled departures per day. An additional INR300b has been planned for the construction of Terminals 2, 3, and 4, along with a second parallel runway (completion expected by 2032).

* For the initial month, this newly built facility will operate for 12 hours daily, managing up to 10 aircraft movements per hour (120 aircraft movements per day). NMIA plans to switch to 24-hour daily operations from Feb’26, increasing the total daily movements to 34 as flight schedules expand.

* NMIA currently has a capacity of 20m annual passengers (vs ~11-14m in T1 and ~40m in T2), with an expected capacity of 90m annual passengers post full completion (expected by 2036).

* Further, the old T1-A building at CSMIA is set for redevelopment, with demolition having commenced in Nov’25 (completion expected by FY29).

* The demolition has not impacted airport operations, as the terminal has been shut since 2016. According to media articles, a complete shutdown of CSMIA T1 will not occur until NMIA’s T2 is open for passengers. Post the operationalization of NMIA, ~10m annual passengers are expected to be redirected from CSMIA T1, with major airlines like IndiGo, Akasa Air, and Air India Express scheduling their flights from Dec’25.

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137

More News

Cement Sector Update: JSW Cement 3QFY26 beats estimates on volumes By Motilal OswalFinancial...